3 Reasons to Buy Nvidia Stock Like There's No Tomorrow

Key Points

Nvidia management sees data center spending rapidly increasing over the next five years.

To take advantage, Nvidia is forming several powerful partnerships.

The stock isn't as expensive as it looks when you factor in its long-term growth rates.

Nvidia (NASDAQ: NVDA) is the world's largest company, which creates the impression that there isn't much more growth it can gain. And yet, there are several compelling reasons why it's still a great investment now. The artificial intelligence (AI) buildout is far from over, and Nvidia's leadership position will be nearly impossible to topple.

There are countless reasons why Nvidia is an excellent investment. Here are three specific reasons it's a great buy now for the long term.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

1. There is a lot more AI infrastructure spending coming

With companies already spending billions of dollars annually on AI data centers, it would seem that there isn't much more that can be spent. And yet the AI hyperscalers are seeing so much demand that they keep committing more cash flow to AI buildout. Nvidia sees total data center capital expenditures reaching $600 billion this year, but by 2030, it expects global data center buildouts to reach $3 trillion to $4 trillion.

That's a massive increase, but is that realistic?

Currently, there are only two countries that are heavily investing in AI technology, the U.S. and China. As of now, Nvidia still hasn't acquired its export licenses to resume selling to China, so this massive market is still unavailable to Nvidia. Furthermore, Europe is just now starting to wake up to the AI trend, and that could represent another giant economy that could massively increase the demand for Nvidia's graphics processing units (GPUs).

Additionally, data centers take years to build. The announcements that are coming out this year about data centers being built by the AI hyperscalers will take a few years to become operational, so it's a good bet that these companies are in constant communication with Nvidia to ensure that the computing units will be available when the time comes to install them.

This all bodes well for Nvidia, and it's becoming clearer that the AI computing power buildout trend is far from over.

2. Nvidia is positioning itself well with partnerships

Nvidia has also been busy forming partnerships to ensure it stays at the top of the computing world.

Nvidia recently announced that it signed a deal to deploy 10 gigawatts of AI computing power to OpenAI, the makers of ChatGPT. OpenAI is paying for this through Nvidia's $100 billion investment, making Nvidia a partner with OpenAI. By teaming up with one of the leaders in generative AI technology, Nvidia is securing its spot as the computing provider of choice to one of the most important AI companies.

Nvidia is also expanding its product line through a $5 billion investment in Intel. This will allow it to design and build CPUs to better control its GPUs, increasing the dominance of Nvidia's ecosystem.

CoreWeave also secured a $6.3 billion order of Nvidia GPUs to increase its computing capacity. CoreWeave's business model is to purchase top-tier GPUs from Nvidia and then rent those back to clients for their AI needs. Because Nvidia GPUs are the best all-purpose computing devices available, this partnership ensures that several companies will need to stay in the Nvidia ecosystem if they ever decide to build on-premises rather than rent through CoreWeave.

Nvidia has developed several strong relationships already, and those ties only look to be growing stronger.

3. The stock isn't all that expensive

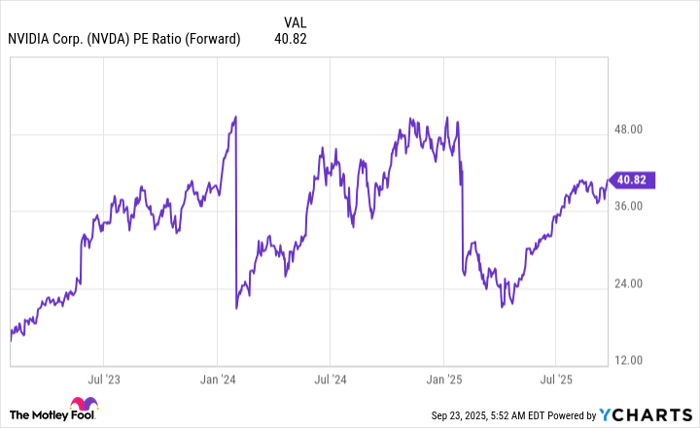

Despite all of Nvidia's success, the stock still doesn't appear all that expensive. Trading at 41 times forward earnings, Nvidia's stock may seem pricey from a historical standpoint. However, investors must factor in how quickly Nvidia is expecting to grow.

Data by YCharts.

Nvidia expects to see huge spending expansion over the next five years, so maintaining its impressive 40% to 50% revenue growth each quarter over the next few years isn't out of the question. This makes Nvidia's stock look relatively cheap when taking the five-year view, which makes it a great stock to buy now.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $651,593!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,089,215!*

Now, it’s worth noting Stock Advisor’s total average return is 1,058% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Intel and Nvidia. The Motley Fool recommends the following options: short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.