Should You Buy Archer Aviation While It's Below $10?

Key Points

Its Midnight aircraft is a flying taxi that will enable urban aerial transportation and potential military applications.

Archer expects UAE approval for exhibition flighs, while in the U.S., it's progressing toward AAA certification.

It faces significant operational and development costs, having reported a loss of $206 million in the last quarter.

Imagine a world where traffic jams vanish, airport lines become obsolete, and your daily commute takes to the skies. Until recently, that world was left to science fiction. Today, it's being built by pioneers in electric vertical takeoff and landing (eVTOL) technology, like Archer Aviation (NYSE: ACHR).

These sleek, silent aircraft combine the agility of helicopters with the sustainability of electric propulsion. eVTOLs represent a once-in-a-generation leap forward in transportation innovation. With Archer Aviation stock recently dipping below $10 a share, is now the time for investors to get in? Let's explore Archer and how things are expected to unfold from here.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Archer's Midnight aircraft could revolutionize transportation

Archer Aviation develops electric vertical takeoff and landing aircraft, with its Midnight aircraft as its flagship product. With this eVTOL technology, Archer aims to provide direct-to-consumer aerial ride-sharing services. Think of Uber Technologies, but zooming around the city in an electric-powered drone-like vehicle.

The company's Midnight aircraft is built on its proprietary 12-tilt-6 distributed electric propulsion platform. It can seat four pilots, take off vertically from a helicopter pad, and its lithium-ion-battery-powered motor is quiet, making it ideal for urban transportation.

This technology is promising for urban transportation, enabling people to travel quickly to and from airports. Additionally, military applications of this eVTOL technology could be a significant source of growth. With its low thermal and acoustic signatures, the aircraft could be great for reconnaissance, rescue, and other military missions.

What's next for Archer Aviation

Archer is currently producing six Midnight aircraft, with three already in final assembly, which will incorporate a four-blade rear propeller. When complete, it will have eight total Midnight aircraft in its fleet.

It aims to build up to 10 Midnight aircraft in 2025 to support ongoing certification-related testing and deployments with key partners. The primary focus for 2025 is on manufacturing piloted, type-design aircraft for testing and early commercial deployment, with plans to ramp up production to two aircraft per month by the end of 2025 at its Covington, Georgia, facility.

The eVTOL company is on track to obtain commercial authority from the General Civil Aviation Authority (GCAA) in the United Arab Emirates (UAE) sometime this year. This will enable it to conduct exhibition flights, which simulate actual passenger routes, eventually leading to full commercial flights in the region by the end of this year or early next year.

Turning to the U.S., the government has begun to lay the groundwork for air taxi deployments to begin in the next few years, as it looks to validate Midnight's performance, safety, and scalability in real-world conditions. Archer is currently in phase four of the Federal Aviation Authority's (FAA) type certification process, having completed Midnight's airworthiness criteria in May 2024. A key step remaining is the resolution of the industrywide flight test policy, which Archer anticipates will happen soon.

Image source: Archer Aviation.

By 2026, Archer's goal is to scale production and delivery rates for both U.S. and international customers to achieve a positive gross margin per aircraft. By 2027, the company aims to achieve a positive operating margin, targeting a gross margin of approximately 50% per aircraft. By 2028, the goal is to reach full manufacturing facility capacity of 650 aircraft per year, with a 20% or greater operating margin.

Watch its cash situation

Archer's financial situation is something investors want to monitor closely. Currently, at the end of the second quarter, Archer has $1.7 billion in cash and cash equivalents. This is a positive sign, as it marks the fourth consecutive quarter where the company has increased its cash balance.

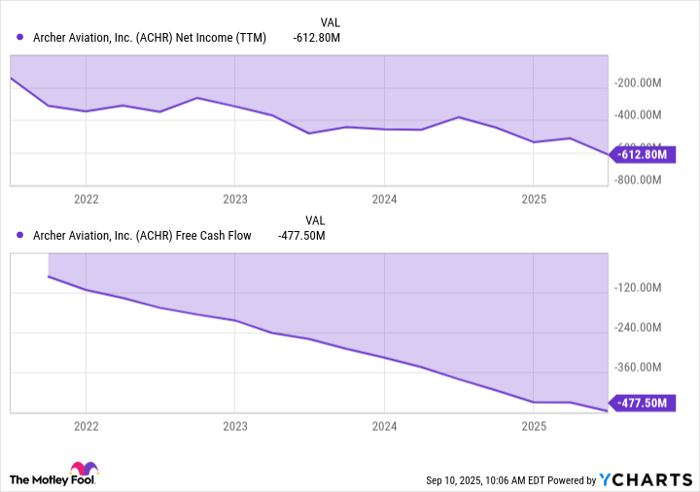

Archer needs capital because of the capital-intensive nature of its business. The company lost $206 million in the second quarter and is still pre-revenue at this stage. In the meantime, it will continue to burn cash for operational, research, and development costs as it works toward certification and scales up its manufacturing capabilities.

ACHR Net Income (TTM) data by YCharts

Is Archer Aviation a buy?

Archer is developing innovative technology that could revolutionize urban transportation as we know it. With that said, the company is in its early stages, as aircraft undergo rigorous testing before rolling out in the UAE sometime late this year or early next year, and in the U.S. after that.

As an early-stage company, it is incurring losses, and profitability remains far off for the company. This makes it vulnerable to any delays or impacts on the timeline of approval, commercial operations, and ramping up of manufacturing capacity.

Right now, Archer is a high-risk, high-reward stock if it can establish a foothold and build out the future of urban air mobility. As such, it's best suited for investors with a long-term horizon who are willing to ride out fluctuations as the company works to make urban air transportation a reality.

Should you invest $1,000 in Archer Aviation right now?

Before you buy stock in Archer Aviation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Archer Aviation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $640,916!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,012!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 8, 2025

Courtney Carlsen has positions in Archer Aviation. The Motley Fool has positions in and recommends Uber Technologies. The Motley Fool has a disclosure policy.