Bitcoin Price Forecast: BTC stabilizes at crucial support while institutional outflows continue

- Bitcoin's price finds support around the key level of $94,253 on Monday, after falling nearly 10% the previous week.

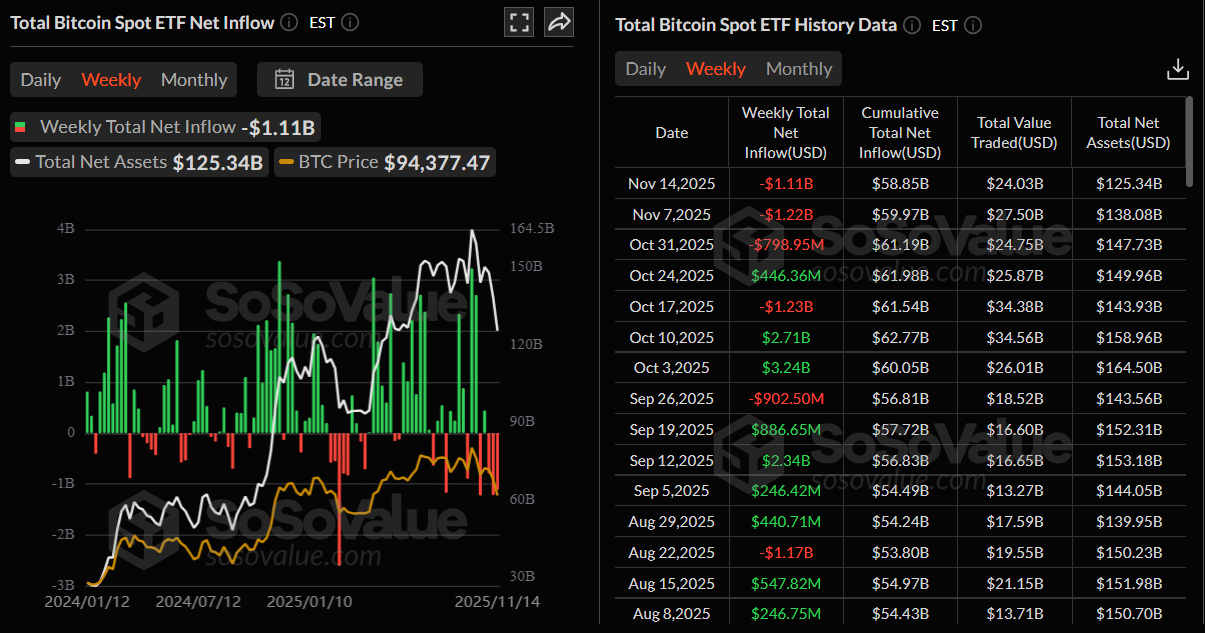

- US-listed spot Bitcoin ETFs record a weekly outflow of $1.11 billion, marking a third consecutive week of investor pullback.

- A report suggests that the broader bull cycle may be at risk, noting that a short-term bounce is possible.

Bitcoin (BTC) price is finding support around the key level of $94,253 at the time of writing on Monday, after correcting nearly 10% in the previous week. Institutional demand continues to weaken as US-listed spot Bitcoin Exchange Traded Funds (ETFs) recorded over $1 billion in outflows over the past week. Analysts caution that while a brief rebound may materialize, the broader bull cycle appears increasingly fragile amid fading investor confidence.

Signs of fading institutional confidence

Bitcoin institutional demand continued to weaken. SoSoValue data shows that spot Bitcoin ETFs recorded a total outflow of $1.11 billion by November 14, marking the third consecutive week of outflows. If these outflows continue and intensify, BTC could extend its ongoing price correction, suggesting declining institutional confidence.

Bull cycle risk grows

QCP Capital’s report on Monday warned that Bitcoin’s recent price action has pushed the market to a critical juncture. The report explained that BTC’s 27% slide from its all-time highs of $126,199, coupled with a decisive break below the 50-week moving average, has heightened the risk that the current bull cycle may be approaching exhaustion.

While the analyst acknowledged the possibility of a short-term bounce — especially with BTC hovering above the key $92,000 support and an unfilled CME gap — the broader outlook remains pressured by weakening liquidity, persistent ETF outflows, and rising macro uncertainty.

“For now, crypto’s bull cycle hangs in the balance. A short-term bounce may come, but the path of least resistance remains lower,” concluded the analyst.

Bitcoin Price Forecast: BTC finds support around a key level

Bitcoin price faced rejection at the 38.20% Fibonacci retracement level at $106,453 (drawn from the April 7 low of $74,508 to the all-time high of $126,299 set on October 6) last week and declined nearly 10%. At the time of writing on Monday, BTC hovers around $95,700.

If BTC finds support around the 61.8% Fibonacci retracement level at $94,253, it could extend the recovery toward the 38.20% Fibonacci retracement level at $106,453.

The Relative Strength Index (RSI) on the daily chart is 34, rebounding from oversold territory, suggesting fading bearish momentum. For the recovery rally to be sustained, the RSI must move above its neutral level.

On the other hand, if BTC closes below the $94,253 support level, it could extend the decline toward the key psychological level of $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.