Bitcoin has found or is near a bottom, extended consolidation to follow: K33

- Bitcoin may have seen or is nearing a bottom following its recent downtrend, according to K33.

- The firm noted that the top crypto could continue trading sideways in the $60,000 to $75,000 range for an extended period.

- K33 argues that the Crypto Fear and Greed Index is not an efficient indicator of future price performance.

Bitcoin (BTC) is nearing or has already established a bottom, which could be followed by a sustained period of slow price movement, according to K33.

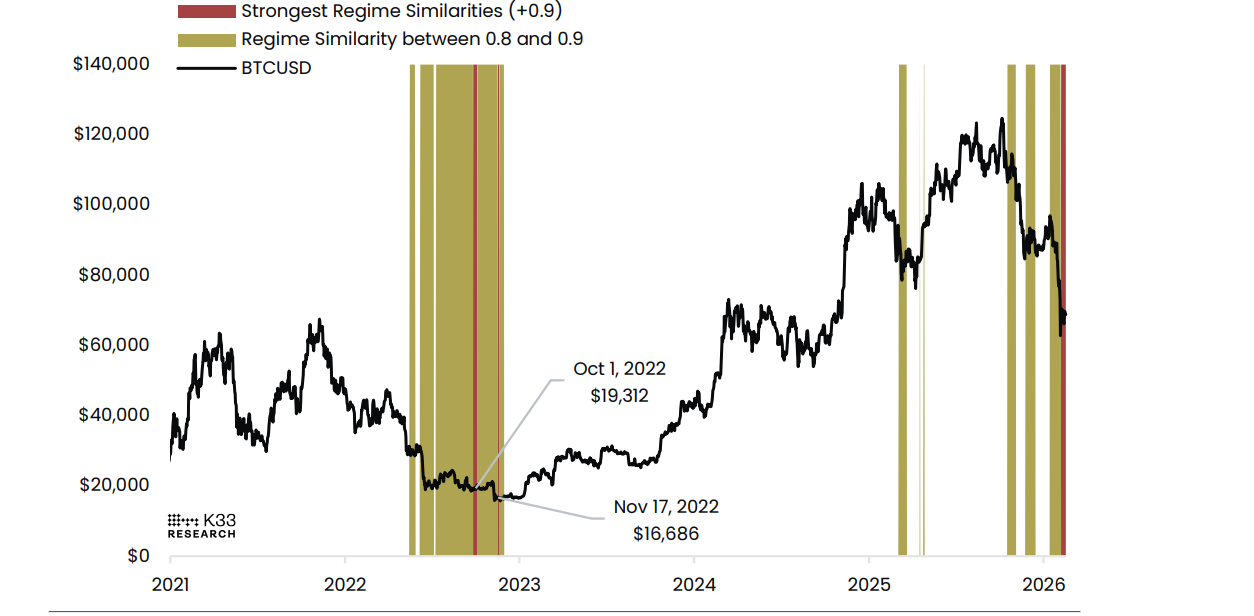

In a Tuesday report, K33 Head of Research Vetle Lunde highlighted that the current market regime closely aligns with the October and November 2022 regimes, which were near the global bottom of the last bear market. During these regimes, prices stayed fairly flat, with Bitcoin posting average returns ranging from -3.5 to +3%.

"These observations align with our view that we are very close to, or have already reached, the global bottom of this downturn, while also aligning with our view that BTC is due to face a slow and discouraging consolidation environment going forward," noted Lunde.

The firm estimates that Bitcoin could continue trading sideways in the $60,000 to $75,000 region despite viewing the range as a "very attractive" entry level.

Crypto Fear and Greed Index shows limitation in price prediction

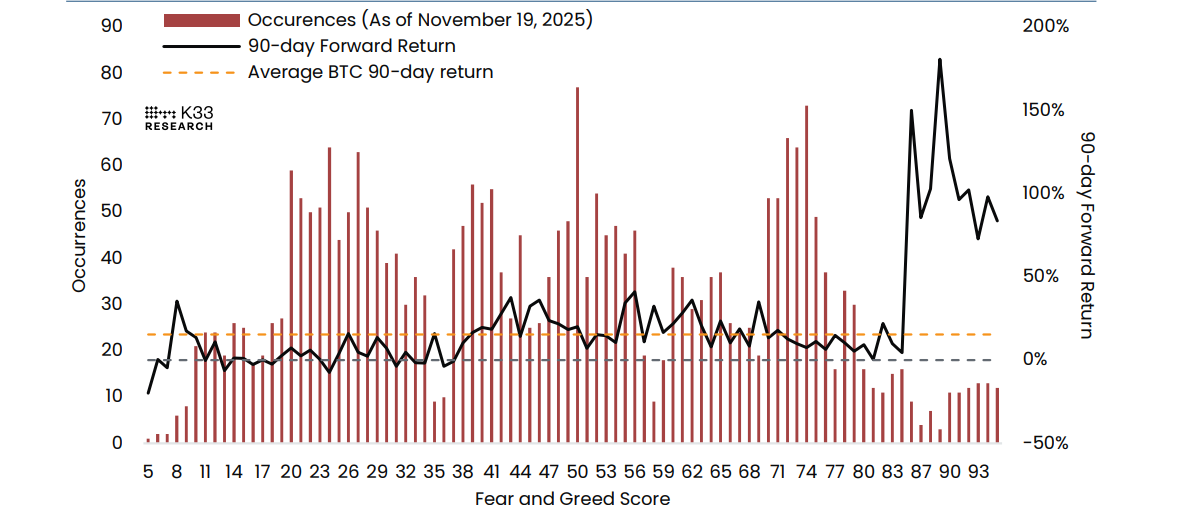

The prediction comes as K33 highlighted that the Crypto Fear and Greed Index has limitations in predicting future price performance. After the Index reached a record low of 5 last week following Bitcoin's sustained decline, many investors saw it as a potential buy signal.

Historically, investors interpret extremely weak readings in the index as a buy signal and strong greed readings as a sell signal. However, K33 argues that the index functions more like a backward momentum indicator than a future price predictor, correlating 0.71 with past performance and 0.14 with future returns.

Lunde noted that an analysis of nearly 3,000 trading days showed that traders who bought during extreme greed saw an average 90-day return of 95%, compared to 2.4% for those who bought during extreme fear.

"This counterintuitive result stems from the nature of the index itself, greed readings tend to occur during the acceleration phase of bull markets, not at their tops," wrote Lunde.

The report also highlighted that while buying at extreme fear hasn't always produced strong returns, it has helped limit downside risk, as the index has historically posted an average maximum future drawdown of -29.5% when it falls below 10.

Bitcoin is trading around $67,000, down 0.4% over the past 24 hours as of writing on Wednesday. The top crypto has continued to post flashes of negative funding rates as its open interest declines.