Prediction: This Stock Will Be Worth More Than Palantir 3 Years From Now

Key Points

The solid demand for Palantir's AI software has supercharged the stock, but it is trading at a very expensive multiple right now.

ASML Holding is expected to witness an acceleration in growth.

ASML is trading at an attractive valuation and isn't much behind Palantir when it comes to market cap.

Palantir Technologies (NASDAQ: PLTR) has been one of the hottest stocks on the market in the past year. The software specialist has seen a significant surge in the demand for its artificial intelligence (AI) platform, which allows organizations and governments to integrate generative AI tools into their operations and processes.

The robust growth in Palantir's revenue and earnings in recent quarters has led to a 5x jump in the company's stock price in the past year. The generative AI software provider now has a market cap of $385 billion following its recent surge and it is among the top 30 companies in the U.S. by market cap.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

However, there is another company that has the potential to upstage Palantir in the next three years. Let's take a closer look.

Image source: Getty Images.

This semiconductor bellwether is well placed to overtake Palantir

ASML Holding (NASDAQ: ASML) is one of the most important semiconductor companies in the world. Its machines play a critical role in helping foundries and chipmakers manufacture advanced chips that are deployed in multiple applications ranging from smartphones to personal computers to cars to data centers to the Internet of Things (IoT).

ASML has a near-monopoly in extreme ultraviolet lithography (EUV) machines, which are essential for manufacturing smaller chips that are energy-efficient and powerful at the same time. Not surprisingly, ASML's machines are being deployed by major chip manufacturers across the globe to meet the fast-growing demand for AI chips that are gaining traction in multiple applications.

ASML's net bookings increased by 40% sequentially to 5.5 billion euros in Q2. The company expects to end 2025 with 15% revenue growth to 32.5 billion euros. However, it is worth noting that the company's 2025 guidance is toward the lower end of its original forecast of 30 billion euros to 40 billion euros.

ASML is being cautious about its outlook on account of the potential impact of tariffs on its business. However, the Dutch company saw a lower-than-expected impact from tariffs last quarter. It recorded a 34% increase in its revenue in the first six months of 2025. So, there is a chance that ASML could end the year on a stronger-than-expected note, especially considering the robust spending on AI infrastructure.

All the major cloud computing companies have reported massive jumps in their remaining performance obligations (RPO), or backlog, recently, suggesting that they are going to bring online more data center capacity to meet demand. McKinsey estimates that $3.1 trillion is likely to be spent on chips and hardware deployed in AI data centers through 2030.

This explains why the semiconductor equipment industry is expected to spend $50 billion for procuring advanced chipmaking equipment in 2028, according to industry association SEMI. That's nearly double 2024 levels. SEMI adds that the investment in "2nm and below wafer equipment represents a particularly dramatic expansion, with funding more than doubling from US$19 billion in 2024 to US$43 billion in 2028."

This bodes well for ASML as its latest EUV lithography equipment will enable chipmakers to produce chips that are smaller than 2-nanometer (nm) in size. This explains why analysts are anticipating ASML's growth to pick up impressively in the next three years.

Here's why ASML could be worth more than Palantir

Palantir stock's stunning surge in the past year has made it expensive. It is now trading at a whopping 114 times sales. That's far higher than the Nasdaq Composite index's average price-to-sales ratio of 5. Palantir will have to keep accelerating its growth so that it can justify the massive premium it is trading at.

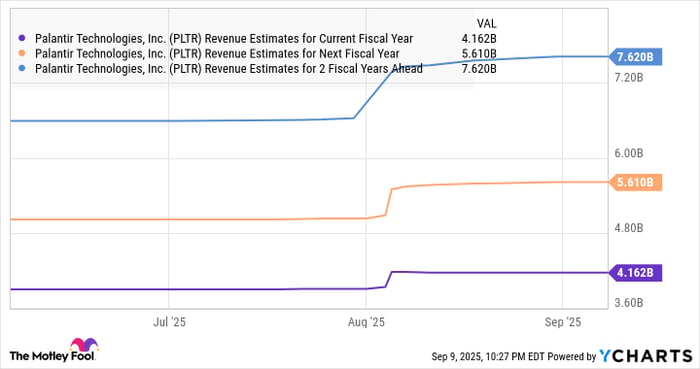

The good news is that analysts expect Palantir to deliver on that front.

PLTR Revenue Estimates for Current Fiscal Year data by YCharts

However, even if Palantir achieves $7.6 billion in revenue after three years, its upside could be limited by its expensive valuation. Moreover, any cracks in the company's growth store could weigh on the stock. On the other hand, ASML is trading at a much more attractive price-to-sales ratio of 8. The market could reward it with a richer multiple thanks to a potential acceleration in its growth.

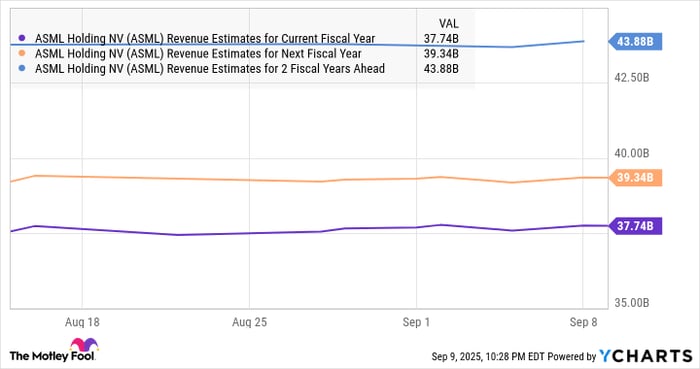

ASML Revenue Estimates for Current Fiscal Year data by YCharts

So, if ASML trades at 8 times sales after three years and achieves $44 billion in revenue (as seen in the previous chart), its market cap could jump to $352 billion. ASML currently has a market cap of $311 billion, which is 24% short of Palantir's. However, if the market decides to lower the massive premium that Palantir enjoys right now owing to any slowdown in its growth or because of intensifying competition in the AI software market, its red-hot rally could stall.

So, ASML has the potential to overtake Palantir's market cap in the next three years on the back of an acceleration in its growth and potential slowing down for Palantir given its high valuation.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $640,916!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,012!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 8, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML and Palantir Technologies. The Motley Fool has a disclosure policy.