A Big Rally for U.S. Treasury Bulls? June NFP Jobs Report Is Expected to Disappoint while Trump’s Tax Bill Faces Final House Vote

TradingKey - The U.S. June ADP employment data unexpectedly declined, signaling a slowdown in the labor market. U.S. Treasury bulls are now waiting for June’s potentially weaker-than-expected nonfarm payrolls report, which may reinforce expectations of a July rate cut by the Federal Reserve. However, the outcome of the House vote on Trump’s tax and spending bill could cloud this outlook.

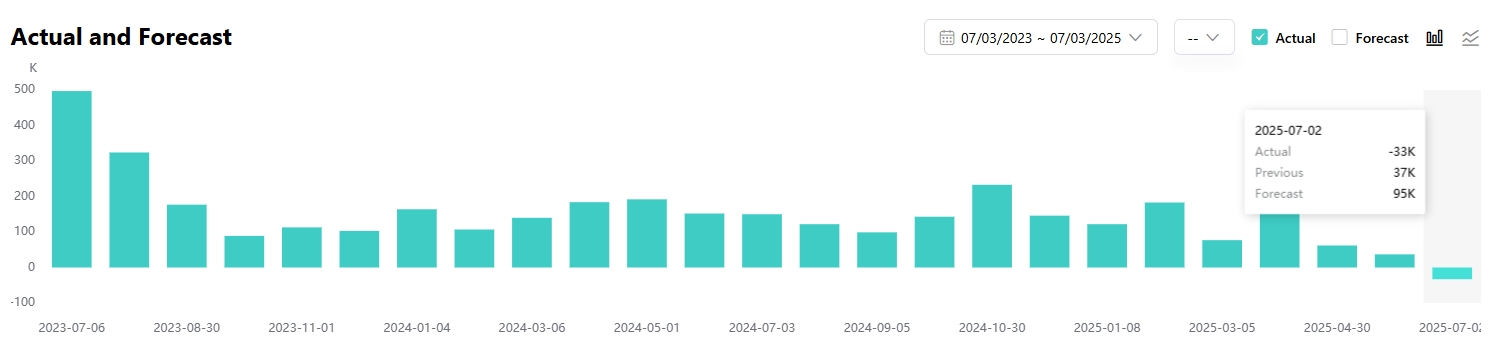

On July 2 U.S. ADP employment dropped by 33,000, marking the first negative reading since March 2023, and falling well short of the expected increase of 95,000. Notably, none of the economists surveyed by Bloomberg predicted a decline.

ADP Employment, Source: TradingKey

This highlights the impact of Trump’s tariff policies on business hiring and economic momentum, and offers a preview of the June NFP report due out on July 3 — which may also surprise to the downside.

The consensus forecast expects 110K new jobs in June, with the unemployment rate rising from 4.2% to 4.3%. Citi’s estimate is even more pessimistic — projecting only 85K job gains, with the unemployment rate rebounding to 4.4%.

Weaker jobs data would support recent speculation that the Fed might cut rates earlier than previously expected. One portfolio manager said that a soft NFP print would make the July FOMC meeting a “live” event, while a strong report would rule out any July cut.

UBS analysts noted that if the unemployment rate rises sharply, it could change the market’s timing and pace of rate cuts.

As of writing, traders have fully priced in two Fed rate cuts by year-end 2025, aligning with the FOMC’s June dot plot projections. In addition, the likelihood of action at the July end-of-month meeting has risen to 25%.

On the other hand, bond market participants are closely watching whether the Trump tax and spending bill will pass the House, as concerns over higher treasury supply and widening budget deficits persist.

Early on July 3 (U.S. Eastern Time), the Republican-controlled House narrowly approved the procedural rule for the bill by 219–213, with the final debate and vote later today seen as critical.