1 Stock Up 467% in 2025, and the Company Just Named an Exciting New CEO

Key Points

Opendoor's co-founders are back, and a new CEO is joining from Shopify.

New leadership is focused on lowering operating expenses and prioritizing product innovation.

In late June, shareholders of real estate company Opendoor Technologies (NASDAQ: OPEN) were holding a stock that was down 99% from its all-time high set back in 2021. It was a disregarded penny stock, seemingly doomed for ultimate failure.

But in under three months, Opendoor stock has increased about 17 times in value from its lows, and it's now sitting on a 467% gain year to date.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Excitement was clearly building already. But Opendoor stock got another boost on Sept. 10 when it hired Kaz Nejatian to be its new CEO. Nejatian is coming to the company, leaving his position as the COO of e-commerce software giant Shopify.

Image source: Getty Images.

In the same announcement as Nejatian, Opendoor also announced changes to its board of directors. Keith Rabois and Eric Wu, co-founders of the company, are returning to the board, along with Nejatian.

Opendoor is clearly remaking its entire management team. Is this something that continue propelling the comeback story for Opendoor stock?

How Opendoor makes money

Opendoor's business model is commonly called iBuying -- it gives sellers a cash offer for their home and then, once the offer is accepted, it makes necessary repairs before reselling. Therefore, it must find good deals and move fast to make a profit.

It's true that Opendoor has other ways of making money. The company allows sellers to get a cash offer, but still work with an Opendoor-affiliated agent to try to get a better offer elsewhere. It also has an online marketplace and provides title and escrow services. But the vast majority of revenue comes from selling the houses it directly owns.

Opendoor's business model fights an uphill battle when it comes to profitability. When housing is hot, it's hard to find a deal. The company is more apt to get a good deal when the housing market cools down. But a cooler market means that it can hold on to a house longer than hoped. And when that happens, there are holding costs that hinder profitability.

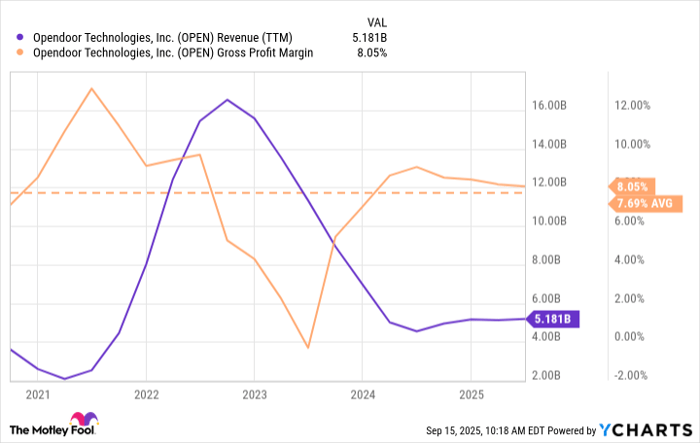

As the chart shows, Opendoor's gross profit margin has only averaged 8% since going public several years ago. That doesn't leave much to work with when it comes to paying its operating expenses.

OPEN Revenue (TTM) data by YCharts

This is why Opendoor hasn't reported positive operating income on a trailing-12-month basis since going public.

Hold on to your iBuying hats

There's new management in town for Opendoor, and it's not business as usual. Big changes could be coming down the pipe.

Rabois is the new Opendoor chairman, and he's wasted no time saying that most of the company's workers aren't needed. He believes that perhaps 85% of employees can be let go. Even assuming he's 100% correct, this will take some time and money to implement.

According to Rabois, the problem with Opendoor's profitability has nothing to do with buying and selling homes. Indeed, he seems to believe that the business model is fine. By contrast, he views general and administrative (G&A) expenses as the real culprit -- these are expenses related to corporate overhead. As COO, Nejatian helped Shopify lower its G&A expenses as a percentage of revenue, and Rabois believes he can do the same for Opendoor.

Both Rabois and Wu also believe that Opendoor needs to innovate, which is another reason to bring in Nejatian. He led a team building products at Shopify, and Opendoor's board hopes that he can do the same at Opendoor after several years of innovation drought at the company.

In other words, Opendoor got new management and now enters a season of change, both from a head count and product perspective.

Is Opendoor stock a buy?

Lowering expenses is always helpful when profits are missing. But if I may gently push back against Rabois' assessment of G&A, this line accounted for less than 4% of Opendoor's revenue in 2024 and less than 3% in the first half of 2025. That's actually lower than Shopify.

Moreover, even if Opendoor were somehow magically able to run its business with zero G&A expenses, it would still have negative operating income. Therefore, it seems that improving its gross margin is the real key to unlocking profitability.

The iBuying business model is hard, and I would say gross margin improvement is easier said than done. For this reason, I wouldn't buy Opendoor stock today.

Perhaps product innovation can deliver margin improvements for Opendoor, and I hope that's the case. But it will take time and money to deliver these changes for shareholders, so I'll patiently watch and wait from the sidelines for the time being.

Should you invest $1,000 in Opendoor Technologies right now?

Before you buy stock in Opendoor Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Opendoor Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $647,425!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,071,739!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Shopify. The Motley Fool has a disclosure policy.