Will This 1 New Development Be a Game-Changer for Solana Investors?

When it comes to cryptocurrencies that are currently in the limelight, few are more compelling to invest in than Solana (CRYPTO: SOL). The blockchain's claims to fame are already numerous and growing by the day, and with its price rising by 55% during the past three months alone, its attractiveness as an investment is only increasing for now.

But there's one potential impending event that many of the coin's holders often propose as being truly transformational. Let's investigate what they're excited about, the potential impacts on the coin's price, and the rationale for investing in Solana for the long term.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

A new financial instrument could give investors easier access to the coin

Solana, like the other major cryptocurrencies, is currently undergoing a period of rapid adoption and integration into the traditional financial system, as well as into global cryptocurrency markets.

Part of that adoption process is the acceptance of the cryptocurrency as a legitimate investment that financial companies should be allowed to use to create other financial products. At the guardrails are regulators at the Securities and Exchange Commission (SEC), which oversees the financial industry in the U.S. The SEC is now considering approval of several exchange-traded funds (ETFs) that would hold Solana directly, either as the only holding of the fund, or as one holding of many.

Many of the chain's investors calculate that such ETFs would attract new capital from the traditional financial system, driving prices upward. Under the best conditions, it's true that enabling more capital to flow to Solana from outside would support higher prices, increasing demand for the main coin of the chain.

But given that the SEC recently sued cryptocurrency exchanges, claiming among other things that Solana was an unregistered security, any approval of the ETF applications has also been deprioritized. It may take until 2026 before that changes. However, the process is complicated by the fact that the new Trump administration is openly pro-cryptocurrency, and thus is likely to install leadership at the SEC that reflects its priorities more closely than those of the prior administration.

Thus it's unclear how soon Solana ETFs might get approved, or whether they will even get approval. But the odds have significantly increased in the coin's favor.

This potential catalyst didn't turn out as expected for a competitor

There's another reason to be leery of the idea that ETF approval would be a game-changer for Solana.

Ethereum (CRYPTO: ETH) is, in many ways, the biggest competitor to Solana. It's the original hub for decentralized finance, non-fungible tokens, and an ample number of meme coins. Ethereum is slightly older, and its market cap is higher, at more than $400 billion compared to Solana's market cap of roughly $122 billion. What's more, there are already Ethereum ETFs, which have been operating since late July of 2024.

But the advent of those ETFs didn't quite have the explosive positive effect on the coin's price that investors had hoped. Rather than causing a spike of inflows of new capital from investors, the impact on Ethereum's price seems unremarkable.

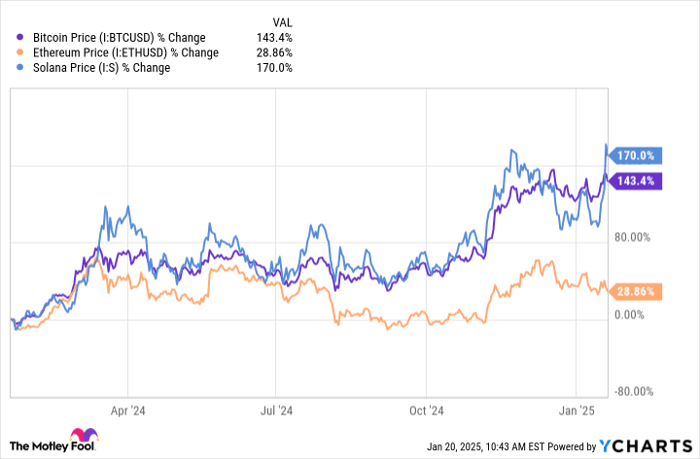

Take a look at this chart:

Bitcoin Price data by YCharts

As you can see, the cryptocurrency market was cooling off about the time in late July when the first batch of Ethereum ETFs were approved.

Based on the data here, it isn't possible to say with confidence that the ETFs supported the price much, or that they had any real impact. This means that Solana investors should temper their expectations, as it may well have the same experience as its competitor.

That doesn't mean there aren't other compelling reasons to consider buying Solana. Its status as a quick and cheap chain for transactions, as well as its penchant for attracting a lot of meme coin investing activity, are likely to send its price higher in the long run.

Should you invest $1,000 in Solana right now?

Before you buy stock in Solana, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Solana wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $863,081!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 21, 2025

Alex Carchidi has positions in Ethereum and Solana. The Motley Fool has positions in and recommends Ethereum and Solana. The Motley Fool has a disclosure policy.