Where Will Rivian Be in 2028, and Is It a Buy Now?

Key Points

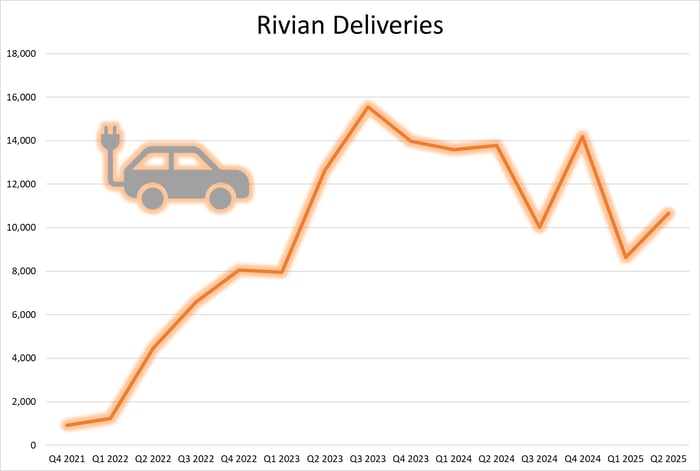

After peaking in 2023, demand appears to have waned for Rivian's R1 vehicles.

Rivian's R2 is expected to appeal to a more price-conscious consumer.

Distant plans and concepts are in the works for even an R4 and R5.

This has mostly been a forgettable year for Rivian Automotive (NASDAQ: RIVN), as the young electric vehicle (EV) maker doesn't have any vehicle launches this year. That's also a good thing, because a mostly forgettable year means nothing horrible happened either -- just ask Ford Motor Company, which is currently setting a record for most recalls in one year ever.

For Rivian to really reward long-term investors, it's going to have to scale. But how soon will we see growth? Where will Rivian be in, say, three years, and is it a buy now? Let's dig in.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

What have you done for me lately?

Rivian arguably had as much momentum as any EV maker exiting 2023, but then its delivery growth began to slow and signs of waning demand appeared. You can see this develop in the graphic.

Data source: Rivian production and delivery press releases. Image source: Author.

As most investors following the EV industry know, Rivian has a card up its sleeve for 2026 when the R2 goes into production and deliveries begin. It'll be a strategic move for the company to enter into more affordable SUV EV segments, with a starting price around $45,000 before shipping.

In the near term, one of Rivian's primary objectives is to scale its business to try and consistently reach positive gross profits. Scaling won't come easy in the EV industry currently, with the $7,500 federal tax credit disappearing at the end of September and tariff uncertainty looming. Rivian expects to produce between 40,000 and 46,000 vehicles in 2025, which means it has a long ways to go to reach scale -- how much can it do over the next three years?

Are we there yet?

Rivian is all hands on deck to getting the R2 into showrooms and eventually consumers' driveways, but what comes after that? After the R2 begins to enter its prime, or perhaps peak, the R3 -- which shares the R2's vehicle platform -- will have an even lower sticker price. Though official details aren't out yet, the price tag will likely aim to check in under $40,000 before shipping.

What's intriguing about the R3 is that rather than design it to look like a miniature R2, it gives more of a lifted hatchback feel that could be a hit with younger buyers -- it would be a huge win if they were first-time EV buyers as well. Rivian also unveiled a performance version of the R3, the R3X.

Image source: Rivian.

The R3 will represent yet another step closer to reaching mainstream consumers and bringing price points lower while slowly scaling the business. Production and deliveries of the R3 won't start until mid-2028 at the company's future Atlanta factory, which were delayed in an effort to push up the R2 schedule and save on costs in the near term.

Rivian's CEO even said the automaker was working on concepts for its next vehicles following the R2 and R3, again at even lower price points. The R4 and R5 could potentially share a platform to help scale and bring down costs, and there's also the possibility Rivian could bring a smaller electric pickup truck into the fold, with both Slate Auto and Ford planning compact pickup trucks -- but this move wouldn't likely be until 2030 or later.

Another thing that could develop over the next two to three years is additional customers for its RCV. Back in 2021 Rivian began producing its commercial vans exclusively for Amazon until 2023, when sales were opened to other large fleet buyers. This might be the X factor over the next couple of years, as Rivian gained much credibility and notoriety with investors when it inked its deal with Amazon to deliver 100,000 RCVs by the end of the decade.

Now with the doors open to different customers, if Rivian were able to ink another large customer, it would go a long way to increasing scale in the near term.

Is Rivian a buy now?

Rivian will be at an absolute pivotal point in its young history in roughly three years' time. It will be cutting costs and improving production efficiency to help boost gross margins to be positive on a full-year basis, and likely trying to prove it can turn the corner for bottom-line profits.

The company will also be ushering in the R3 and attempting to accelerate production as quickly and efficiently as possible. The R2 and R3 will pave the way into the next phase of growth for the EV maker, as it drops price points to lure in a wider addressable target audience. Look for Rivian's revenue to begin soaring in about a year, and if the company can execute cost-cutting initiatives, it should be taking strides toward profitability in as soon as three years.

But does that make Rivian a buy now? It's going to be a very bumpy and risky road for this young EV maker, and if you believe in its ability to scale and become profitable, it would still be wise to limit high-risk companies like Rivian to a small position in your portfolio.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $648,369!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,089,583!*

Now, it’s worth noting Stock Advisor’s total average return is 1,060% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Daniel Miller has positions in Ford Motor Company. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.