Statistics Say: This Is the Best Age to Claim Social Security

Key Points

The longer you wait to file for Social Security, the more your benefits increase.

Studies show that delaying Social Security beyond age 65 should result in a larger lifetime benefit.

Deciding when to claim Social Security should be a holistic decision that considers multiple factors.

Throughout your career, you should ideally be saving and investing for retirement. In many cases, it happens passively through a 401(k) or related account. In other cases, it takes a little work on your end when you use accounts like a traditional IRA or Roth IRA.

While you're doing this, Social Security is working behind the scenes to keep a running record of your lifetime earnings to determine your eventual benefit. The other part of what determines your Social Security benefit is when you claim it. For many Americans, Social Security will account for a significant portion of their retirement income, so the claiming decision is one of the most important decisions people make as they're approaching retirement.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

The earliest age one can typically claim Social Security is 62, but that's not the right move for everyone. With that in mind, here's what one study suggests is the best claiming age.

How claiming age affects your monthly Social Security benefit

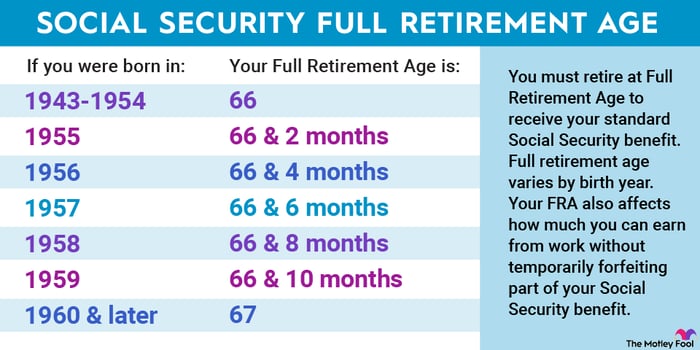

Before digging into the best age, it's important to understand how benefits are affected by the timing of your claim. It all revolves around your full retirement age (FRA), which is when you're eligible to receive your base benefit, called the primary insurance amount (PIA).

Image source: The Motley Fool.

If you claim before FRA, the Social Security Administration reduces your benefit by 5/9 of 1% (6.7% annually) per month, up to 36 months. Every additional month beyond 36 months further reduces benefits by 5/12 of 1% (5% annually). This means if your FRA is 67 -- which is the case for most workers today -- and you claim benefits at 62, your monthly benefit will equal your PIA less 30%.

However, delaying benefits past your FRA will increase your benefits by 2/3 of 1% (8% annually) until you reach age 70. This works out to around a 24% boost on top of the PIA for someone whose FRA is 67 and who delays until 70. Once you reach 70, benefits are no longer increased by delaying them, so that's the latest age anyone should realistically claim.

So, what's the best age to claim Social Security?

A Nov. 2022 working paper released by the National Bureau of Economic Research (NBER) noted that "virtually all American workers aged 45 to 62 should wait beyond age 65 to collect." For someone whose FRA is 67, claiming benefits at 65 would result in around a 13.3% deduction from their PIA.

The same NBER write-up concluded that "More than 90 percent should wait till age 70" to claim benefits. However, only around one in 10 people do so.

For some people, delaying benefits as late as possible is feasible because they have other sources of income (retirement accounts, pensions, investments, etc.) that can keep them afloat while they wait. This is an ideal scenario, which is why making conscious efforts to save and invest for retirement during your working years is so important.

By waiting to file, you're maximizing the lifetime benefits you receive from Social Security, assuming you live into your 80's.

Your claiming decision should be holistic

The most important thing to remember when it comes to claiming Social Security is that the "right" decision very much depends on your personal situation. If Social Security will be your only source of retirement income, then you should just claim when it is necessary to do so.

Even if you have supplementary income sources, it's important to consider other factors, such as your personal health and family health history, and how they could affect your life expectancy. If any of these factors suggest a shorter life expectancy, claiming early may be your best path to maximizing your lifetime benefits.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

The Motley Fool has a disclosure policy.