The 3 Things That Matter for Realty Income (O) Now

Key Points

Realty Income is a giant real estate investment trust and a bellwether in the net lease sector.

The REIT is so large relative to its peers that it is likely to be a laggard on the growth front.

However, it is working to ensure that it remains a reliable foundation for dividend portfolios.

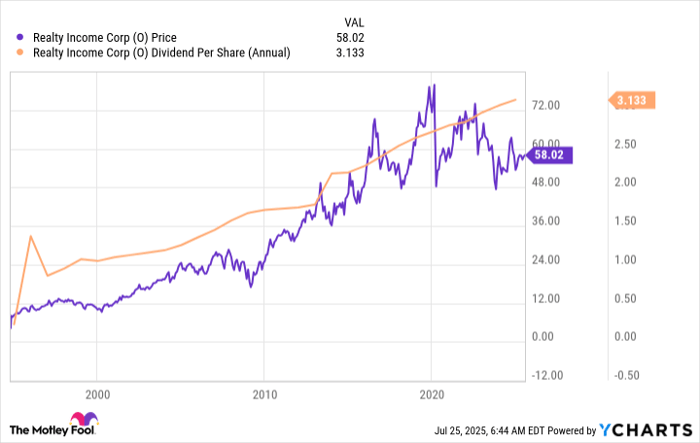

Realty Income (NYSE: O) is offering investors a 5.6% dividend yield today. That's well above both the market's 1.2% yield and the average real estate investment trust's (REIT's) yield of roughly 3.9%.

If you're a long-term dividend investor, it probably makes sense to consider adding Realty Income to your portfolio, since it has increased its dividend annually for three decades and counting. But make sure you understand these three things before you buy it.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

1. Realty Income is a giant

With a market capitalization of roughly $50 billion, Realty Income is multiple times larger than its next closest peers in the net lease niche of the REIT sector. This is both good and bad.

Image source: Getty Images.

On the negative side, Realty Income is so large that it takes a huge amount of new property acquisitions to move the needle on the top and bottom lines. This means that relatively slow growth is likely to be the norm here in the future. But being so large isn't all bad.

On the positive side, Realty Income has the wherewithal to take on deals that its peers couldn't manage. It likely sees all of the material deals that are in the market (allowing it to cherry-pick to some degree), it can act as an industry consolidator, and its size gives it easier access to Wall Street. So while slow growth is probably going to be the norm, steady growth is also highly likely, with contractual rent bumps in its leases augmented by its ability to keep buying new properties.

2. Realty Income is looking to increase its growth opportunities

Realty Income isn't ignoring the size limitations it faces. In fact, it is embracing its scale. For example, a few years ago it began expanding into Europe, a market that is still only just starting to use the net lease approach. That materially expands the opportunity set the company has as it looks to buy new properties.

Realty Income has also been working to increase the number of property markets in which it competes. Historically, retail and industrial has been the core here. But management has been venturing into new spaces, like casinos and data centers, as it looks to find new levers for growth.

More recently, Realty Income has started to make loans and to offer asset management services to institutional investors. Overall, this giant REIT is using its scale to reach out into new areas that will, hopefully, help to sustain its growth over the long term.

3. Realty Income knows what it is

The last issue that really matters here is that Realty Income isn't trying to be something it's not. Management understands that it is a giant company and that investors buy it because of its large and reliable dividend. In fact, the company trademarked the nickname, "The Monthly Dividend Company" to highlight the commitment it has to being a reliable dividend stock.

This is so important because it means that the board and the CEO aren't building castles in the sand that will get washed away when the tide comes in. They are building a REIT that can keep paying dividends reliably through thick and thin. That means that long-term investors can use Realty Income as a foundational investment atop which they can comfortably buy more aggressive dividend stocks.

What really matters with Realty Income is both obvious and subtle

Every company has nuances to consider, and that's true of Realty Income, too. The two most obvious stories are the company's vast size and what it is doing with the scale it has achieved. In the background, however, is perhaps the most notable issue. Realty Income knows what its shareholders expect, and it's working every day to meet those expectations by providing investors with a reliable and growing dividend.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $625,254!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,257!*

Now, it’s worth noting Stock Advisor’s total average return is 1,036% — a market-crushing outperformance compared to 181% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 29, 2025

Reuben Gregg Brewer has positions in Realty Income. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.