Prediction: This Is Where Opendoor Technologies Stock Will Be in 5 Years

Key Points

Opendoor stock is soaring because of a new CEO and board member changes.

The company has a long way to go if it wants to improve its business model and generate a profit.

After soaring 20x in a year, Opendoor stock is now overvalued.

Opendoor Technologies (NASDAQ: OPEN) was left for dead. Then, it became a meme stock. The real estate platform is up over 500% this year and 20x off the lows set in June, recently surpassing $10 a share. After the company ousted the prior CEO, brought in an experienced executive, added the founders back to the board of directors, and plotted a business turnaround, investors are gushing over Opendoor stock at the moment.

But should you buy the stock? Let's take a look at Opendoor's financial opportunity and see where the stock will trade five years from now.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

A fast-moving turnaround

As a digital platform that buys and sells residential real estate, Opendoor has struggled to ever generate a profit. It has thin profit margins and a capital-intensive business model that requires holding homes as inventory on its balance sheet. This model has struggled to grow with a frozen residential real estate market. This is why the stock fell to under $1 a share at the beginning of this year.

On seeing this cratering share price, activist fund managers stepped in and fought for change at the executive level. Then, the meme stock traders started piling in, sending Opendoor stock up 20x in just a few months. Opendoor has now replaced its CEO with Kaz Nejatian, who was previously the chief operating officer (COO) of Shopify. This week, Nejatian was given a stock-based compensation plan that would reward him with huge bonuses if Opendoor's stock price hit various levels up to $33.

Opendoor has also brought Keith Rabois and Eric Wu, two co-founders of the business, into the board of directors. Working fast, these new leaders are already planning major changes for Opendoor. Rabois stated that the company has cost bloat and only needs 200 total employees, instead of the 1,400 currently employed by the business today.

Image source: Getty Images.

Can the business model work?

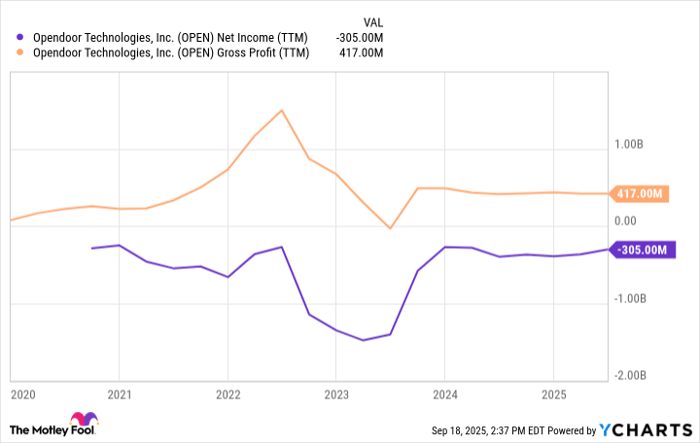

Cost cuts are needed for Opendoor, as the business has never generated a profit. Over the last 12 months, Opendoor posted negative net income of $305 million. Trimming its expenses may help the company stem the bleeding and get to breakeven profitability.

Over the long run, Opendoor will need to expand its business model away from just flipping homes. History has proven that this model cannot generate a profit, with gross profit margins of just 8.2% last quarter. To do so, Opendoor is beginning to expand its software services, working with real estate agents to drive transactions (and commissions) to Opendoor through its Key Agent app. It opened up a new way for customers to finance home sales with a Cash Plus model that pays some money out now, and then a bonus if Opendoor is able to sell the home at a profit.

With the new executive team just arriving, there are likely many more products coming in the near future. We do not know the details of these products, but they have hinted at being driven by artificial intelligence (AI) to improve the homebuying and selling process.

OPEN Net Income (TTM) data by YCharts.

Where Opendoor stock will be in five years

There is a lot of talk about the potential at Opendoor. But that is all it is today: Potential. Opendoor stock is already trading like it has disrupted the residential real estate market when it is still a business with thin margins consistently losing money. At the current stock price of $10, Opendoor has a market cap of $7.5 billion. That's around half the level of Zillow Group, the dominant digital player in residential real estate.

With no earnings, it is impossible to value Opendoor stock on a price-to-earnings ratio (P/E) basis. However, we can look at its gross profit of $417 million, which is close to 20x its current market cap (not including upcoming shareholder dilution). This is wildly expensive. Opendoor may turn around its business, cut costs, and start generating positive cash flow due to new products launched by the incoming executive suite.

The problem is that all this success is already priced into today's stock price. In five years, I expect Opendoor shares to be flat at best and likely down from current levels. Avoid buying this meme stock for your portfolio right now.

Should you invest $1,000 in Opendoor Technologies right now?

Before you buy stock in Opendoor Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Opendoor Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Shopify and Zillow Group. The Motley Fool has a disclosure policy.