The Best Ultra-High-Yield Bank Stock to Invest $10,000 in Right Now

Key Points

Banks provide what amounts to a necessity service in today's connected world.

The Great Recession proved that some banks are more resilient than others.

If you are looking to maximize your dividend income, this ultra-high-yield bank should be on your short list.

Banks aren't supposed to be exciting. They are supposed to provide basic services that help the world function on the financial front. Boring is good, but it often doesn't lead to a stock that has an ultra-high dividend yield. That said, Bank of Nova Scotia (NYSE: BNS) is boring enough to buy but "exciting" enough to have a lofty dividend yield. Here's why you might want to jump on this ultra-high-yield bank if you have $10,000 to invest right now.

What does Bank of Nova Scotia do?

Bank of Nova Scotia, which generally goes by the nickname Scotiabank, isn't particularly different from most other large banks. It provides customers with the basics, like bank accounts, checking accounts, and mortgages. It deals with business customers, too. But on top of that it also adds things like wealth management and investment banking. In this way it not only competes with local banks, but also with giants like Bank of America or Citigroup.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

That said, there's a key difference here that is important to keep in mind. Scotiabank hails from Canada. Canadian banking regulations are very stringent, leading the largest of the country's banks, of which Scotiabank is one, to have entrenched industry positions. The heavy regulation has also resulted in Canadian banks having a conservative ethos that permeates all aspects of their businesses. All in, Scotiabank has a very solid business foundation.

The best display of this comes from Scotiabank's dividend. It has paid a dividend continuously since it started paying a dividend in 1833. That said, the dividend hasn't increased every single year (more on this below), but it also didn't get cut during the 2007 to 2009 financial crises. The Great Recession, as that deep recessionary period is known, led both Citigroup and Bank of America to cut their dividends.

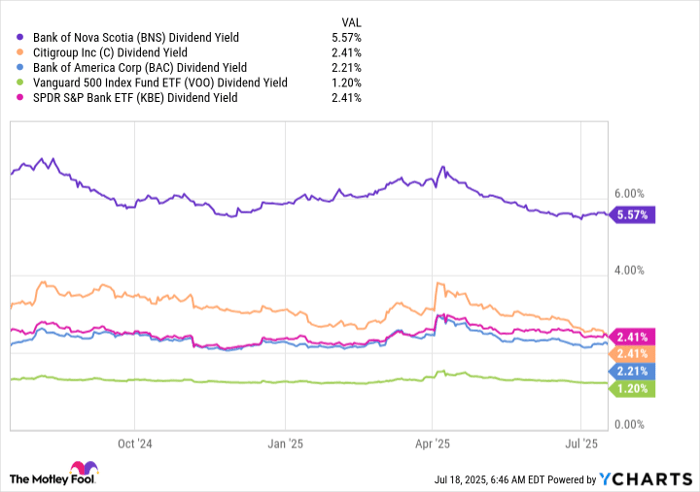

So it stands out on the dividend front for its consistency. But it also stands out because of the huge 5.7% dividend yield. For reference, the S&P 500 index (SNPINDEX: ^GSPC) is yielding just 1.2% and the average bank has a yield of 2.5%.

BNS Dividend Yield data by YCharts

Why such a high yield from Scotiabank?

Scotiabank's yield would suggest that it is a risky bank. And yet its core Canadian operations would suggest the exact opposite. What's going on? As it turns out, like other Canadian banks, Scotiabank has looked to foreign markets for growth. Most of its peers chose to focus on the U.S. market, but Scotiabank sought to differentiate itself by focusing on Central and South America. That didn't work out quite as well as hoped.

It has since shifted gears, getting out of less desirable markets and focusing on becoming a leading Mexico to Canada bank, as it attempts to bulk up its business in the United States. This overhaul resulted in the dividend not being increased in 2024. However, Scotiabank has made quick progress, and it started increasing its dividend again in 2025.

That doesn't mean the transition process is complete, but it does signal that the board and management are confident in the progress the company is making. All in, Scotiabank looks like a fairly low-risk turnaround story that comes with a very attractive dividend yield. While there's more work to be done, you are being paid well to stick around.

A sizable chunk of Scotiabank stock

A $10,000 investment in Scotiabank today will get a dividend investor a bit over 175 shares of the Canadian bank giant. And it will get you access to a well-above-market and well-above-peer dividend yield. But the key is that the yield is supported by a conservatively run bank that is moving its business in a positive direction.

Should you invest $1,000 in Bank Of Nova Scotia right now?

Before you buy stock in Bank Of Nova Scotia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bank Of Nova Scotia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,628!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,063,471!*

Now, it’s worth noting Stock Advisor’s total average return is 1,041% — a market-crushing outperformance compared to 183% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 21, 2025

Citigroup is an advertising partner of Motley Fool Money. Bank of America is an advertising partner of Motley Fool Money. Reuben Gregg Brewer has positions in Bank Of Nova Scotia. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool recommends Bank Of Nova Scotia. The Motley Fool has a disclosure policy.