Want $1 Million in Retirement? 3 Simple Index Funds to Buy and Hold for Decades.

Key Points

Large companies may be more stable, but smaller companies have proven to offer greater growth opportunities to investors.

Contrary to a common assumption, the Invesco QQQ Trust isn’t an investment in all of the technology sector’s top names.

It has never been more important to diversify your portfolio -- not just in terms of sectors, but also in terms of styles and geographies.

What's your retirement savings goal? Although it's a somewhat arbitrary target, many people find $1 million is a nice round number to aim for. The thing is, a nest egg of that size is achievable. For most ordinary investors, it will take some work and a bit of sacrifice over time to get there. But people are quietly making it happen all the time.

The irony? Most people who have invested their way from nothing to seven-figure nest eggs didn't do it by constantly chasing after the market's hottest tickers. That strategy is a bit of a fool's errand. Instead, they bought and held a well-diversified portfolio of quality stocks, added money to it regularly and steadily, and then let time and compound growth do most of the work.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

With those concepts as the backdrop, here are three simple but savvy exchange-traded funds (ETFs) that could help you grow your retirement nest egg to the $1 million mark. (And, if the bulk of your retirement savings is in a 401(k) plan that doesn't allow you to buy exchange-traded funds, you'll still likely have access to a comparable mutual fund.)

Image source: Getty Images.

1. SPDR S&P MidCap 400 ETF Trust

The SPDR S&P 500 ETF Trust (NYSEMKT: SPY) remains the go-to foundational index fund for most everyone looking to plug into the broad market's long-term growth. After all, its constituent companies account for about 80% of the total value of the U.S. stock market.

However, if you're looking to add a little performance booster to your portfolio, buy a stake in the SPDR S&P MidCap 400 ETF Trust (NYSEMKT: MDY).

As the name suggests, this ETF holds a market-cap-weighted basket of stocks that parallels the S&P 400 Mid Cap index, which consists of companies with market caps typically in the $2 billion to $10 billion range. This is usually a sweet spot in most organizations' existence -- after their wobbly start-up years, but before their key product or business idea has had a chance to deliver outsized growth and put the company on the proverbial map. Super Micro Computer and Deckers Outdoor are a couple of names that recently outgrew the S&P 400 and were promoted into the S&P 500 (SNPINDEX: ^GSPC).

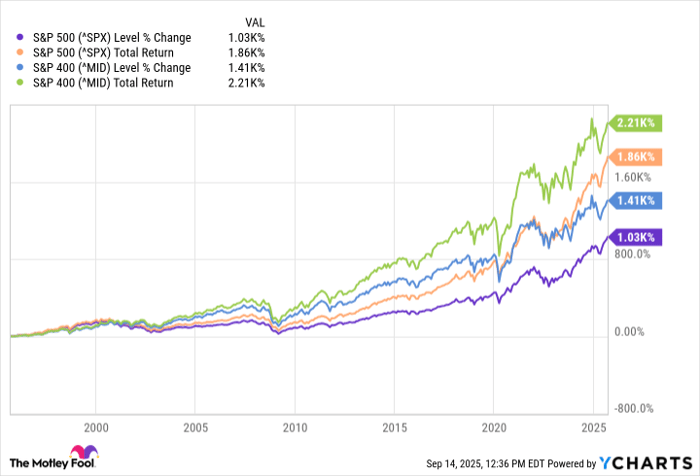

This group's historical results confirm it: Over the course of the past 30 years, the S&P 400's total return performance on an annualized basis was about 0.5% better than the S&P 500's when reinvesting dividend payments, and about 1% better when not reinvesting dividends. But over time, those small outperformances can really add up, as the chart below illustrates.

Data by YCharts.

It's worth noting that you'll likely experience more short-term volatility with the SPDR S&P MidCap 400 ETF Trust than you will with the SPDR S&P 500 ETF Trust. That's just how investing works -- the greater the potential gain, the more the market tries to shake out uncommitted investors, and the more buying and selling of these tickers you can expect.

For true long-term investors, though, mid-cap stocks are worth the wilder ride.

2. Vanguard Information Technology ETF

It's no secret that tech stocks as a class have outperformed all other sectors for the better part of the past three decades. But, understandably so. It has been technology that has spurred some of the biggest social and cultural changes during this time, after all. And for many investors, the tech-heavy Invesco QQQ Trust (NASDAQ: QQQ) provides their primary portfolio exposure to this sector.

There's a better option, though. Consider the Vanguard Information Technology ETF (NYSEMKT: VGT) instead, for a couple of reasons.

