Billionaire Warren Buffett Has Always Recommended Investing in the S&P 500. However, the Current S&P 500 May Make This Advice Tricky to Follow.

Key Points

While historically diversified, the S&P 500 has become overly concentrated in tech stocks.

So it no longer seems like an accurate representation of the broader U.S. stock market.

The Invesco S&P 500 Equal Weight ETF offers a more balanced alternative today.

To say that Warren Buffett has made quite a name for himself in the stock market would be quite an understatement. With more than 60 years of professional experience under his belt, Buffett has managed to make himself one of the richest people in the world ($150 billion net worth at the time of this writing) and his company, Berkshire Hathaway, one of the world's most valuable public companies (over $1 trillion market cap).

It's because of Buffett's success that many investors pay close attention to his investing moves, as well as his words of wisdom. Although the investing strategy of a billionaire and a trillion-dollar corporation doesn't align with that of your average investor, Buffett makes it a point to provide investing wisdom that applies to the latter.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

One piece of advice that Buffett has repeatedly echoed is that the best investing move for the average investor is to own an S&P 500 index fund and let that lead you throughout your investing. And while this is undoubtedly sound investing advice, the current state of the S&P 500 means this advice may be much trickier to follow.

Image source: The Motley Fool.

Tech's influence is becoming hard to ignore

The S&P 500 is a market-cap-weighted index, meaning that larger companies account for more of the index and have more influence on the index than smaller companies. Historically, this hasn't been that big of a deal, but with the surge in tech stock valuations (thanks, artificial intelligence (AI)), the index has become very concentrated.

Nine of the index's top 10 holdings are tech companies, with the sole exception ironically being Berkshire Hathaway:

| Company | Percentage of the ETF |

|---|---|

| Nvidia | 8.06% |

| Microsoft | 7.37% |

| Apple | 5.76% |

| Amazon | 4.11% |

| Meta Platforms (Class A) | 3.12% |

| Broadcom | 2.57% |

| Alphabet (Class A) | 2.08% |

| Alphabet (Class C) | 1.68% |

| Berkshire Hathaway (Class B) | 1.61% |

| Tesla | 1.61% |

Data source: Percentages as of July 31 and based on the Vanguard S&P 500 ETF. Table by author.

Nvidia, Microsoft, and Apple alone make up over 21% of the index, which isn't ideal, considering that it consists of just over 500 companies. The tech sector in total is 34% of the index, giving it an outsized influence on the index's performance.

It has worked out in the index's favor in recent years due to the success of these companies and the tech sector. However, this could easily change if the tech sector stalls or experiences a downturn, and it goes against the original intent of the index. This concentration is higher than it was during the peak of the dot-com bubble.

What is the original intent of the S&P 500?

The S&P 500 tracks 500 of the largest American companies on the market. Its original intent was to provide a reliable, transparent benchmark that reflected overall U.S. stock market performance systematically.

Although the S&P 500 isn't directly correlated with the U.S. economy, it has often been used to gauge its health because its broad coverage of sectors historically mirrored economic trends and the financial health of the country's top corporations.

Now that the tech sector is the bulk of the index, this isn't quite the case. It's more of a gauge on the performance and momentum of a handful of dominant megacap technology companies.

What should investors do to address the index's concentration?

Investors can't change how the S&P 500 is weighted, but what they can do is understand this overconcentration and the risks that come along with it. One way to address this would be to use sector-specific exchange-traded funds (ETFs) to complement an S&P 500 ETF and get more exposure to sectors that don't have as much representation (materials, real estate, utilities, and energy only account for around 9% of it).

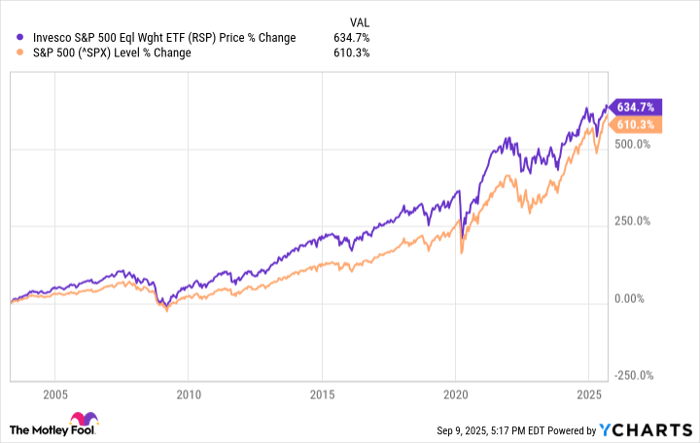

Another option, if you're still interested in investing in the S&P 500, would be to invest in an equal-weight S&P 500 ETF like the Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP). Instead of weighing the companies by market cap, this ETF splits investments roughly equally among all S&P 500 companies. This approach has helped the ETF outperform the S&P 500 since it hit the market in April 2003.

By investing in this ETF, you gain exposure to the index without relying heavily on megacap tech stocks for your success (or lack thereof). The tech sector accounts for approximately 13.9% of the ETF.

The composition of the standard S&P 500 will inevitably change as companies' market caps change, but the current overconcentration risk is something investors should keep in mind when following Buffett's "just invest in the S&P 500" advice.

Should you invest $1,000 in Invesco S&P 500 Equal Weight ETF right now?

Before you buy stock in Invesco S&P 500 Equal Weight ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco S&P 500 Equal Weight ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $640,916!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,012!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 8, 2025

Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.