Here's the Smartest Way to Invest in the S&P 500 in September

Key Points

There are many ways to invest in the S&P 500 index.

The broad market benchmark has hit new all-time highs on many occasions this year.

With the market at all-time highs and heavily concentrated in a small group of tech and AI stocks, investors may feel a bit wary about investing in the S&P 500 right now.

Composed of roughly 500 of the most well-known large-cap U.S. stocks, the S&P 500 index is a benchmark for the entire market, which is why so many investors choose to own the index in one way or another. Over many decades, it can be very difficult for investors to outperform the broader market with their own investing strategies.

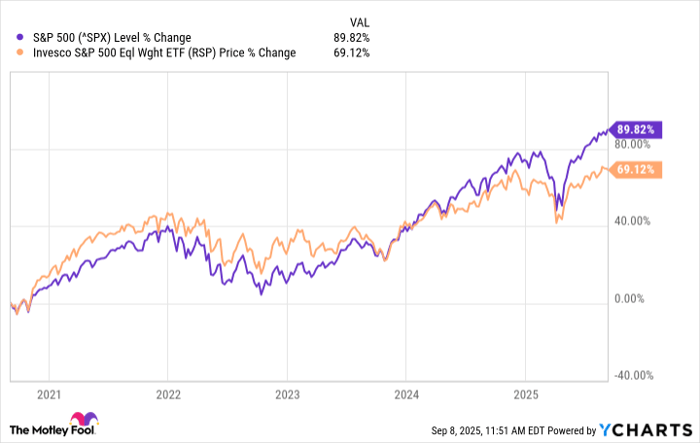

And over the past five years, the S&P 500 has seen particularly strong returns, nearly doubling in that period. That said, it has also been very volatile while operating under conditions that have made it difficult for investors to properly value the market or determine its ceiling. Given the uncertainty, here's the best way to invest in the S&P 500 in September.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

How we got here

The S&P 500 has been hitting new all-time highs for several years now. The momentum is being driven by a small group of large technology stocks investing heavily in artificial intelligence. These companies, known as the "Magnificent Seven," make a tremendous amount of money and are believed to be the primary beneficiaries of the AI tailwind, which is why they are investing hundreds of billions into AI-related capital expenditures. Most of their market caps have now surpassed $1 trillion, while the AI chip giant Nvidia has a market cap of over $4 trillion.

Due to their incredible size, these seven companies make up over 30% of the S&P 500. On one hand, this concentration has contributed to the S&P 500's outperformance. On the other hand, many investors are concerned by big tech's premium valuations and what might happen to the broader market if the AI revolution stumbles and takes this group of stocks down with it. Even the S&P 500 is trading at an above-average forward price-to-earnings (P/E) ratio of 23.

That's not to say investors are wrong to be bullish on AI, but just as the internet changed the world, the markets had to survive the dot-com bubble first. The internet and AI booms are different in many regards, but there are enough similarities to put some people on high alert.

The best way to invest in the S&P 500

Considering the dynamics mentioned above, the smartest way to invest in the broader benchmark this month, in my opinion, is to actually buy the Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP). As the name suggests, this index removes the market cap weighting used by the S&P 500, so investors will have equal exposure to all companies in the index. In doing so, investors remove the concentration risk posed by the Magnificent Seven.

Data by YCharts.

Over the past five years, the standard S&P 500 has outperformed the equal-weight S&P 500, driven by tech and AI. The Invesco ETF isn't likely to outperform the S&P 500 in the near term, but it could certainly limit investors' downside if the market takes a turn for the worse. And if investors broaden their focus beyond the index's biggest names, the equal-weight index fund may also outperform. Currently, the Invesco ETF trades at a forward P/E ratio of about 18, so it's also much cheaper than the benchmark index.

Now, more aggressive investors with a long-term horizon can certainly still invest in the S&P 500, as long as they are prepared for more volatility. The market has experienced many crashes and recessions, but it has gone on to reach new highs while generating strong returns for investors. If you do continue to buy ETFs tracking the S&P 500, consider dollar-cost averaging, which should smooth out your cost basis over time.

But if you're primarily looking for the best way to buy the S&P 500 right now, I still like the Invesco S&P 500 Equal Weight ETF, given where valuations are and the looming uncertainty around monetary policy and the economy.

Should you invest $1,000 in Invesco S&P 500 Equal Weight ETF right now?

Before you buy stock in Invesco S&P 500 Equal Weight ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco S&P 500 Equal Weight ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $672,879!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,086,947!*

Now, it’s worth noting Stock Advisor’s total average return is 1,066% — a market-crushing outperformance compared to 186% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 8, 2025

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.