Living Costs Outpace Social Security: Most Retirees Say They're Cutting Back

Key Points

Social Security checks go out every month to help seniors cover their costs of living.

For over half of recipients, losing half of a Social Security check would be a severe hardship.

Inflation chips away at the buying power of Social Security -- and will continue to do so.

If you have gone to the grocery store lately, you know all about inflation. Costs are going up and they aren't likely to come back down. This is the insidious nature of inflation, which eats away at the buying power of your money. It's why people on a fixed budget, like retirees, have been struggling. Here's what retirees are doing to help stretch their Social Security checks.

Image source: Getty Images.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

What is inflation?

From a big picture perspective, inflation is simply the fact that costs rise steadily over time. This has the effect of reducing the value of money, since a dollar 20 years ago was able to buy more than a dollar can buy today. There are different components to inflation, but it impacts everything from salaries to bread prices. The interplay here is important since salaries generally have to be increased so people can still afford bread.

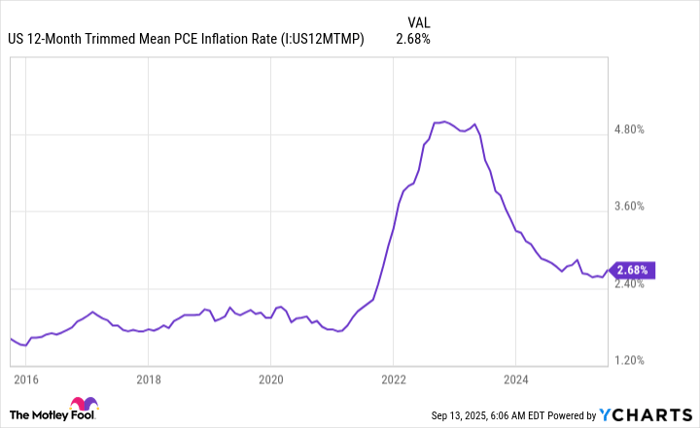

US 12-Month Trimmed Mean PCE Inflation Rate data by YCharts

This brings up an important point. If you are working, you have more flexibility to deal with the impact of inflation. While not ideal, you could increase your own income by working more, even if that meant taking a second job. If you are retired, and Social Security is a key part of your income each month, you don't have as much flexibility. You are on a fixed income, as the saying goes.

The problem is that prices go up, but they usually don't come back down. When Wall Street types talk about inflation coming down, it just means inflation is rising less quickly than it had been. Once bread prices go up, generally speaking, a new floor is set. And you, the consumer, just have to deal with it. Lately, inflation has been rising faster than Social Security benefits have been increased to adjust for the impact of inflation. Here's how retirees have been dealing with it.

|

Changes Made Due to Rising Living Costs Outpacing Social Security Benefits (Among Those Currently Receiving Social Security) |

|

|---|---|

|

Cut back on discretionary spending |

52% |

|

Reduced spending on essential items |

31% |

|

Relied more on savings or retirement accounts |

29% |

|

Downsized my living situation |

18% |

|

Sought part-time work or additional income |

15% |

|

Other |

1% |

|

I have not made any of these changes |

32% |

Data source: The Nationwide Retirement Institute® 2025 Social Security Survey

Steps you can take if you are feeling the pinch of inflation

Relying more on savings or retirement accounts is the ultimate Social Security safety valve. It means that you built up a nest egg and now you have the ability to use it to maintain your spending in retirement. Bank accounts, brokerage accounts, IRAs, and 401(k)s are all options here, if you have them.

Unfortunately, not all retirees are able to save enough. Which is where cutting back on costs comes in. There are two easy choices if you have to reduce spending. Things like eating out and traveling less often are unfortunate, but hardly the end of the world. Downsizing your home is also a good option, since a smaller residence will likely come with lower costs. And if you are selling a home to buy a smaller one, you might actually come away with additional savings, which would be a double win.

While perhaps less desirable, another choice is to go back to work if you can. Part-time employment is probably the least disruptive option, but the additional income might be enough to make up the shortfall you are facing. Full-time employment is less ideal and could be a difficult step depending on your age and health. Regardless, you will need to check Social Security rules around working to ensure that you don't inadvertently disrupt your current benefits.

The least-positive outcome is to cut back on necessities like medication or food. If you find yourself in that situation, you may qualify for other assistance. Make the effort to reach out to see if you can get help in other ways, via such services as food banks. You will likely find that one service can help you connect with others if you do a little networking.

Cutting back isn't ideal, but it isn't impossible

Roughly half of all Social Security recipients in The Nationwide Retirement Institute's 2025 Social Security Survey said that missing just half of a single Social Security check would be a severe hardship. That's a precarious position to be in. If you find yourself in that same situation, you may need to take steps like the ones above to cut down on your spending.

If you aren't in that position, you may want to cut back just the same, to give yourself more options if rising living costs outpace your Social Security check.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

The Motley Fool has a disclosure policy.