Bitcoin Price Forecast: BTC slips below $116,000 as markets eye US-Ukraine talks

- Bitcoin price slips below $116,000 on Monday after last week’s record high of $124,474.

- US macroeconomic data dampened hopes for a rate cut, weakening overall risk appetite.

- Market focus shifts to Ukrainian President Volodymyr Zelenskyy’s meeting with US President Donald Trump.

Bitcoin (BTC) trades in red, slipping below $116,000 at the time of writing on Monday, after notching a record high of $124,474 the previous week. Fading optimism over a potential Federal Reserve (Fed) rate cut following mixed US macroeconomic data last week has weighed on risk sentiment. Meanwhile, investors are closely watching geopolitical developments, including Ukrainian President Volodymyr Zelenskyy’s meeting with US President Donald Trump later on Monday, for potential market cues.

Traders await fresh volatility after US-Ukraine talks

Bitcoin price faced a minor fall after reaching a new all-time high of $124,474 last week. The ongoing geopolitical developments could take a new turn later on Monday as Trump meets with European Union leaders and Ukrainian President Volodymyr Zelenskyy at the White House to discuss ending the war in Ukraine.

This comes after the summit in Alaska on Friday, in which Trump met with Russian President Vladimir Putin. US special envoy Steve Witkoff said on Sunday that the sides agreed that the US will offer security guarantees to Ukraine.

Witkoff, who attended the meeting in Anchorage, said in a CNN interview on Sunday that “Mr. Putin had edged toward making some concessions in talks to end the war, including by agreeing to strong security protections, though not under NATO, that Mr. Trump had floated earlier.”

Investors adopted a cautious stance early on Monday, with crypto markets trading in the red and the largest cryptocurrency falling below $116,000. However, any positive outcome of the US-Ukraine talks and agreement of the Ukraine-Russia peace deal could help risk-on sentiment, which could boost investors' confidence and rally in cryptocurrencies such as Bitcoin.

BTC slips below $116,000 as Fed rate cut optimism wanes

US macroeconomic data released last week caused BTC to face volatility. The US Consumer Price Index (CPI) data released during the first half of last week fueled optimism for a rate cut in September, as the data came slightly softer than expected, which caused BTC to reach a record high of $124,474 on Thursday.

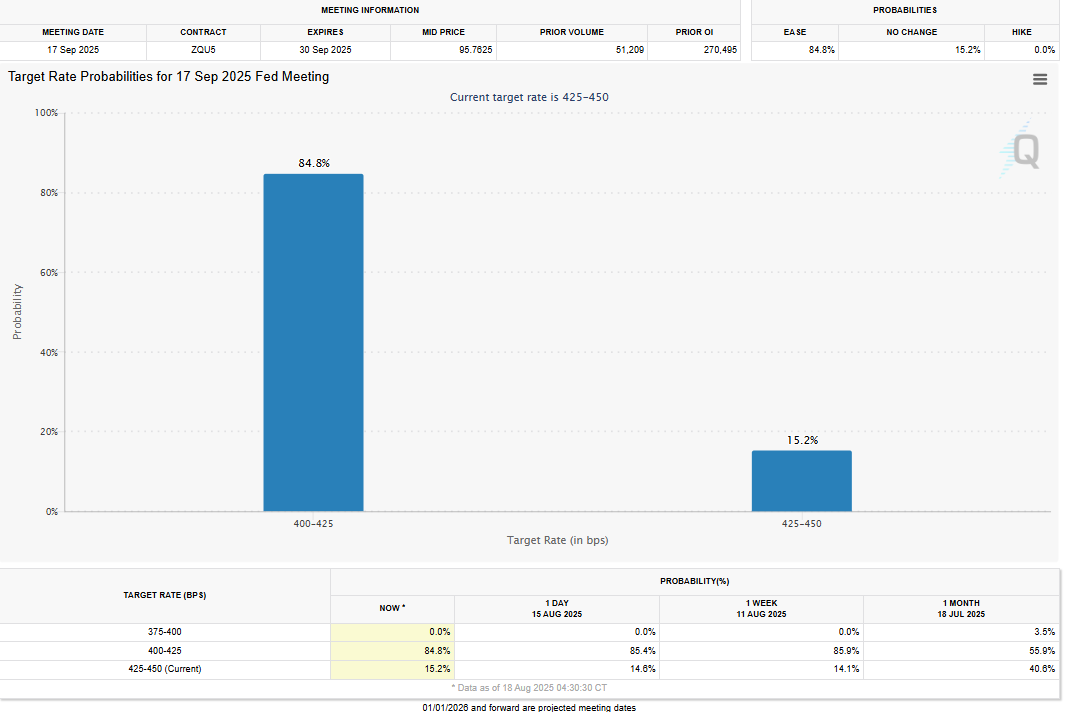

This optimism waned after strong inflation data later on Thursday, erasing BTC's recent gains. The US Producer Price Index (PPI) data figures significantly exceeded economists’ expectations, suggesting that inflation is gradually escalating in the pipeline. PPI data triggered a wave of risk-off sentiment and effectively ruled out the possibility of a larger 50-basis-point rate cut. According to the CME Fed Watch tool, the odds of a 25 basis points (bps) rate cut currently stand at 84.8%, down from 98% last week.

