Amazon's Latest Healthcare Move Could Be a Big Problem for Walgreens and CVS

Amazon (NASDAQ: AMZN) has been showing a lot of interest in healthcare in recent years. It launched an online pharmacy in 2020, and last year, it acquired primary care company One Medical. It also got into telehealth before abandoning that business. But one thing's for sure: Healthcare is on the tech giant's radar.

Retail pharmacy giants Walgreens Boots Alliance (NASDAQ: WBA) and CVS Health (NYSE: CVS) have been struggling in recent years, but the looming threat from Amazon hasn't crippled their businesses by any means -- at least not yet. But Amazon's latest move does have the potential to drastically cut into their retail operations.

Amazon is expanding same-day prescription delivery

On Oct. 9, Amazon announced that it would be opening more pharmacies across the country, and that it would offer free prescription delivery in 20 new markets next year, which more than doubles its footprint. By the end of next year, Amazon says that 45% of people in the U.S. will be able to get same-day delivery for prescriptions. And the company says that in most cases, people can order by 4 p.m. and still receive their prescription the same day.

Amazon already provides customers with plenty of incentives to use its website, as it offers lots of savings on medications. Prime members can also sign up for RxPass, which, for $5 per month, gives customers access to many common generic medications, with free delivery included. By expanding the number of markets where same-day delivery is offered, that could incentivize customers to sign up for Prime and RxPass as well.

Why this could spell trouble for Walgreens and CVS

News of Amazon expanding its prescription delivery business could hurt sales at Walgreens and CVS stores, which rely heavily on foot traffic. There was a lot of traffic at the stores during the early stages of the pandemic when people were going there to receive vaccinations, so business was good for the pharmacy retailers. The stores are conveniently located for customers, making it easy for someone to quickly go to a store, pick up prescriptions, and perhaps buy other items on the same trip.

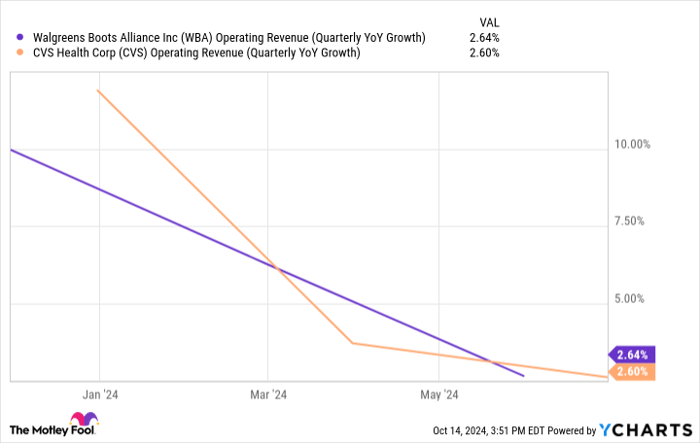

But if Amazon gives consumers less of a reason to go to their neighborhood pharmacies and instead they just utilize same-day delivery through its site, that could drastically undercut the traffic that Walgreens and CVS rely on. Even though it's just a prescription, that's a big reason why a customer might go to a pharmacy retailer in the first place. Offering quicker delivery in more markets has the potential to put a significant dent in the top lines for both Walgreens and CVS, which have already been coming under pressure of late.

WBA Operating Revenue (Quarterly YoY Growth) data by YCharts

Has Amazon become a better healthcare play than Walgreens and CVS?

Walgreens stock is down more than 65% this year as its retail pharmacy operations are struggling to grow and margins remain razor thin. CVS is down only 14%, but its business is broader than Walgreens and doesn't rely entirely on pharmacy operations. But both companies are facing considerable challenges these days, and news of Amazon intensifying its competition isn't going to help.

Amazon has arguably become a better healthcare play these days, as its operations are leaner, and by expanding its pharmacy operations, it can potentially unlock a big growth opportunity for its business. And by offering customers more of an incentive to sign up for Prime, that can lead to greater all-around revenue growth for Amazon, beyond just revenue for its pharmacy operations.

For investors looking for a good growth stock to own, Amazon is hands down the better option these days than either CVS or Walgreens, even if your focus is on healthcare.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,139!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,239!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $380,729!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool recommends CVS Health. The Motley Fool has a disclosure policy.