Airbnb's Cash Cow Can Thrive Despite Its Challenges

Key Points

Airbnb faces regulatory hurdles that management must attempt to overcome.

The company benefits from significant demographic tailwinds.

Airbnb is a cash-flow machine and a great stock to own.

The travel industry is a lucrative but tricky realm in which to do business. This is especially true when it comes to short-term rentals. Navigating local regulations and international expansion while satisfying thousands of hosts and even more guests are a few of the daunting challenges faced by Airbnb (NASDAQ: ABNB), one of the leaders in the space.

Its management is working to increase its cooperation with localities and promote what it views as commonsense regulations while maintaining its ability to operate freely. Still, in some major markets, such as Hawaii, New York City, and Paris, local and state governments have imposed stringent restrictions on how short-term rentals can be operated. Many homeowners' associations also have rules that are unfriendly to owners who want to turn their properties into short-term rentals. However, the news isn't all bad for Airbnb.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

The market it operates in is massive and continues to grow. There are also demographic tailwinds, as younger generations tend to gravitate toward Airbnbs more than their parents. Short-term rentals (labelled vacation rentals on the chart below) make up a significant portion of a market that is forecast to exceed $1.1 trillion by 2029.

Statista.

What does this mean for Airbnb? Cash, and lots of it.

Terrific business model

Airbnb is just a software platform at its core. There is also a customer service element. However, companies in this industry lack the factories, expensive equipment, and other major infrastructure that many other industries have. Property and equipment purchases are often referred to as capex (short for capital expenditures) and reduce the amount of cash a company can keep. Free cash flow is one reason why software companies, such as CrowdStrike (NASDAQ: CRWD) and Palantir (NASDAQ: PLTR), often trade at higher valuations than companies in other industries.

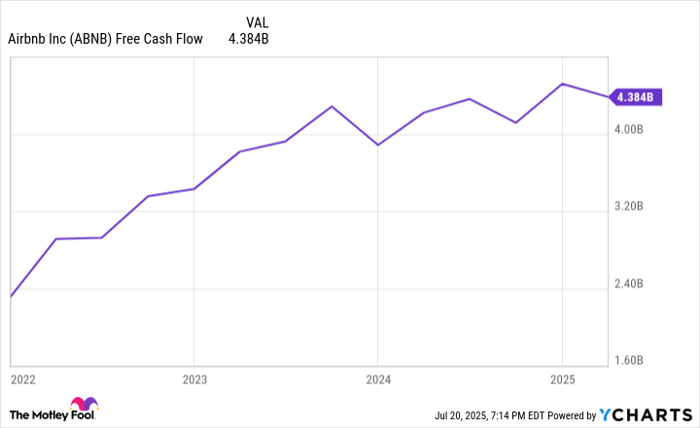

For instance, Intel (NASDAQ: INTC), a semiconductor designer and manufacturer, spent $5.2 billion on capex in its most recent quarter, a whopping 40% of its revenue. Airbnb spent just $14 million last quarter on capex, less than 1% of its revenue. Meanwhile, its free cash flow -- the amount that's left over after operating expenses and capital expenditures -- has soared.

ABNB Free Cash Flow data by YCharts.

The $4.4 billion shown above is 40% of revenue over the same period. A 40% free cash flow margin is an incredible figure and bodes well for shareholders.

Airbnb uses its cash to fund growth initiatives and reward shareholders through stock buybacks, which reduce the number of shares available, thereby increasing the value of each remaining share. Think of a company like a giant pizza, and every share is a slice. If the number of slices decreases, each of the remaining slices represents a larger portion of the pizza. Airbnb has repurchased $3.5 billion worth of its stock over the last 12 months, accounting for approximately 4% of its total market capitalization. It's likely to continue in this pattern for a long time, given its fantastic cash-producing business model.

Is Airbnb a buy?

Since free cash flow is what attracts me to Airbnb, the price-to-free-cash-flow ratio is my preferred metric for valuing the company. Airbnb currently trades for around 20 times free cash flow. This is well under its 2024 high of 29, and slightly below its 3-year average of 22. It is also lower than rival Booking Holdings, which trades for 23 times its own excellent free cash flow. In short, Airbnb is a better value based on cold, hard cash.

Booking Holdings is also a fantastic company and is worth having in a portfolio. However, its market cap is more than twice that of Airbnb's, which means that Airbnb could have an easier time growing faster from here. At this valuation, it is an excellent buy-and-hold stock.

Should you invest $1,000 in Airbnb right now?

Before you buy stock in Airbnb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Airbnb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,628!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,063,471!*

Now, it’s worth noting Stock Advisor’s total average return is 1,041% — a market-crushing outperformance compared to 183% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 21, 2025

Bradley Guichard has positions in Airbnb and CrowdStrike. The Motley Fool has positions in and recommends Airbnb, CrowdStrike, Intel, and Palantir Technologies. The Motley Fool recommends the following options: short August 2025 $24 calls on Intel. The Motley Fool has a disclosure policy.