What's Going on With AST SpaceMobile Stock?

Key Points

AST SpaceMobile is going to have future competition from SpaceX.

The company is well ahead of the pack in direct-to-device satellite internet but still has a lot to prove.

Shares of AST SpaceMobile stock are still priced at a premium today.

Investors cannot get enough of space economy stocks. Upstarts such as AST SpaceMobile (NASDAQ: ASTS) are seeing soaring stock prices, with AST SpaceMobile stock going from a low of around $2 in 2024 to $40 as of this writing on Sept. 16. The company is building a constellation of large satellites that can beam high-speed internet directly to mobile devices, which could radically disrupt the telecommunications market.

Excitement abounds, but a potential roadblock has just been reached for AST SpaceMobile, and its stock is now down 30% from all-time highs because of it. What is causing this drop in AST SpaceMobile shares? And should you scoop up some stock on the dip? Let's take a closer look at this satellite internet player and find out.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Incoming SpaceX competition

AST SpaceMobile is launching large satellite arrays to provide internet connectivity directly to mobile devices instead of requiring a clunky terminal or large antenna. By partnering with telecommunications providers like AT&T, the company hopes to upsell customers looking for fast internet in places that land-based mobile internet can't reach. Down the line, this technology could start to replace cell tower and wired internet services entirely for customers. With a few satellites already launched, AST SpaceMobile is planning to get between 45 and 60 of its large satellites into orbit in order to start commercial services sometime in 2026.

SpaceX and Elon Musk see the future in AST SpaceMobile and have recently made a giant move to try and enter the direct-to-device market. SpaceX made a $17 billion purchase and a $2 billion commitment to debt payments to take ownership of spectrum licenses owned by EchoStar. This news is what set AST SpaceMobile stock reeling.

A large company and the leader in satellite internet connectivity today, SpaceX will prove a formidable competitor to AST SpaceMobile. However, SpaceX still operates in the terminal-based internet market, which AST SpaceMobile is trying to disrupt. Elon Musk said it will take around two years to get all the systems ready to enable direct-to-device satellite internet, which could take an even longer time given how optimistic Musk generally is on future promises.

If AST SpaceMobile can stick to its current timeline, it may have a few years of runway to try and tackle the direct-to-device market with little competition. Plus, it has many more partners than SpaceX, which today is just partnering with T-Mobile and now EchoStar (owner of Boost Mobile).

Image source: Getty Images.

Heavy upfront investment, huge addressable market

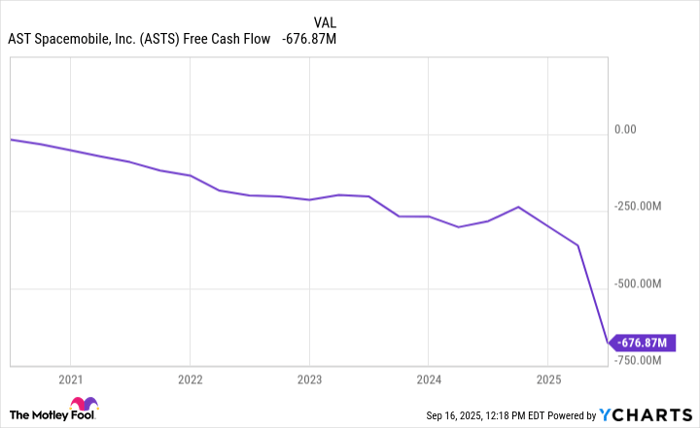

Building and deploying satellites is not cheap. AST SpaceMobile is generating near zero revenue today and burned $676 million in free cash flow over the last 12 months. In order to fund this upfront spending, AST SpaceMobile has raised a lot of funds, including a recent convertible notes offering of $575 million. As of the latest update, the company had $1.5 billion in cash on the balance sheet, which should give it a funding bridge from now until it starts operating its satellite network.

Once the network is operational, AST SpaceMobile will have a target market in the billions to go after through its telecommunications partners. It will not be targeting users directly but utilizing existing customer relationships through partners such as AT&T, which can upsell the satellite internet service to its millions of customers. These can be day passes or monthly additions to existing subscriber plans.

It is unclear what the exact size of the addressable market will be, but AST SpaceMobile could see rapid revenue growth in the next few years. Management is already guiding for at least $50 million in revenue for the back half of 2025.

ASTS Free Cash Flow data by YCharts.

The truth about AST SpaceMobile stock

AST SpaceMobile has an exciting business model. If it can get its satellite constellation working properly, the company will have disrupted the terminal-based satellite internet market, giving it a huge opportunity globally. For context, SpaceX's Starlink service is already doing over $1 billion in annual revenue and growing quickly.

However, even with this stock drawdown, it looks like AST SpaceMobile is overvalued. It has a market cap of $14.5 billion compared to a business that is currently generating zero in revenue. Debt is increasing on the balance sheet, while shares outstanding are rising due to capital raises in order to fund the current burn rate. Even if the satellite constellation works as intended, it is unlikely that AST SpaceMobile will generate more than $1 billion in revenue a few years from now, let alone talking about bottom-line profitability.

For all these reasons, AST SpaceMobile stock does not look like a buy after this recent dip.

Should you invest $1,000 in AST SpaceMobile right now?

Before you buy stock in AST SpaceMobile, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AST SpaceMobile wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends T-Mobile US. The Motley Fool has a disclosure policy.