FTSE 100 Latest Weekly Roundup&Predicted Close Today

Welcome to the investing.com UK weekly FTSE 100 update, designed to keep investors informed on the latest market movements and key developments. In this concise report, you'll find a summary of the last week's significant news, and trends affecting the index, helping you stay ahead with timely insights for your investment decisions.

We update every Friday morning as soon as the London Stock Exchange (LSE) market opens at 8:00am UK local time (GMT+1).

FTSE 100 Share Price Opening 10th June 2024

The opening share price for this week, Monday 10th June, was 8,245.37, which sat 0.48% lower than at open on Friday 7th June, indicating that the FTSE had some ground to try and make up for the week ahead.

Investor Sentiment This Week For The FTSE 100

The FTSE 100 started the week sluggishly, with a 0.2% drop on Monday, led by blue chip stocks sliding - likely thanks to the geopolitical uncertainty created by the French snap election called by Macron after the European parliamentary results.

Data from the Office of National Statistics (ONS) released on Tuesday (11th June) revealed that the UK economy stagnated in April, just a few months after confirming that we had managed to exit a recession. GDP for April finished at 0%, decreasing from 0.4% growth in the previous month. While analysts had expected a 0.1% contraction, disappointment in the overall results still rippled through the markets.

Analysts also believe that the early general election in July will make way for better fiscal certainty, while also making the central bank’s decision around interest rates more complicated thanks to the most recent UK unemployment data. In the first quarter of 2024, the UK unemployment rate grew compared to the end of 2023. This might suggest that the country’s labour market and tight monetary policies will prompt ongoing concerns about overall economic stability in light of underlying additional geopolitical pressures.

The FTSE 100 continues to hover around a similar price to the start of May, and it’s important to remember that the index is still more than 6.67% up so far this year. Overall, the UK equity market is trading under its overall fair value, analysts at JP Morgan believe. Alongside China exposure, its low beta play and highest dividend yield out of all large developed markets make it a continued attractive play for investors.

Long-term investors are keeping an eye on the index and snapping up value buys wherever they can.

Want to know whether specific FTSE 100 stocks fit your investment strategy? Use InvestingPro and win on your decisions. Sign up TODAY for less than £9 per month and get up to 40% off your 1-year plan!

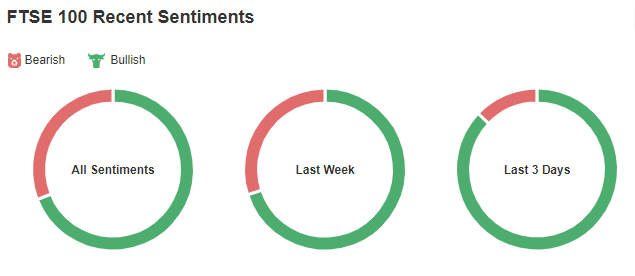

We can see that the investing.com UK community’s sentiment towards the FTSE 100 index has has improved over the last seven days, with a 30-70 Bearish-to-Bullish split, when compared to last week. Could this indicate the start of a more optimistic swing towards future modest growth, despite trailing stagnation data?

Notable Movements & News

Revolut Continues To Increase Expenditure

This week the challenger bank Revolut made the decision to sign a 10-year lease in London’s financial Canary Wharf district. Staff are expected to work from the recently refurbished offices by the end of May next year.

This ambitious flag-in-the-sand comes after a recent (and ongoing) hiring spree where more than 1,500 new staff are expected to be added to their roster by the end of this year. These actions are a far cry from the likes of Wise and Virgin Money (LON:VMUK) dipping this week thanks to warnings of lower interest rates.

Why Are Wise Share Prices Going Down?

Shares in Wise PLC (LON:WISEa) dipped at one point this week by more than 15% after analysts flagged growing concerns regarding near-term interest rate decreases.

Hannes Leitner, analyst at the US bank Jeffries, argued that, "While the announced guidance is disappointing at first glance given the price reduction, we think the cuts boost confidence in medium-term growth.”

The pre-tax profit margin guidance, by Wise, of 13%-16% (£175 million to £225 million), was down by a substantial 19% in comparison to the City’s estimates - surprising, considering Wise having reported pre-tax profits on track to treble in 2024 to £242 million.

L&G’s Plans To Streamline Shake Market Confidence

Shareholders for Legal & General Group PLC (LON:LGEN) were left unimpressed this week after the market disliked the company’s latest plans to streamline their offering by selling housebuilder Cala, merging divisions, and initiating a £200 million share buyback.

Some analysts are praising new boss Antonio Simoes, but there are still concerns around the lack of dividend growth. Current targets according to the 14 analysts used for InvestingPro fair Value suggest a price of 277, resulting in only marginal potential upside for the next 12 months.

Rentokil lifts the FTSE 100

Shares for Rentokil Initial PLC (LON:RTO) surged more than 13.5% on Wednesday of this week, reaching its highest swing since mid-March. Before this, the stock had been stagnating at a 36% dip from its highest price in 2023, so the reversal has been welcome news to investors.

The increase in price came on the heels of news of billionaire fund manager and activist investor Nelson Peltz's investment firm Trian Partners snapping up a significant stake in the company to make it one of the top ten largest shareholders. Talks are reportedly already underway between Peltz and the company in order to improve shareholder value.

Raspberry Pi to IPO Today

DIY computer kit producer Raspberry Pi Holdings PLC (LON:RPI) has confirmed its IPO will launch today, with shares initially listed at 280p each. This price comes in at the upper end of previously suggested guidance, showing a solid sentiment right out of the gate for the London Stock Exchange's newest constituent.

The company’s market capitalisation will exceed £540 million thanks to its aim to sell 45.9 million shares alongside the 3% of shares still being held by the company.

Today's FTSE 100 Close

The above investor sentiment and factors driving this week's 'Footsie' volatility meant that today the FTSE 100 is likely to close at a price which sits higher than the weekly FTSE 100 opening price of 8,245.37.

Best FTSE 100 Shares To Buy

Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks' AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

Explore various wealth-building strategies and use our comprehensive stock screener to see the top FTSE 100 companies to add to your watchlist today. Get an extra 10% discount on applying the code UK10 on our 1 & 2 year plans!