Is Arm Holdings Stock a Buy Now?

Key Points

Arm Holdings stock dipped substantially after the release of its latest quarterly results.

The company is investing heavily in R&D to make the most of promising growth opportunities.

Its stock is expensive right now, but could justify its valuation by clocking strong earnings growth.

British technology company Arm Holdings (NASDAQ: ARM) has witnessed a remarkable surge in its stock price since April 7, when its shares were trading at a 52-week low, driven by the broader rally in technology stocks.

However, its red-hot rally came to a grinding halt following the release of the company's fiscal 2026 first-quarter results (for the three months ended June 30) on July 30. Arm stock fell more than 13% in a single session. Investors weren't impressed with the company's in-line results and weaker-than-expected guidance, as they were expecting stronger numbers from the company to justify its expensive valuation.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Let's take a closer look at Arm's numbers and check if the recent slide could be a buying opportunity for investors looking to add a technology stock to their portfolios.

Image source: Getty Images.

Arm's aggressive spending is taking a toll on its bottom line

Arm Holdings gets its revenue from selling licenses for its chip architecture. Semiconductor companies use this architecture to design and develop chips that go into various applications, ranging from smartphones to personal computers (PCs) to data centers. Arm also gets a royalty from the sale of each chip that's manufactured using its architecture and intellectual property (IP).

The company's revenue in the first quarter of its fiscal 2026 increased 12% year over year to $1.05 billion. This was driven by a solid jump of 25% in its royalty revenue, which accounted for 55% of its top line during the quarter. Arm attributed the increase in its royalty revenue to the growing adoption of its artificial intelligence (AI)-focused Armv9 architecture for manufacturing data center chips, and its compute subsystems (CSS), which are used to develop chips for custom applications.

However, the company's non-GAAP net income fell to $0.35 per share during the quarter from $0.40 per share in the year-ago period. Arm witnessed a sharp contraction in its operating margin during the quarter, which was a result of a big jump in its research and development (R&D) expenses. Specifically, Arm's R&D expenses increased by 34% on a year-over-year basis in fiscal Q1.

Arm management remarked on the company's latest earnings conference call that it will continue to invest aggressively in R&D. As pointed out by CEO Rene Haas:

We are continuing to explore the possibility of moving beyond our current platform into additional compute to subsystems, chiplets and potentially full end solutions. To ensure these opportunities are executed successfully, we have accelerated the investment into our R&D. These investments include expanding engineering delivery across multiple levels, adding to the already significant product investments we have made to date.

Arm's stance isn't surprising, since the company's architecture is now being widely used in data centers to build and deploy custom AI chips. The company says that there has been a 14x jump in the number of data center chips that are manufactured using its designs since 2021. That's not surprising, as major cloud computing companies such as Amazon, Microsoft, and Alphabet's Google are using its architecture to design custom AI silicon.

Even Nvidia has used Arm's IP to design its Grace Blackwell server processors. Smartphone giants Apple and Samsung are also Arm's customers, using the British tech giant's chip architecture to manufacture AI-capable smartphone processors. The good part is that Arm's CSS licenses are now gaining traction among customers for developing smartphone, PC, and data center chips.

Arm says that it "signed three additional CSS licenses this quarter with existing CSS customers, including two for the data center and one for PCs, more than doubling our CSS licenses from a year ago." Importantly, Arm management points out that the royalty rate of its CSS license is double that of its Armv9 architecture.

So, it's easy to see why the company is looking to push the envelope on the product development front to provide end-to-end solutions to customers to help them design advanced chips capable of tackling complex workloads. Even better, Arm's spending on R&D is bearing fruit as the company is gaining impressive share in the data center and PC processor markets. Its smartphone revenue is growing at a faster rate than the end market, thanks to the use of its IPs to manufacture processors for flagship smartphones.

However, Arm's R&D spending is going to keep its bottom line under pressure. The company's earnings estimate of $0.33 per share for the current quarter (at the midpoint of its guidance range) is lower than the $0.35 per share consensus estimate. The positive thing to note is that earnings would increase in double digits from the year-ago period's reading of $0.30 per share at the midpoint, with revenue expected to increase by more than 25%.

But then, analysts are expecting an increase of just 5% in Arm's earnings this year, which can be attributed to the investments that it is making to secure its long-term growth. That could be a problem considering its expensive valuation.

The stock is richly valued, but the long-term picture seems bright

Arm trades at an expensive 208 times earnings as of this writing. It's easy to see why investors hit the panic button following its latest quarterly report. The decline in its earnings didn't justify the rich valuation, and the single-digit earnings growth that it's expected to deliver this year doesn't help matters either.

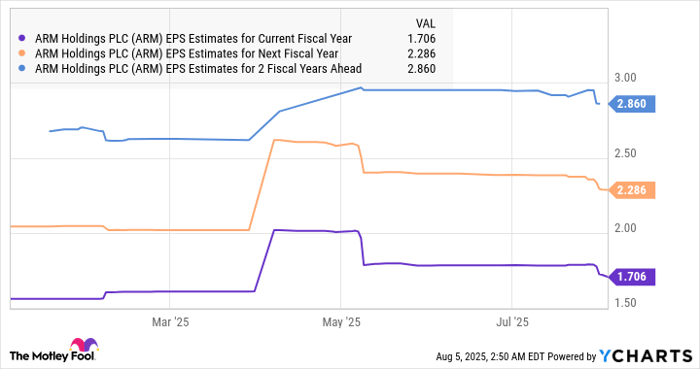

However, Arm's forward earnings multiple of 76 is way lower than its trailing multiple. That's not surprising, as its earnings growth is expected to accelerate nicely over the next couple of years.

ARM EPS Estimates for Current Fiscal Year data by YCharts. EPS = earnings per share.

Its forward price-to-earnings (P/E) ratio based on its fiscal 2028 earnings is even lower at 49 (calculated using the earnings estimate of $2.86 per share provided in the above chart). Moreover, there is a good chance that Arm's earnings growth could eventually turn out to be better than expected, thanks to the higher royalty from its CSS licenses and the Armv9 architecture.

That's why growth investors can consider buying Arm stock on the dip. Its bottom-line pressure shouldn't last for long, thanks to the secular growth of the lucrative end markets that it's serving.

Should you invest $1,000 in Arm Holdings right now?

Before you buy stock in Arm Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Arm Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,563!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,108,033!*

Now, it’s worth noting Stock Advisor’s total average return is 1,047% — a market-crushing outperformance compared to 181% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 4, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.