One of those reasons is simply that while the Nasdaq-100 index that the QQQ tracks is indeed loaded up with technology stocks like Nvidia and Broadcom, it's not strictly a technology fund. Only about 60% of the fund's value is in tech sector stocks. The other 40% isn't. That's not the case with the market-cap-weighted Vanguard Information Technology ETF. Its portfolio only includes tech names -- but 315 of them, which means many of them are mid caps and small caps that you might not otherwise get exposure to.

And the second reason to use VGT as your exposure to the tech sector? The Invesco QQQ Trust also only includes Nasdaq-listed names -- there are no NYSE-listed tickers in its basket. Although most of the best-performing tech stocks of recent years -- think Nvidia and Palantir -- are indeed Nasdaq listings, you don't want to miss out on fantastic NYSE-listed technology names like Taiwan Semiconductor Manufacturing and Arista Networks.

The Vanguard Information Technology ETF is also just a cost-effective holding, with an annual expense ratio of only 0.09%.

3. Schwab International Dividend Equity ETF

Finally, add the relatively new Schwab International Dividend Equity ETF (NYSEMKT: SCHY) to your list of exchange-traded funds that could help make you a millionaire by retirement. This is a completely different kind of fund than the Invesco QQQ Trust, and measurably different from the S&P MidCap 400 ETF Trust, making it a complementary holding to either -- or both.

Launched in early 2021 and meant to mirror the Dow Jones International Dividend 100 index, the Schwab International Dividend Equity ETF not only dishes out reliable payouts with a current yield of more than 4%, but also offers exposure to some quality stocks that American investors are less likely to come across. While its top holding is the relatively familiar British American Tobacco, its second- and third-biggest positions are Australian conglomerate Wesfarmers and Japanese drugmaker Ono Pharmaceutical -- not exactly household names here. Given the sheer levels of near-term and long-term uncertainty regarding the United States' economy these days, it just makes good sense to diversify your portfolio beyond our borders.

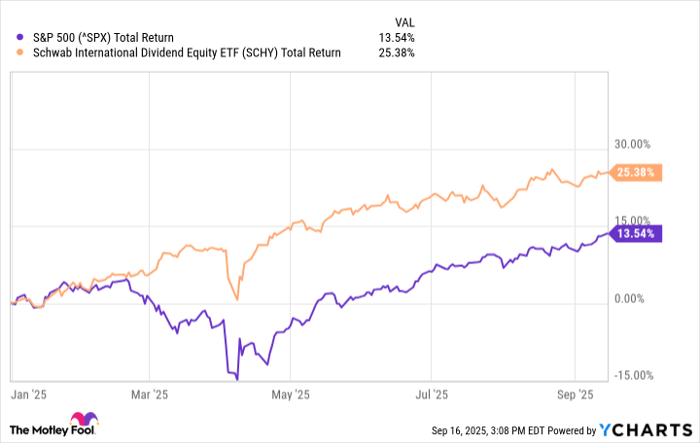

You don't have to look very far back in time to see why either. Remember the market's big pullback in February and March? That was not a global phenomenon. The companies whose shares tumbled were mostly U.S.-based businesses that were vulnerable to President Donald Trump's steep new import tariffs. The rest of the world's stocks largely rallied at the same time the S&P 500 was cratering.

Data by YCharts.

Granted, most international stocks also tumbled in November and December of last year while domestic stocks rallied, and both classes of stocks moved largely in tandem from 2021 to early 2023 (as is typically the case).

Still, this ETF could help compensate for some of the volatility your U.S.-based investments are likely to experience from here. It's also a healthy, easy-to-own hedge against the ever-changing value of the U.S. dollar.

But you just don't need or even want to collect dividends right now? That's OK. You can reinvest the dividends it distributes into more shares of the ETF, effectively turning it into a growth investment. Over the course of the past decade, investors reinvesting their dividend payments in more shares of the Dow Jones International Dividend 100 index would have booked an average annual gain of more than 9%. Not bad, given the amount of diversification it brings to the table.

Should you invest $1,000 in SPDR S&P MidCap 400 ETF Trust right now?

Before you buy stock in SPDR S&P MidCap 400 ETF Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SPDR S&P MidCap 400 ETF Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $647,425!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,071,739!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Arista Networks, Deckers Outdoor, Nvidia, Palantir Technologies, Taiwan Semiconductor Manufacturing, and Wesfarmers. The Motley Fool recommends British American Tobacco P.l.c. and Broadcom and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.