Could Investing $10,000 in Realty Income Make You a Millionaire?

Key Points

Realty Income is a large and high-yield net lease REIT.

The stock is likely to be a slow and steady tortoise.

Don't underestimate the power of dividend reliability.

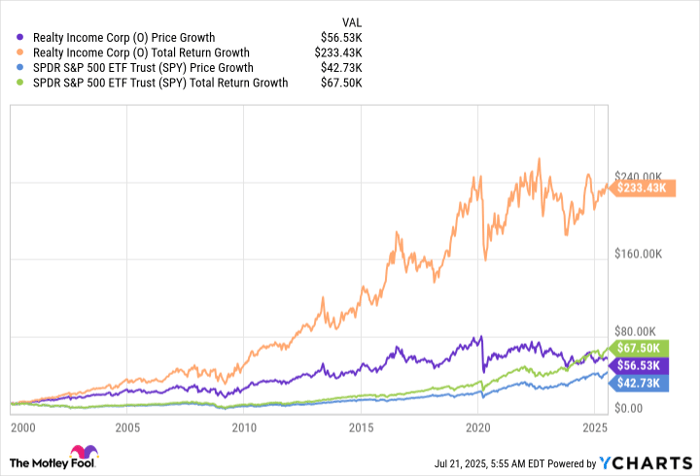

If you invested $10,000 in Realty Income (NYSE: O) at the turn of the last century, it would be worth around $56,000 today. That is a long way off from $1 million, but don't look at this result in a vacuum. The truth is, Realty Income has outperformed the S&P 500 index (SNPINDEX: ^GSPC) over that span. And even if Realty Income can't repeat that feat, there's still a very good reason to own this high-yield real estate investment trust (REIT). Here's what you need to know.

Times have changed, but history is important

Back at the turn of the century, REITs were still a somewhat obscure asset class. In fact, they remained a niche segment of the financial sector until 2014, when real estate finally got its own sector designation. Ultimately, way back in 2000, REITs weren't well followed and were largely the purview of small, income-oriented investors. A material portion of the growth over the past 25 or so years has come from the inclusion of REITs in the portfolios of larger investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

But the performance numbers are still interesting to consider. The growth of $10K noted above for Realty Income compares to the same investment increasing to roughly $43,000 for the S&P 500 index. That, however, is a price-only figure. That same amount with dividend reinvestment would have grown to nearly $68,000 in the S&P 500 and, hold your hat, over $230,000 for Realty Income.

How is that possible? The answer is that back in the 2000s, Realty Income's yield was quite high. Compounding the dividend via dividend reinvestment supercharged the stock's total returns. The S&P 500's yield wasn't nearly as high. So, Realty Income benefited from both the increase in price that came with the broader acceptance of the REIT asset class and its lofty, and steadily growing, dividend.

What's the future going to look like?

Obviously, the future is unknowable. However, given the past, Realty Income is likely to be a reliable dividend stock. It has increased its dividend annually for 30 consecutive years. If it keeps that up, even though growth is generally fairly modest in any given year, it will be a solid foundation for a broader income portfolio.

But there's another bit to consider here. While Realty Income's dividend yield isn't as high as it was back when REITs were less popular, it is still pretty high at roughly 5.6%. For comparison, the S&P 500's yield is only about 1.2%. Compounding that dividend will still help to supercharge Realty Income's return.

But that's not the only thing worth noting. Realty Income's stock price is down around 30% from the highs it reached prior to the coronavirus pandemic. That suggests that there is some recovery potential here to go along with the lofty dividend. Put the two together, and investors could see pretty attractive and reliable long-term returns over time.

Realty Income is a foundational investment

That said, Realty Income isn't going to excite you. But that's the point of buying this REIT. It is a boring and slow-growth business that will provide you with a lofty yield. You can pair it with lower-yielding but higher-growth investments to create a portfolio that will help turn you into a millionaire. That's the value of a $10,000 or $100,000 investment in Realty Income. It can give you the emotional and financial strength to take on the kind of investment risks that will drive the value of your portfolio into seven figures. And yet, as history shows, this REIT, which has outperformed the S&P 500, is anything but dead money.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,628!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,063,471!*

Now, it’s worth noting Stock Advisor’s total average return is 1,041% — a market-crushing outperformance compared to 183% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 21, 2025

Reuben Gregg Brewer has positions in Realty Income. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.