Up Over 35% in 2025: This "Boring" Stock Is Offering Exciting Returns for Investors

Key Points

United Rentals' management stays flexible to maximize shareholder value.

The valuation is higher than normal, but it might not be a deal-breaker.

When it comes to boring investments, United Rentals (NYSE: URI) likely makes the short list. And yet the stock for this equipment rental company is trading up 35% year to date, as of this writing, crushing the 12.5% comparable return for the S&P 500. Moreover, its returns in 2025 aren't a fluke -- the stock is up 1,310% over the last 10 years, and that's before accounting for its dividend.

Boring stocks such as United Rentals are among my favorite ideas. It's true, investors don't score any points for originality (although I still enjoy blazing my own trail nevertheless). But when investors are willing to wander off the beaten path, it's often possible to find long-term market-beating investments at a bargain.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Why is United Rentals' stock up so much, and is it still a bargain today? Let's dive in.

Image source: Getty Images.

Why United Rentals has been a great stock

United Rentals lives up to its name: It provides rental equipment (think scissor lifts and backhoes) to customers nationwide. It's not an insignificant business; it's the largest player with 15% market share.

Management seems to have two primary goals. First, generate as much free cash flow as possible. Second, use its free cash flow as efficiently as possible to create shareholder value. And it's done a great job at both.

United Rentals generates revenue in two primary ways: It rents equipment and it sells used equipment. Management likes to stay as flexible as possible, based on market conditions. Its capital expenditures can consequently fluctuate wildly. But the end result is strong free cash flow. The company has averaged a stellar free-cash-flow margin of over 17% during the past decade.

When it comes to using its free cash flow, United Rentals prefers to acquire other businesses to increase its share of the market. For instance, in early 2024, it acquired matting solutions (ground protection on job sites) business Yak for $1.1 billion.

What's great about acquisitions in this space is that they're usually reasonably priced. In this case, Yak had earned $171 million in adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) just the year before it was acquired. United Rentals paid just 6 times this profit figure, which is better than almost any deal you'll find on the stock market.

It means that United Rentals quickly earns back its investment, giving it more cash to deploy yet again to create more shareholder value.

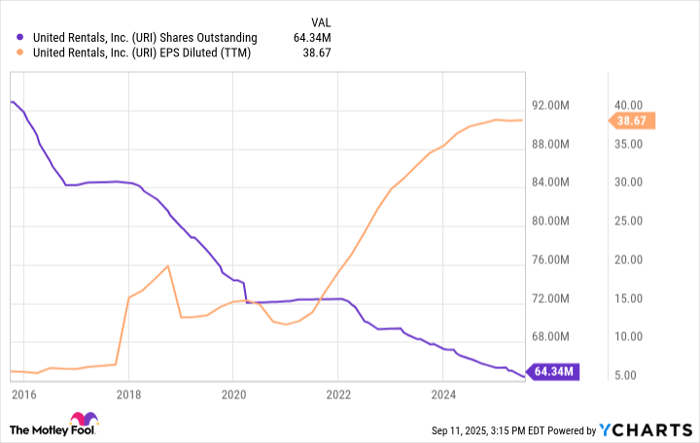

When United Rentals' management can't find an acquisition that it likes, it will buy back stock -- it scales up and down based on its free-cash-flow availability. But while the rate of buybacks isn't constant, the overall share count consistently trends lower, as the chart below shows, and it's a big reason why its earnings per share (EPS) are near an all-time high.

Data by YCharts.

Is United Rentals stock a good deal today?

Investors shouldn't have any conversation about valuation until they've talked business. For United Rentals' business, the space is resilient, and trends remain strong. I don't see why the company won't continue to generate free cash flow and use it prudently. In short, the business remains investable, in my opinion.

The valuation for United Rentals seems expensive. Management believes it will generate roughly $2.5 billion in free cash flow this year. With a market cap just over $60 billion, United Rentals' stock trades at around 25 times free cash flow for this year. Historically, it trades closer to 15 times free cash flow.

The price-to-sales (P/S) ratio paints a similar picture. United Rentals' stock has often traded between a P/S of 1 and 2. But right now it's almost a P/S of 4. Both of these valuation metrics suggest that United Rentals' stock is overvalued.

Investors could move to the sidelines and wait for a better price. It would seem prudent, considering the stock has pulled back 25% or more every couple of years for a decade, on average. But then again, waiting on a better valuation can be a losing game. Just ask me: I sold United Rentals stock at around $660 per share, waiting on a better valuation. It's appreciated about 50% since.

For investors who believe in United Rentals' long-term prospects but have valuation concerns, a better approach may be to use dollar-cost averaging -- regularly making small buys to build a position.

That might sound like a boring answer. But considering how boring business is for United Rentals, it may be fitting. Moreover, investors should take care not to confuse boring with unprofitable. Indeed, dollar-cost averaging into a long-term winner such as United Rentals' stock could prove to be a lucrative investment decision five years from now.

Should you invest $1,000 in United Rentals right now?

Before you buy stock in United Rentals, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United Rentals wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $640,916!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,012!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.