Is Energy Transfer the Smartest Investment You Can Make Today?

Key Points

Energy Transfer operates in the midstream arena, the most reliable part of the energy sector.

The master limited partnership has a huge 7.5% yield.

Stepping down a little bit on yield with two of Energy Transfer's largest competitors may turn out to be a smarter move.

Energy Transfer (NYSE: ET) has a huge 7.5% yield. To put that into perspective, the S&P 500 index (SNPINDEX: ^GSPC) is yielding a scant 1.2% and the average energy company just 3.2%. It might seem like a smart move to lock in a lofty income stream by adding Energy Transfer to your portfolio. You'd probably be better off with one of these two competitors.

It's easy to get lost in Energy Transfer's yield

Energy Transfer's 7.5% distribution yield is very attractive. That yield is backed by a master limited partnership (MLP) that operates an extensive collection of vital energy infrastructure assets. The business basically uses a toll-taker model, in which customers pay it for the use of its assets, such as pipelines. The midstream, which is the industry segment in which Energy Transfer operates, is the most reliable segment of the broader, and generally commodity-driven, energy sector.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

But Energy Transfer isn't the only company that is focused on the midstream. Large peers like Enterprise Products Partners (NYSE: EPD), a fellow MLP, and Canada's Enbridge (NYSE: ENB) also own reliable cash-generating pipelines, storage, and transportation assets. Enterprise is yielding around 6.8% right now and Enbridge's yield is 5.6%. If all you look at is yield, then Energy Transfer is clearly the smartest call. Or is it?

The most direct comparison is Enterprise

Given that Energy Transfer and Enterprise Products Partners are both MLPs and both hail from the United States, they are the closest competitors from an investment standpoint. What separates the two from an income investor's point of view is going to be trust. To state it simply, most dividend investors are looking for companies that can pay a reliable, and, hopefully, growing dividend over time.

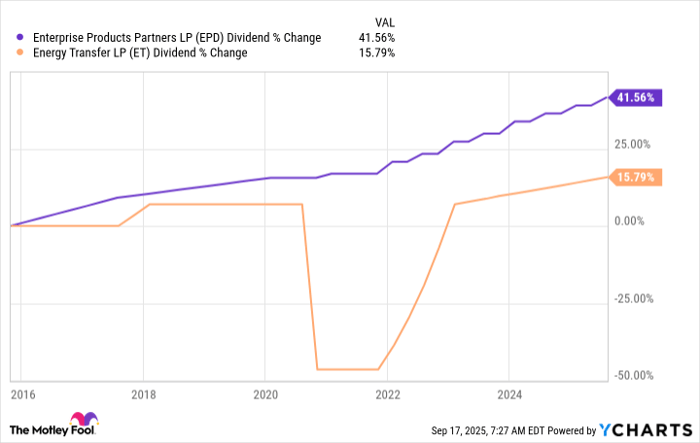

EPD Dividend data by YCharts

Energy Transfer cut its distribution in 2020 amid the uncertainty of the coronavirus pandemic. Enterprise has increased its distribution year in and year out for 27 consecutive years. In fairness to Energy Transfer, its distribution is growing again and above where it was prior to the cut. However, if you were a unitholder during that admittedly difficult period for the energy sector, Energy Transfer's distribution cut would have been a bitter pill to swallow. That's true even if it was the right move for the business.

If you want to go to bed at night believing that your income stream is safe even in the hardest times, it will likely be hard for you to trust Energy Transfer. Enterprise's distribution history, by comparison, should have you sleeping well all night long.

The future is changing for energy

There's another issue to consider when looking at an energy company, however, because the industry itself is starting to shift. The big move, which will likely be decades long, is from dirtier energy sources to cleaner ones. Energy Transfer is moving with the times, given it has a focus on both oil and natural gas, which is cleaner-burning than oil and coal. But you can get even further ahead of the clean energy curve and still collect a hefty yield from a midstream business.

That's where Enbridge and its 5.6% dividend yield comes in. For starters, Enbridge's dividend has been increased annually, in Canadian dollars, for three decades. That already puts it ahead of Energy Transfer (and Enterprise) on the dividend reliability front. But Enbridge has also made a concerted effort to include cleaner energy options in its portfolio of reliable cash-flow-generating assets. The biggest move of late was the acquisition of three regulated natural gas utilities. But there's also a small, but growing, division centered around renewable power assets like offshore wind farms.

If you want to own a business that is looking decades into the future as it grows, Enbridge will probably be more to your liking even though it has a lower yield.

Buying Energy Transfer wouldn't be a mistake

If you buy Energy Transfer you probably aren't committing some gross error from which you'll never recover. However, that doesn't mean it is the smartest investment choice you can make. Given the distribution history, conservative investors may want to step back on yield and buy more reliable Enterprise Products Partners. And if you want a clean energy hedge with your pipeline investment, then even more reliable dividend payer Enbridge is going to be the brightest option to consider despite its lower yield.

Should you invest $1,000 in Energy Transfer right now?

Before you buy stock in Energy Transfer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.