Nu Holdings Stock: Buy, Sell, or Hold?

Expectations tend to play an outsized role when it comes to quarterly earnings. And missed expectations are likely what affected Nu Holdings' (NYSE: NU) stock price after its Q4 release.

The financial technology (fintech) company operating as a neobank in Latin America posted strong Q4 revenue growth (again) but saw shares fall due to the high expectations Wall Street developed going into the report. As of this writing, share prices are down 32% from all-time highs set in mid-November 2024 and down 22% since the report's Feb. 20 release. That drop comes even though Nu is expanding rapidly in its home market of Brazil along with other large Latin American countries such as Mexico and Colombia (Nu Holdings now has over 114 million customers using its digital banking platform).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Given the missed expectations over the latest earnings report, some investors looking into the stock have to be asking: Is Nu Holdings stock a buy, sell, or hold right now? Let's take a closer look at the Latin American fintech giant to see if an answer presents itself.

More fast growth in Brazil

Nu Bank (its customer-facing name) has become a mainstay in Brazil. It has around 100 million customers in this market alone, or more than half the country's adult population. Despite its huge market share, its financials continue to compound at an aggressive pace. Deposits in the country now sit at $23.1 billion (calculated in U.S. dollars), growing 11% year over year.

As Nu Bank builds out its relationship with existing customers, it is able to offer more and more products for them. In turn, this leads to more revenue growth. Revenue in Brazil hit $9.5 billion in 2024 and has grown at a 79% annual rate since 2018. Customers can now invest, get personal loans, obtain insurance policies, and open credit cards through the Nu Bank platform. Nu Bank has become a key personal finance tool in Brazil and keeps growing its relationship with the population.

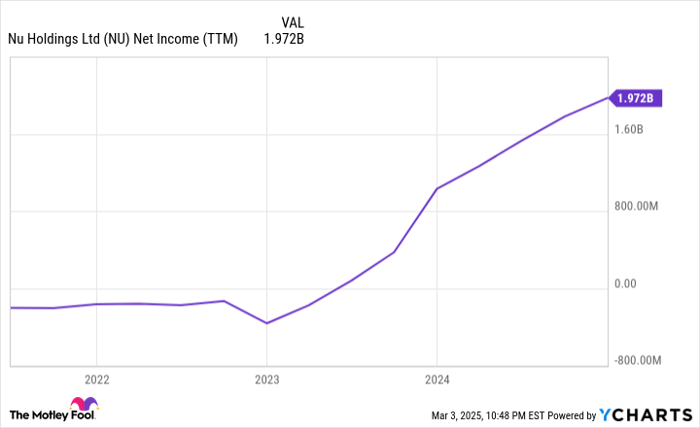

Through more scale, Nu Bank has been able to grow its earnings at a rapid pace. In 2022, Nu Holdings posted negative net income. In 2024, net income was just under $2 billion. As the business achieves more operating leverage (especially in new markets outside Brazil), we should see earnings grow even faster than overall revenue. Not a bad place to be as a business.

Emerging expansions into Mexico and Colombia

Likely due to Mexico and Colombia's large market size, Nu Bank decided to expand there first after establishing itself in Brazil. Argentina was most likely left off the list due to its hyperinflation concerns, even though it is a larger market. As of Q4 2024, Mexico surpassed 10 million customers, and Colombia passed 2.5 million customers. While much smaller than the Brazilian segment, these countries are growing quickly for Nu Bank and have a long runway to reinvest and acquire new digital customers.

Revenue is exploding higher in the Mexican segment, essentially going from $0 to $650 million annually in less than five years -- an impressive feat that proves the Nu Bank platform can succeed outside of the Brazil market. Colombia is much smaller at $161 million in annual revenue.

Combined, these two countries are not relevant to Nu Holdings consolidated financials today. What investors should focus on is not how these two countries impact the business in 2024, but how they will affect the business by 2030. Nu Holdings showed how successful its fintech playbook works in Brazil, which supports the assumption it will work in these two countries as well. Investors should also expect Nu Holdings to launch in more Latin and South American markets.

Data by YCharts.

Buy, sell, or hold Nu Holdings stock?

Nu Holdings generated $2 billion in net earnings in 2024. As of this writing, the stock trades at a market cap of $50 billion, resulting in a price-to-earnings ratio (P/E) of approximately 25. This might look cheap when compared to the S&P 500 average P/E of 29, especially considering how fast Nu Holdings is growing its revenue. But financial stocks and banks rarely trade at this high a ratio. P/Es in the financial sector usually hover around the 10-15 range. A lot of Nu Holdings earnings are from lending. Making loans is cyclical, and earnings can fall if the markets it operates in fall into a recession.

Given the information presented above, I can see merit in arguments that Nu Holdings is a screaming buy, but I can also see why some suggest it is an easy sell. For that reason, I think the stock is a simple hold for investors today. Investors shouldn't sell their stakes right now, but don't go backing up the truck and load up on a bunch of Nu Holdings stock at these prices. It doesn't come without some level of risk, especially given the uncertainties in the economy at the moment.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $304,161!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,694!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $534,395!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of March 3, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.