The Ultimate Growth Stock to Buy With $1,000 Right Now

Key Points

Uber Technologies currently leads the ride-hailing market here and abroad.

Being the second (or even third) biggest name in a business, however, doesn’t mean there aren’t opportunities for growth.

Lyft’s smaller size forces it to be creative and clever when it comes to competing and promoting its service.

Is your portfolio in need of a new growth holding? There are certainly plenty of good ones to choose from right now, including ride-hailing powerhouse Uber Technologies (NYSE: UBER). If you're considering any new name at this time, however, Uber's rival Lyft (NASDAQ: LYFT) is arguably the better bet (if not your best) bet. Here's why.

Image source: Getty Images.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Yes, the number-two name

It's admittedly a bit counterintuitive. Broadly speaking, the biggest name in any given business is also usually its best investment; there's a reason it became the market leader, after all. And to be fair, there's nothing wrong with holding a position in Uber here.

In terms of potential performance from a stock, though, Lyft brings more to the table right now.

But first things first.

You've almost certainly heard of the company -- it's the second-biggest name of North America's ride-hailing industry, launching in 2012 just a couple of years after rival and market leader Uber officially began commercial operations. What a difference a couple of years can make, however! Lyft's 2024 revenue of $5.8 billion is only a fraction of Uber's $44 billion.

Granted, Uber also operates overseas, while Lyft didn't have any international operations until acquiring Europe's ride-hailing outfit Freenow in July of this year. But even then, data from Bloomberg suggests Uber accounts for about three-fourths of the United States' ride-hailing market, versus Lyft's one-fourth.

Not every meaningful comparison is to a competitor, however. Comparing Lyft's likely future to its present still paints a pretty compelling picture for investors.

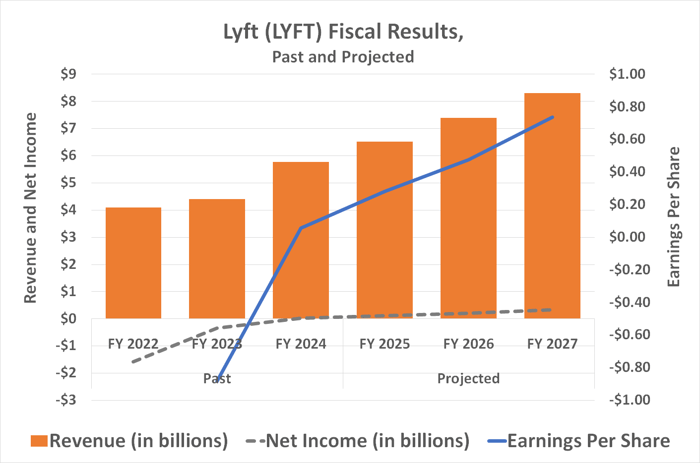

Case in point: Lyft swung to a full-year profit just last year, finally reaching critical mass by creating enough self-sustaining scale to cover all of its fixed and variable costs. As the company continues to expand, analysts expect its profit margin rates to continue widening.

Data source: Simply Wall St. Chart by author.

And there's every reason to believe in these optimistic growth outlooks.

Future growth drivers

It's not just the accelerating growth trajectory of Lyft's historical top and bottom lines underscoring the bullish argument. A handful of specific developments working in its favor may not yet be fully reflected in analysts' outlooks.

One of these developments is the recently completed acquisition of Europe's Freenow.

In terms of revenue, the taxi-oriented service is tiny compared to Lyft's existing business (which is why the acquisition only cost roughly $200 million). However, its potential penetration of the European market is enormous; Lyft reports that Freenow serves less 1% of Europe's personal mobility market. Now armed with the same financial resources and marketing know-how that allowed Lyft to grow in a market dominated by Uber, look for similar market penetration in Europe.

And consider this: While Freenow wouldn't have been a meaningful addition for Uber, Lyft's smaller size means whatever upside Freenow brings to the table will make greater net impact on its top and bottom lines. Sometimes being small really does mean more relative growth is possible, which is really all investors care about.

Lyft is also arguably building more -- and more important -- relationships with business-building partners than Uber is. For example, although it's still years away from becoming a major profit center, last month Lyft announced it was working with China's Baidu to develop autonomous vehicles that will ultimately serve the European market. Meanwhile, it's also been working closely with credit card outfit Mastercard, DoorDash, and recently forged a partnership with United Airlines that's expected to begin adding to the top and bottom lines next year.

Lyft's also seemingly thinking more strategically than Uber is these days. In its second-quarter earnings call, for instance, it highlighted several small-market (but still major) U.S. cities like Indianapolis and Nashville that were still underserved, and therefore ripe for more of the above average growth that the company is already achieving in those locales.

It's all relative

Now, don't lose perspective on the situation. Lyft is still playing second fiddle to Uber, here and abroad. It's clear that it just doesn't enjoy the same kind of resources and scale as its biggest rival. Last quarter's revenue and rider growth both trailed the improvements reported by Uber for the same three-month stretch. Technically speaking, Uber is outgrowing Lyft.

Lyft shares are also curiously trading above analysts' currently consensus price target of $16.80 following an enormous run-up from April's low, suggesting there's no actual upside left to tap.

Underscoring this concern is the fact that the majority of the analyst community also only rates Lyft stock as a hold at this time. And to be fair, it might not be crazy to wait for a decent-sized dip before diving in.

Just don't wait too long though, or be too picky about your entry price.

Take a step back and look at the bigger picture. Lyft enjoys a unique position within a global industry that Mordor Intelligence believes is set to grow at an average annualized rate of 16.6% through 2030. It may never lead any market it serves. But Lyft's figured out how to cost-effectively be a competitive second-place name wherever it operates, which still translates into tremendous opportunity for investors.

Indeed, from where Lyft's stock is right now it's arguably got more potential upside than Uber at this time even if it is the smaller company. Shareholders will just need to shrug off the short-term noise and volatility and remain focused on the five-year or even 10-year timeframe.

Should you invest $1,000 in Lyft right now?

Before you buy stock in Lyft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lyft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Baidu, DoorDash, Mastercard, and Uber Technologies. The Motley Fool recommends Lyft. The Motley Fool has a disclosure policy.