2 Reasons to Buy Lululemon Stock (and 1 Reason to Sell)

Key Points

Lululemon has posted strong historical growth and market share gains in the apparel category.

The stock now trades at a cheap earnings ratio.

Apparel is a tricky category that presents a cyclical risk to Lululemon's business.

Lululemon (NASDAQ: LULU) has been a huge winner for long-term shareholders, up a cumulative 1,000% since going public in 2007. However, shares are currently in a drawdown of nearly 70% from all-time highs, making 2025 one of the worst years for the stock ever.

Why? The athleisure leader has hit a growth rough patch in the United States, which has investors nervous about competition in leggings, athletic clothing, and the general apparel category. With the stock falling so rapidly, Lululemon now trades at one of its cheapest earnings multiples in history.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Here are two reasons to buy -- and one reason to sell -- Lululemon stock after this massive 2025 drawdown.

Image source: Getty Images.

Historical growth

One reason to buy Lululemon is its impressive historical growth in the hypercompetitive apparel category. With its sleek athleisure outfits and branding, Lululemon has taken a ton of market share in the United States. Its revenue has grown from well under $1 billion at the time of its initial public offering (IPO) to $10.9 billion over the last 12 months, for cumulative growth of 3,910%.

In recent years, Lululemon has begun to expand internationally, with plenty of room to still grow. First up was China. China is the largest apparel market in the world, with a population that skews toward higher spending on fashion and clothing compared to the average country. Lululemon's Mainland China revenue grew 24% year over year last quarter and now makes up 16% of total net revenue. With space to keep adding new store locations and drive online adoption, Lululemon's business in China is nowhere near market saturation.

Other regions are in even earlier stages of growth potential for the Lululemon brand. Revenue outside of China and North America accounts for just 15% of Lululemon's business, with major expansions planned for Europe, Latin America, and other Asian countries.

Athleisure as a category has already proven it works in virtually every market. Nike and Adidas are iconic global brands for a reason. Lululemon has a path to global reach at a similar level to these brands as long as it stays atop of the performance apparel category.

Cheap valuation

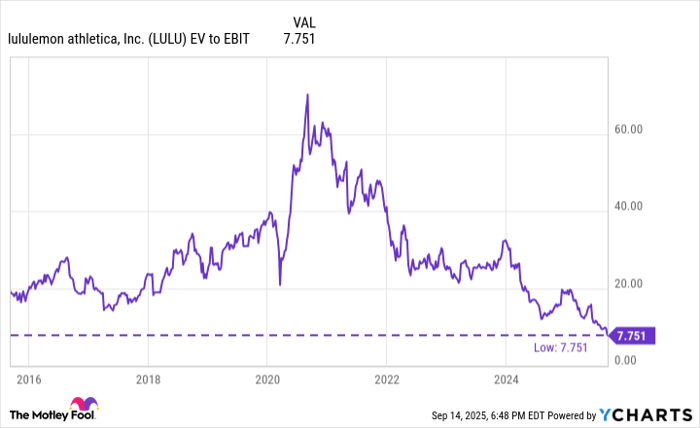

Perhaps the most attractive reason to buy Lululemon stock today is its valuation. As of Sept. 14, Lululemon stock trades at an enterprise value-to-operating income (EV/EBIT) ratio of 7.75. Enterprise value is a way to measure the size of a stock when taking into account cash and debt on the balance sheet, while operating income is income earned from the business before any interest earned or taxes paid.

This EV/EBIT ratio is the lowest level for Lululemon in the last 10 years. At the same time, management is pouring its cash flow into buybacks at this discounted valuation, with shares outstanding falling 15% in the last 10 years and at an accelerating pace. A low earnings ratio and consistent share repurchases can help boost earnings per share (EPS) growth and long-term stock price appreciation. This is the sweet spot Lululemon sits at today.

But why is the stock trading at such a discounted price?

LULU EV to EBIT data by YCharts

Apparel cyclicality

For the last 15 years, athleisure brands have seemed indestructible. Market share gains and the supercharged growth of the category during the COVID-19 pandemic led to stocks like Lululemon getting premium valuations from Wall Street. As you can see from the chart above, Lululemon used to trade at an EV/EBIT in the 30 to 60 range, which is well above the stock market average.

Now, this growth is coming into question. Last quarter, North America revenue only grew by 1% year over year, which is lower than inflation. Tariffs on imports are going to hurt profit margins, which could lead to falling earnings for Lululemon in 2025.

Apparel is a cyclical category with viral trends coming in and out of style. Lululemon's athleisure category is facing broad consumer headwinds at the moment, with other types of clothing gaining popularity. This is why Lululemon still gained market share in the athleisure category last quarter despite barely growing in North America.

While the changing dynamics of the apparel sector should not be forgotten, Lululemon is a premium brand that has many years of stellar historical growth, and at its current valuation the stock looks like a good buy even considering these cyclical risks to the business. Smart investors will add Lululemon stock to their portfolio on this 2025 dip.

Should you invest $1,000 in Lululemon Athletica Inc. right now?

Before you buy stock in Lululemon Athletica Inc., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lululemon Athletica Inc. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $647,425!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,071,739!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lululemon Athletica Inc. and Nike. The Motley Fool has a disclosure policy.