2 Magnificent Stocks to Buy That Are Near 52-Week Lows

Key Points

Chipotle Mexican Grill is facing rising labor and food costs, but has a loyal customer base.

Target is being pinched by tariffs, labor costs, and supply chain issues, but a new CEO will take over in February.

For contrarian, long-term investors, both stocks have potential.

For every winning stock or sector in 2025, you can also find some disappointments. The major indexes are doing well so far, with the Nasdaq Composite up 26%, the S&P 500 rising 11% and the Dow Jones Industrial Average moving 11% higher.

But there are plenty of big names that are struggling, and some are currently sitting near their 52-week lows. These could be tempting contrarian buys for investors looking to profit from what they believe will turn out to be temporary weaknesses for the companies in question.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

When contrarian investors pick well, it can be a winning strategy. Choose poorly, and you'll be stuck with a value trap, or even worse, a situation where you've tried to "catch a falling knife."

Here are two well-known companies that are in weakened positions right now that could be ripe for small investments.

Image source: Getty Images.

Chipotle Mexican Grill: Down 31% in the last year

Chipotle Mexican Grill (NYSE: CMG) stock seems to ride the highest highs and suffer the lowest lows. The company experienced a series of foodborne illness outbreaks in its restaurants from 2015 to 2018 that led to a $25 million fine from the Justice Department -- the largest-ever regulatory fine in a food safety case. Those outbreaks drove away customers, sapped its profits, and clobbered the stock. But Chipotle addressed its issues, sales recovered, and the stock soared so high that in 2024, the company executed a 50-for-1 stock split to make the stock more accessible to employees and retail investors.

This year, however, that roller coaster has been heading down again. Chipotle currently trades just 4% above its 52-week low -- and about 42% off its peak.

However, what makes Chipotle promising is its loyal customer base. Chipotle revolutionized the fast-food niche by offering something different than burgers, chicken, or sandwiches. Its ingredients use no preservatives, and its kitchens don't have freezers because everything is prepared fresh. That helps make Chipotle appealing to health-conscious customers.

The company's revenue in the second quarter was $3.1 billion, up 3% from a year before, although comparable restaurant sales fell by 4%. Adjusted earnings came in at $0.33 per share, down by $0.01 per share from the same quarter a year ago.

The company is dealing with higher prices for its ingredients, particularly steak and chicken, as well as modestly higher labor costs, all of which are cutting into the company's margins. Management believes that full-year sales will be flat, but plans to open between 315 and 345 additional locations this year.

Target: Down 41% in the last year

Not so long ago, Target (NYSE: TGT) was a high-flying retailer viewed as a true challenger to Walmart. However, the last few years have not been kind. Revenue has declined since 2023, and the company's stock is struggling. Currently, it's down by about 50% from its peak, and trades less than 3% above its 52-week low.

The company is trying to turn things around by promoting Chief Operating Officer Michael Fiddelke to CEO -- he'll take over in February. Fiddelke has been central to Target's efforts to be more flexible, use technology, and make the company more agile to position it for growth. He was credited for the success of Target's omnichannel efforts, and also helped the company develop its private-label brands, which it can sell at lower prices while still earning better margins than it does on national brand products.

Sales in the second quarter were $25.2 billion, down nearly 1% from the prior-year period. The company's operating income margin of 5.2%, down from 6.4% a year earlier. Gross margin was 29%, down from 30%.

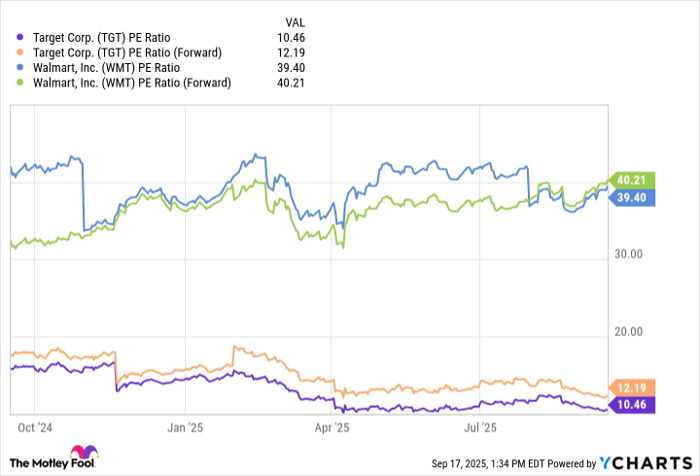

Regardless of who is in the CEO's office, Target will face a challenging environment, with supply chain issues, tariffs, and labor costs providing headwinds. Those who invest now should only do so if they have a long time horizon in mind. But considering that Target's price-to-earnings ratios are still far cheaper than Walmart's right now, it's an intriguing bet on a retailer that at one point showed some real power on Wall Street.

TGT PE Ratio data by YCharts.

The bottom line

There are compelling cases for bargain-hunting investors to consider Chipotle and Target. Chipotle has a dominant brand, a loyal customer base, and it stands apart from other fast-casual restaurants. It has proven that it can face adversity, recover, and prosper. Target, meanwhile, has omnichannel strength, a growing base of private-label products, and new leadership waiting to take the helm. Both companies are turning profits -- they're just not making the margins that investors had hoped to see.

These are long-term contrarian plays right now that could profit shareholders handsomely as the companies rebound. But if you're going to invest in either of them now, the position should only be a small piece of a balanced and diversified portfolio, and one that you plan to hold for at least three to five years.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $651,345!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,080,327!*

Now, it’s worth noting Stock Advisor’s total average return is 1,058% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Patrick Sanders has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Target, and Walmart. The Motley Fool recommends the following options: short September 2025 $60 calls on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.