If I Could Tell Retirees 1 Thing About Social Security Right Now, It Would Be This

Key Points

Social Security is a social safety net, providing income to seniors who are no longer working.

Historically, companies provided pensions but the trend now is for companies to offer 401(k) plans.

Retirees need to understand the limitations inherent to the Social Security checks they collect.

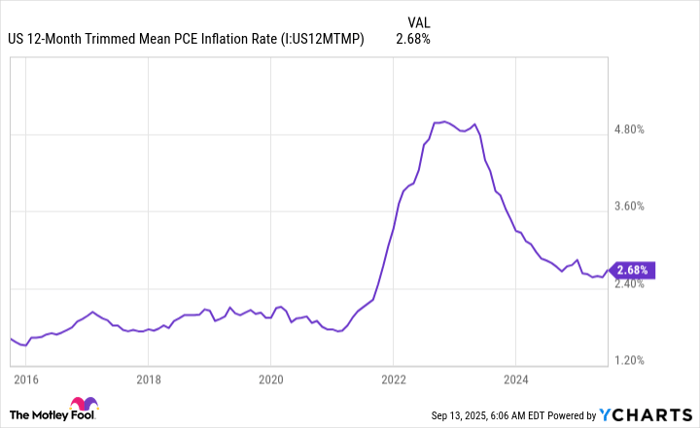

Social Security has been an amazing benefit for seniors, providing a regular check to help pay the bills in retirement. That said, The Nationwide Retirement Institute's 2025 Social Security Survey highlights that roughly half of retirees have had to cut back on discretionary spending because of the impact of inflation. This fact highlights the most important thing I would tell a retiree about Social Security today.

Image source: Getty Images.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

What's the purpose of Social Security?

Social Security is, basically, meant to be a safety net. The goal is to keep retirees who are no longer working out of poverty. While you are working, you pay into the system. And when you retire, you collect a regular check from the system. Social Security has long performed a valuable service, particularly for those who didn't make a lot of money during their working years.

That, however, highlights the big issue you need to keep in mind. Social Security isn't meant to provide you with a lush retirement. It is intended to keep you out of poverty, since you are no longer working. Don't expect Social Security to pay all of your bills. The rise in inflation has clearly highlighted this fact, as 52% of respondents to The Nationwide Retirement Institute® 2025 Social Security Survey said they have had cut back on discretionary spending like eating out and travel.

Essentially, as the cost of basics like food and housing rose, Social Security payments had to stretch. That's simple, kitchen-table budgeting. What's interesting is that the same survey highlighted that roughly 30% of respondents did something else to cover the gap between their costs and Social Security. They dipped into savings. That might include cash in a bank account or in their 401(k)s and IRAs.

Social Security is just one part of the retirement story

Years ago, companies provided pensions to employees to provide for income in their retirement years. Increasingly, companies are moving away from pensions and pushing the savings burden onto employees by offering 401(k) plans. Sure, the company may match up to a certain percentage of your contribution, which is nice. But that match is small potatoes when it comes to retirement. The heavy lift is up to you, the employee.

An IRA is a tax-advantaged saving account meant to entice you to save on your own for your retirement. There are different versions of this type of account, with a traditional IRA being funded with pre-tax dollars and a Roth IRA funded with after tax dollars. Traditional IRA withdrawals are taxed like income, while Roth withdrawals are tax free. But the key here is that the government is incentivizing you to save for your own retirement.

US 12-Month Trimmed Mean PCE Inflation Rate data by YCharts

The theme is the same, however. You are increasingly responsible for your own retirement. If you are in retirement already and haven't saved any money, this is a problem. You will likely need to cut back on spending. Eating out less, vacationing less, and moving to a smaller home are all things you might want to consider if you are having trouble covering your bills.

However, if you aren't retired yet, you have some time left to save as hard as you can. Unless you are happy living an austere life, you are going to need to have access to money beyond Social Security. If you are just starting out in your work life, meanwhile, you have the best opportunity to prepare. Save early, often, and hard, noting that some 80% of Americans are worried about the long-term viability of Social Security.

Do not keep your problems to yourself

Money is a sensitive topic and people often prefer not to talk about it. That's particularly true if money is a problem. It is unfortunate if that is the situation you are in because Social Security isn't covering your costs like it has in the past. You will likely need to cut back.

But don't stop there. Tell anyone who is younger than you who will listen that Social Security isn't meant to pay all of your life expenses. Tell them that they will need to save and save hard if they want to have a carefree retirement.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

The Motley Fool has a disclosure policy.