The Ultimate Artificial Intelligence (AI) Stock to Buy Right Now

Key Points

Nvidia's GPUs are the most popular chips for AI.

Management projects monster data center growth over the next five years.

Artificial intelligence (AI) investing continues to be the best choice in the market. The AI hyperscalers are spending hundreds of billions of dollars on building out computing capacity, and any company that is a beneficiary of this spending is an excellent place to invest.

One of the most popular investments from the beginning of the AI race has been Nvidia (NASDAQ: NVDA). Despite being among the best performers over the past few years, Nvidia is still the ultimate AI stock right now, I believe, especially if its market projections come true.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Nvidia makes lots of money from each GPU it sells

Nvidia makes graphics processing units (GPUs), which specialize in computing tasks that require plenty of horsepower. They can process multiple calculations in parallel, an effect that can be amplified by connecting hundreds or thousands of them in clusters. This is what occurs in giant AI data centers, where companies connect 100,000 or more GPUs to form supercomputers.

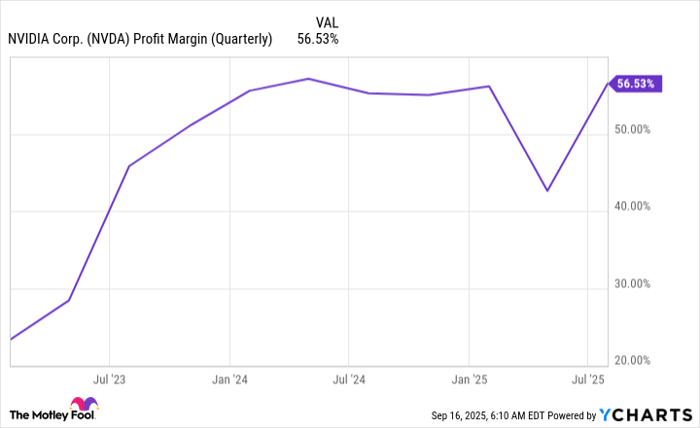

Nvidia's data center GPUs aren't cheap, so it makes a fortune off of each one sold. It's rare to see a hardware company with the margin profile that Nvidia has, but it has consistently delivered a profit margin greater than 50% over the past few years.

NVDA Profit Margin (Quarterly); data by YCharts.

This allows the chipmaker to generate huge profits, which is why the stock has increased so much over the past few years. And if management is right about the general direction of AI spending, its stock is just getting started.

Nvidia's growth is far from over

During the company's second-quarter conference call, management estimated that global data center capital expenditures will rise to anywhere from $3 trillion to $4 trillion by 2030. Currently, AI hyperscalers are spending around $600 billion annually, and with Nvidia estimated to generate $206 billion in revenue during this fiscal year, it's safe to say that it gets around a third of all data center spending.

That indicates that the company's revenue could be $1 trillion to $1.3 trillion by 2030. Should it reach that level, it would be an annual growth rate of 37% on the low end of management's projection. If Nvidia can maintain its impressive profit margins, it's not unreasonable to think that its stock could rise by a corresponding amount over the next five years.

A 37% annual return wouldn't just outperform the market; it would crush it. The S&P 500 tends to return around 10% annually, so Nvidia could easily be the ultimate growth stock to buy now.

However, this projection isn't without its caveats. Its biggest clients would need to continue spending nearly all of their cash flow on AI infrastructure for this to come true. If they don't see a reasonable return on investment, they may begin to taper off their spending.

Furthermore, management's projection includes all data center spending. So, if a competitor comes out with a GPU alternative, it's possible that Nvidia loses market share and doesn't get a third of total data center spending.

Even if it falls short of its projection, there's still plenty of wiggle room for it to be a top-performing stock over the next five years. I think it's an excellent buy at this price point, and anybody who's still bullish on the AI trend should consider buying shares of Nvidia today.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.