Palantir Technologies Is 30% Below Its All-Time High: Here's How Far It Can Fall

For much of the last two-and-a-half years, the bulls have been in firm control on Wall Street. Since the 2022 bear market bottomed out, we've witnessed the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all gallop to numerous record-closing highs.

While a confluence of factors is responsible for lifting the broader market, such as a resilient U.S. economy, a tapering inflation rate, and Donald Trump's return to the White House, nothing has played a bigger role in sending stocks higher than the evolution of artificial intelligence (AI).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Software and systems that are empowered with AI have the capacity to reason and act on their own, and can potentially evolve to learn new tasks, all without the aid of human intervention. It's a technology the analysts at PwC believe can add $15.7 trillion to the global economy by the turn of the decade.

Most investors rightly peg Nvidia (NASDAQ: NVDA) as the face of the AI revolution. After all, Nvidia's graphics processing units (GPUs) have become the mainstay hardware powering AI-accelerated data centers. Generative AI solutions and the training of large language models likely doesn't happen at scale without Nvidia's GPUs.

Image source: Getty Images.

However, Nvidia has taken a back seat, in terms of parabolic stock gains, to AI-driven data-mining specialist Palantir Technologies (NASDAQ: PLTR). At one point earlier this year, shares of Palantir had climbed by close to 2,000% since the start of 2023.

Yet over the last four weeks (as of March 17), this AI darling has lost 30% of its value following its all-time closing high of $124.62 per share. It begs the question: How far can the hottest AI stock fall?

Investors have rallied around Palantir's irreplaceability, profits, and future growth prospects

Before looking to the future, it's important to understand the dynamics of how we go to a point where Palantir is suddenly one of Wall Street's most-influential and widely owned tech stocks.

What's made Palantir such an AI darling is the irreplaceability of its two platforms: Gotham and Foundry. The former is powered by AI and responsible for helping federal governments collect and analyze copious amounts of data. Gotham also assists the U.S. and its immediate allies with military mission planning and execution.

Meanwhile, Foundry is an AI and machine learning-propelled platform that helps businesses make sense of their data in order to streamline their operations and improve their margins. It can assist with everything from supply chain management to automated, data-driven decision making that frees up human personnel for other tasks.

While some businesses may offer bits and pieces of what Palantir's cloud-based software-as-a-service model brings to the table, no other business comes close to matching Palantir's products and services at scale. Generally, investors will pay a premium for businesses that have a sustained moat.

Palantir is also benefiting from its push to recurring generally accepted accounting principles (GAAP) profits well ahead of Wall Street's consensus forecast. Recurring profits from Gotham is a crystal-clear sign that its operating model works and is sustainable. Additionally, it doesn't hurt that the contracts Palantir is landing with the U.S. government often span four or five years, which leads to highly predictable operating cash flow.

Further, Palantir's push to new highs in February may have to do with President Trump's return to the White House and Republicans controlling both houses of Congress. Historically, the GOP has favored aggressive defense spending, and Palantir's Gotham platform is viewed as a key puzzle piece to protecting America's interests -- including its AI innovation.

On paper, Palantir would appear to be ideally positioned to win government contract under the Trump administration.

Image source: Getty Images.

History weighs in -- how far could Palantir stock plunge?

With a clearer understanding of how Palantir peaked at a market cap of more than $266 billion on Feb. 18, let's allow history to weigh in to make an educated guess of how far its stock could fall.

One of the more prevailing concerns for current and prospective Palantir shareholders is the checkered past of next-big-thing innovations, of which artificial intelligence certainly qualifies. Since (and including) the advent of the internet in the mid-1990s, every next-big-thing technology/innovation has endured a bubble-bursting event.

The consistent problem for investors is their eyes grow bigger than the early stage adoption and utility of game-changing technologies. Each and every one of these technologies/innovations has needed ample time to mature, including the internet, 3D printing, blockchain technology, and so on. With most businesses still lacking concrete game plans to monetize their AI investments and/or optimize their AI solutions, it looks to be only a matter of time before the AI bubble bursts.

If there's a silver lining for Palantir Technologies, it's that its revenue is based on lengthy contracts and subscriptions. Even if the AI bubble were to burst, as history suggests it will, Palantir's operating cash flow wouldn't feel any immediate pain.

The other historic concern for Palantir has to do with its valuation.

As noted earlier, businesses that are viewed as irreplaceable tend to be given a premium valuation on Wall Street. Palantir absolutely fits this definition. The question is: How much of a premium is too much?

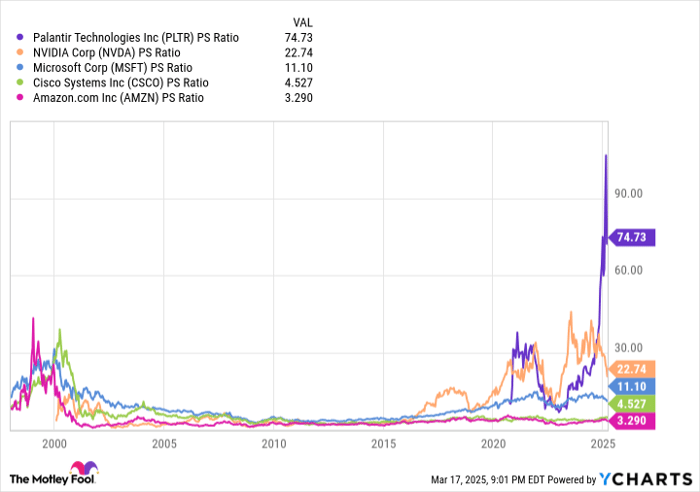

PLTR PS Ratio data by YCharts. PS Ratio = price-to-sales ratio.

Prior to the bursting of the dot-com bubble in March 2000, internet leaders like Cisco Systems, Microsoft, and Amazon all peaked at respective price-to-sales (P/S) ratios ranging from 31 to 43. Interestingly enough, this is also the range AI behemoth Nvidia peaked at last summer, with a P/S ratio of 42 and change. For market-leading companies of next-big-thing trends, this range has served as a fairly constant upper bound.

When the closing bell tolled on Feb. 18 for Palantir, its P/S ratio hovered around 100! This is a virtually unheard-of figure for any company on the leading edge of a next-big-thing trend -- and it's certainly not a valuation that appears sustainable in any way.

Following Palantir's 30% pullback, its P/S ratio has dipped into the mid-70s. Unfortunately, this is still double the range where market leaders have peaked prior to a next-big-thing bubble bursting.

Based solely on history and how other market leaders have traded following their P/S ratio peaks, I'd expect Palantir to eventually work its way to a P/S ratio of closer to 20. Although steady annual revenue growth of around 25% will help lift the floor for Palantir stock, its premium valuation and the growing likelihood of an AI bubble will act as concrete weights around its proverbial ankles. This would take Palantir stock down to a range of the high-$30s to low-$40s, relative to a closing price of $87.35 on March 17, and its all-time closing high of $124.62.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $707,481!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of March 18, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Sean Williams has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Cisco Systems, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.