These Vanguard ETFs Rebounded After Trump's First Days Back in the White House. Should Investors Beware the Bounce?

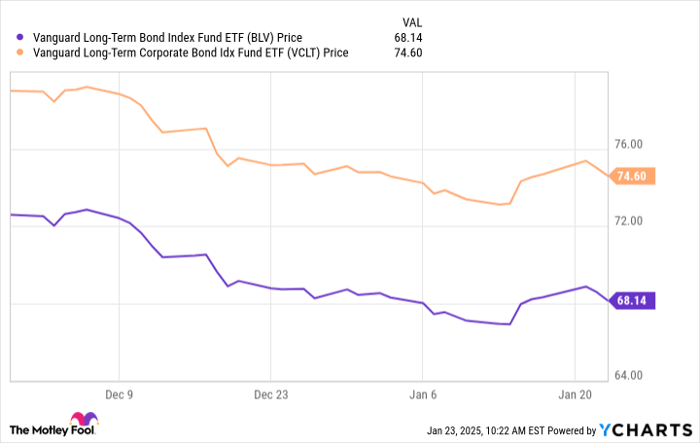

Quite a few stocks gained momentum in the weeks preceding Donald Trump's second inauguration as U.S. president. It was a different story for most bonds, though. For example, the Vanguard Long-Term Bond ETF (NYSEMKT: BLV) slid almost 8% lower. The Vanguard Long-Term Corporate Bond ETF (NASDAQ: VCLT) fell nearly as much. Those are relatively big moves for bond funds.

However, a surprising thing happened during Trump's first few days back in the White House: These and other Vanguard bond ETFs rebounded. Is the bond market back? Or should investors beware the bounce?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Image source: Getty Images.

Why these Vanguard ETFs rebounded

To understand why these Vanguard bond ETFs rebounded, we first need to examine why they declined earlier. Bond fund prices, of course, reflect the underlying prices of the bonds they own. Bond prices typically fall when yields rise (and vice versa).

Ordinarily, bond yields correlate closely with interest rates. So when the Federal Reserve lowered interest rates twice in the final few months of 2024, it would have made sense if bond yields fell and bond prices rose. That didn't happen for the most part.

Long-term bonds are usually more sensitive to interest rate changes than short-term bonds. So why did the Vanguard Long-Term Bond ETF and the Vanguard Long-Term Corporate Bond ETF decline after the Fed's interest rate cuts? Bond markets are forward-looking. Bond investors seemed to be worried that inflation would rise and cause yields to move higher in turn.

That leads us to the obvious question: Why would bond investors worry about inflation with the Fed cutting rates? One of the top answers to this question is concerns about the inflationary impact of Trump's proposed tariffs. During the presidential campaign, Trump pledged to impose tariffs of up to 20% on all imports to the U.S. and even higher tariffs on products imported from certain countries. In particular, he promised to sign executive orders on his first day in office that would levy 25% tariffs on products imported from Canada and Mexico.

Why did Vanguard bond ETFs rebound during the first few days of the second Trump administration? Trump issued many executive orders after his inauguration, but none put new tariffs in place.

Beware the bounce?

I think investors should absolutely be leery of the recent bounces of Vanguard bond ETFs, especially with the Vanguard Long-Term Bond ETF and the Vanguard Long-Term Corporate Bond ETF. For one thing, the rebounds already show some signs of weakening.

More important, though, is the likely reason behind the post-bounce downticks for these ETFs. Trump still seems to be deadset on imposing tariffs. One of the first actions he made after becoming president again was issuing a memorandum regarding an "America first trade policy." This memorandum directed the Secretary of Commerce, with input from the Secretary of the Treasury and the U.S. Trade Representative, to recommend measures to address trade imbalances "such as a global supplemental tariff or other policies."

Additionally, Trump told reporters on Jan. 20 that he expects to implement the tariffs on products imported from Canada and Mexico on Feb. 1. The president also threatened to levy a 10% tariff on goods imported from China.

Many leading economists believe the tariffs Trump has proposed will be inflationary. If they're right, that could be bad news for long-term bond prices -- and for the Vanguard Long-Term Bond ETF and the Vanguard Long-Term Corporate Bond ETF.

A better Vanguard ETF to buy now

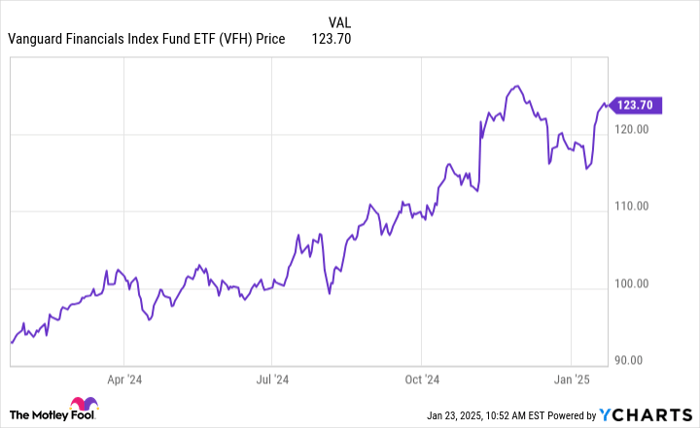

Investors are probably better off staying away from long-term bond funds for now. Is there a Vanguard ETF that could be a good pick? I think so: the Vanguard Financials ETF (NYSEMKT: VFH).

This Vanguard ETF owns 490 financial stocks. Its top holdings include JPMorgan Chase, Berkshire Hathaway, Mastercard, Visa, and Bank of America. These are the kinds of stocks that could benefit tremendously from deregulation and potential corporate tax cuts during Trump's second term.

To be sure, there's no guarantee that the Vanguard Financials ETF will be a winner for investors over the near term. However, it's a much better alternative than Vanguard's long-term bond ETFs, in my opinion.

Should you invest $1,000 in Vanguard Long-Term Bond ETF right now?

Before you buy stock in Vanguard Long-Term Bond ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Long-Term Bond ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $874,051!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 21, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. Bank of America is an advertising partner of Motley Fool Money. Keith Speights has positions in Berkshire Hathaway and Mastercard. The Motley Fool has positions in and recommends Bank of America, Berkshire Hathaway, JPMorgan Chase, Mastercard, and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.