Where Will Oklo Stock Be in 5 Years?

Key Points

Oklo is developing new nuclear energy technology.

It has not gotten its design approved by regulators.

Its stock is overvalued, given that it has zero revenue today and will likely not generate any revenue in five years.

Nuclear energy has come back from the dead, led by the soaring demand for electricity from artificial intelligence (AI) data centers. Oklo (NYSE: OKLO) is a nuclear energy start-up trying to take advantage of this great need. As a so-called "fast fission" developer, the company is in the middle of planning and certification for a nuclear power plant design, nuclear waste recycling, and producing radioisotopes.

Investors have taken notice. At $129.50 a share, Oklo stock trades up 1,980% compared to a year ago, when it went public through a special purpose acquisition company (SPAC) merger. Where will the stock be five years from now? Let's dig into the numbers and find out.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Micro nuclear reactor technology

Oklo's Aurora Powerhouse is a modular nuclear reactor with upwards of 75 megawatts (MW) of power generation. With reliable power that is on 100% of the time, 75 MW of power can fulfill the electricity needs of thousands of homes, which can be scaled up due to the modular design of these systems.

Besides the Aurora Powerhouse, Oklo is working on a nuclear fuel recycling project in Tennessee. This project will be used to produce fuel that will go into the Aurora Powerhouse reactors, and potentially other nuclear systems.

Electric grid analysts expect the United States to need more than 80 gigawatts (GW) of new energy capacity over the next 20 years (one gigawatt equals 1,000 megawatts). That is an immense opportunity for nuclear energy companies like Oklo. The U.S. government is trying to speed up the process of building these reactors, with multiple executive orders from the Trump administration aimed at supercharging the nuclear energy market in the country. Time will tell how much of an effect this will have on actual development, though.

Image source: Getty Images.

Future commitments, but no current revenue

Since it's still in the approval process with the Nuclear Regulatory Commission (NRC), Oklo is unable to build any Aurora Nuclear power plants today. It has plans to do so at some point before 2030, but that won't happen until full certification is awarded.

Beginning construction is just the next step. Nuclear power plants can take years -- if not a decade -- to finish. This means that Oklo may not generate any revenue over the next five to 10 years.

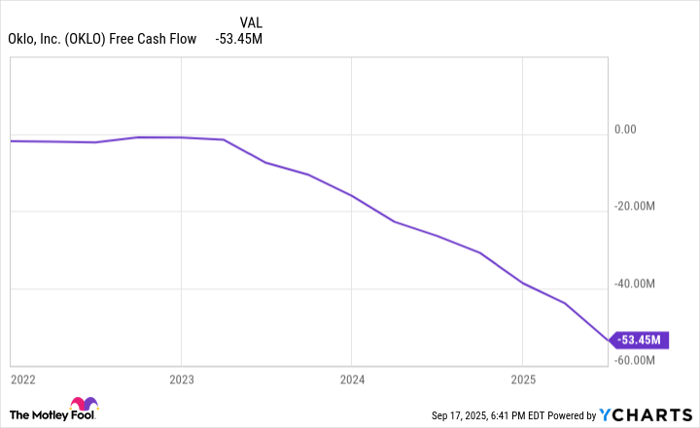

Today, it is generating zero in revenue and burning $53 million in free cash flow. Its cash burn has increased in recent years as it scales up research and certification spending. Once it starts building a power plant, cash burn is going to look even worse in the interim. With over $500 million in cash and equivalents on the balance sheet, Oklo is not going to run out of money anytime soon. Just don't expect it to generate any revenue, either. Nuclear power is a slow-moving market.

Data by YCharts.

Where will Oklo stock be in 5 years?

After rising nearly 2,000% in 12 months, Oklo now has a market cap of $19.2 billion. Its shares outstanding keep rising due to common stock offerings, which will increase its market cap without the share price going higher.

It is hard to value Oklo stock because it generates zero revenue. However, we do know that in five years it will likely also be generating zero in revenue since it still hasn't gotten the Aurora plant approved by the NRC. That is zero dollars in revenue, let alone thinking about generating a profit.

Even if Oklo begins building nuclear power plants, it is unclear why it deserves a $19-plus billion market cap. These are capital-intensive projects with slim margins. If profits materialize at all, it will be over a decade from now. With this context, it is clear that investors should avoid buying Oklo stock, as it is extremely overvalued at current prices and may never generate any revenue. This stock price will likely be lower five years from now.

Should you invest $1,000 in Oklo right now?

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.