Is Federal Realty, the Dividend King, Missing From Your Conservative Stock Portfolio?

Real estate investment trust (REIT) Federal Realty (NYSE: FRT) doesn't operate like most of its peers, which grow by acquiring more and more properties. In fact, Federal Realty, despite a market cap of around $8 billion, only owns around 100 assets. They are very attractive assets, however. They make this stock, with an impressive 4.5% dividend yield, a buy for most conservative investors.

What does Federal Realty do?

From a top-level view, Federal Realty is a property-owning REIT. Its specific focus is on owning strip malls and mixed-use assets. The mixed-use assets are heavy on the retail side of the equation, but also include things like office space and apartments. Overall, Federal Realty has some property diversification in the mix, but it is best to consider it a retail REIT.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

Strip malls are the core of the portfolio, with roughly 80% of the company's properties having a grocery store in them. This is important because grocery stores bring traffic to strip malls, which are basically local, open-air shopping centers. Retail tenants want to be in strip malls that get a lot of customer traffic. But having grocery stores in the mix isn't enough to set Federal Realty apart from other strip mall owners.

The big difference is that Federal Realty focuses on quality over quantity when it comes to its properties. It only owns around 100 assets, which is pretty small compared to most of its closest peers. However, the REIT states that it has "best in class locations," which is a bold claim. It happens to be true, with a mix of higher average incomes and higher average population density around its centers than any of its peers. Retailers want to be located in strip malls that generate a lot of traffic, for sure, but they really want to be in strip malls that do that in wealthy and population-dense areas.

Layered on top of the strip mall core is a collection of mixed-use developments. These are huge investments that Federal Realty has built over time and that still have further development potential in the future. This provides built-in growth for the REIT as projects get completed. That said, redevelopment and capital investment are themes throughout the portfolio. The company tends to focus on buying strip mall properties where it can invest money to improve the performance of the asset.

Federal Realty is actively building your wealth

This is where things get interesting. Given that one of Federal Realty's core skills is development and redevelopment, it always has projects in different stages of completion. And, as noted, it is always looking for well-located properties that can benefit from a little of the company's TLC. But it only owns around 100 assets at a time.

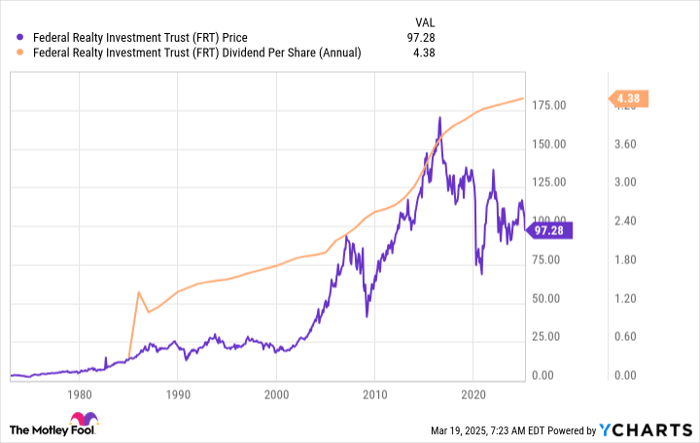

That means that it's actively buying and selling properties. When a property is redeveloped and has reached its full value, Federal Realty will happily sell it for the right price. The proceeds are then reinvested in a new property where the redevelopment cycle starts over again. That's how it has maintained a relatively small portfolio, but still managed to reward investors with an incredible 57 years' worth of annual dividend increases.

That streak makes Federal Realty a Dividend King, and it's the longest streak in the REIT sector. In fact, Federal Realty is the only REIT that is also a Dividend King. If dividend consistency matters to you, this landlord should be on your radar.

The one thing that might be an issue for some investors is the retail focus. During recessions, Federal Realty's financial performance usually takes a hit. That's kind of par for the course in the retail space. The company's investment grade rated balance sheet and focus on wealthier regions help it get through the hard times.

But there's an important nuance here. Federal Realty often uses economic downturns to its advantage, buying assets while they are cheap. It did just that during the coronavirus pandemic, buying its way into a new region (Phoenix, Arizona). In some ways, conservative long-term investors shouldn't fear downturns when it comes to Federal Realty, as they help to set the company up for more success in the future.

Boring, predictable, and time-tested

Few Federal Realty shareholders are bragging to their friends about this stock. It just isn't that kind of investment. What kind of stock is it? It's the kind that provides a reliable foundation for your portfolio, the kind of stock that you can count on to pay you dividends through thick and thin. Conservative income investors should find that very appealing today as the markets get increasingly turbulent.

Should you invest $1,000 in Federal Realty Investment Trust right now?

Before you buy stock in Federal Realty Investment Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Federal Realty Investment Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $739,720!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of March 24, 2025

Reuben Gregg Brewer has positions in Federal Realty Investment Trust. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.