First Chinese bank-affiliated brokerage firm to conduct cryptocurrency trading in Hong Kong

CMB International Securities, a subsidiary of China Merchants Bank, announced on Monday the official launch of virtual asset trading in Hong Kong, supporting trading of BTC, ETH, and USDT.

This announcement marks a milestone as it becomes the first Chinese bank-affiliated brokerage firm to carry out this business in compliance, covering mainstream currencies such as Bitcoin and Ethereum.

This announcement, alongside the ongoing development and regulatory push by the Hong Kong government in the previous weeks, acts as a bullish outlook for Bitcoin in the long term.

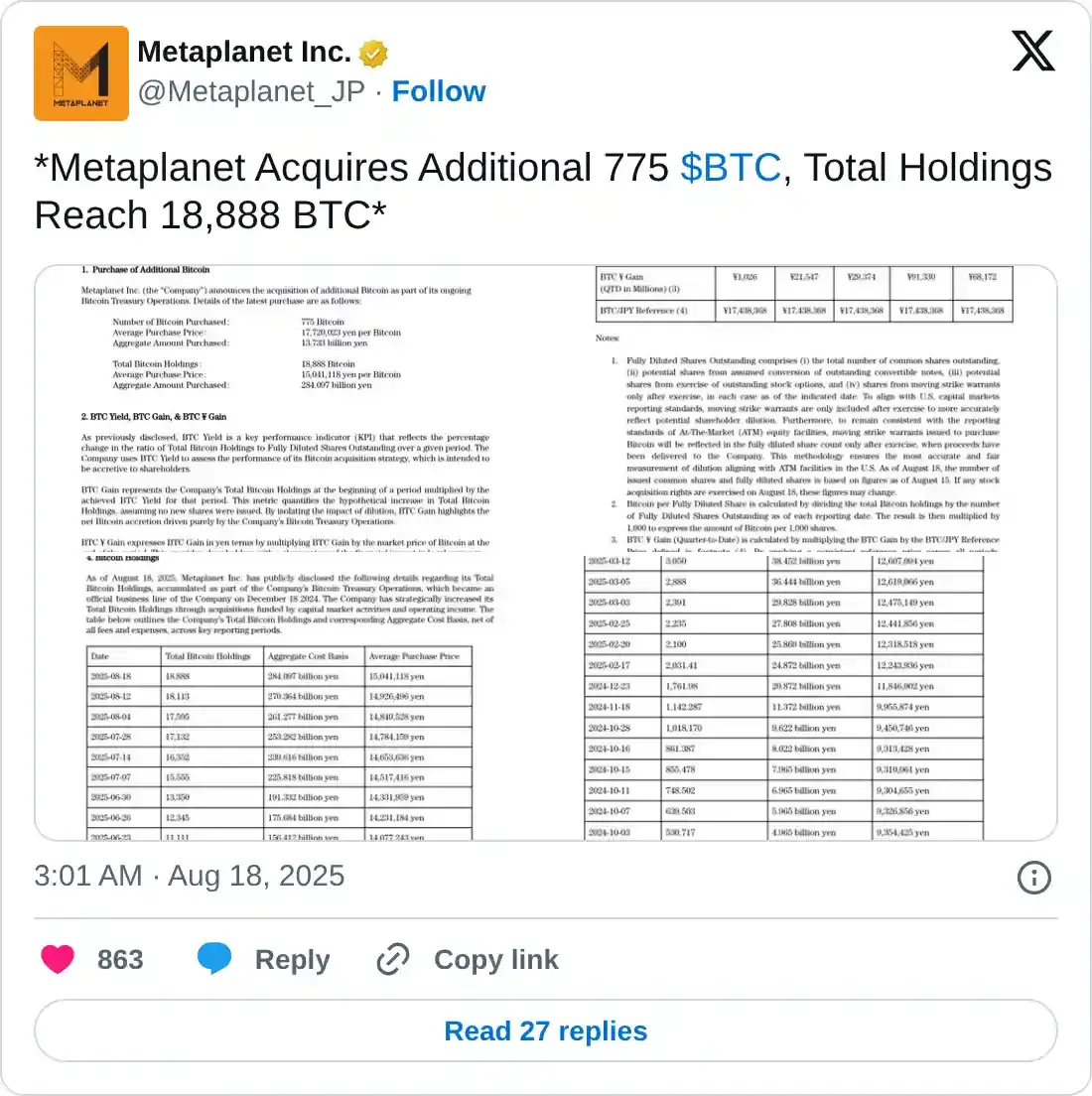

Metaplanet adds 775 BTC to its reserve

Japanese investment firm Metaplanet announced on Monday that it has purchased an additional 775 BTC, bringing the firm's total holdings to 18,888 BTC, suggesting growing adoption and confidence despite price dips.

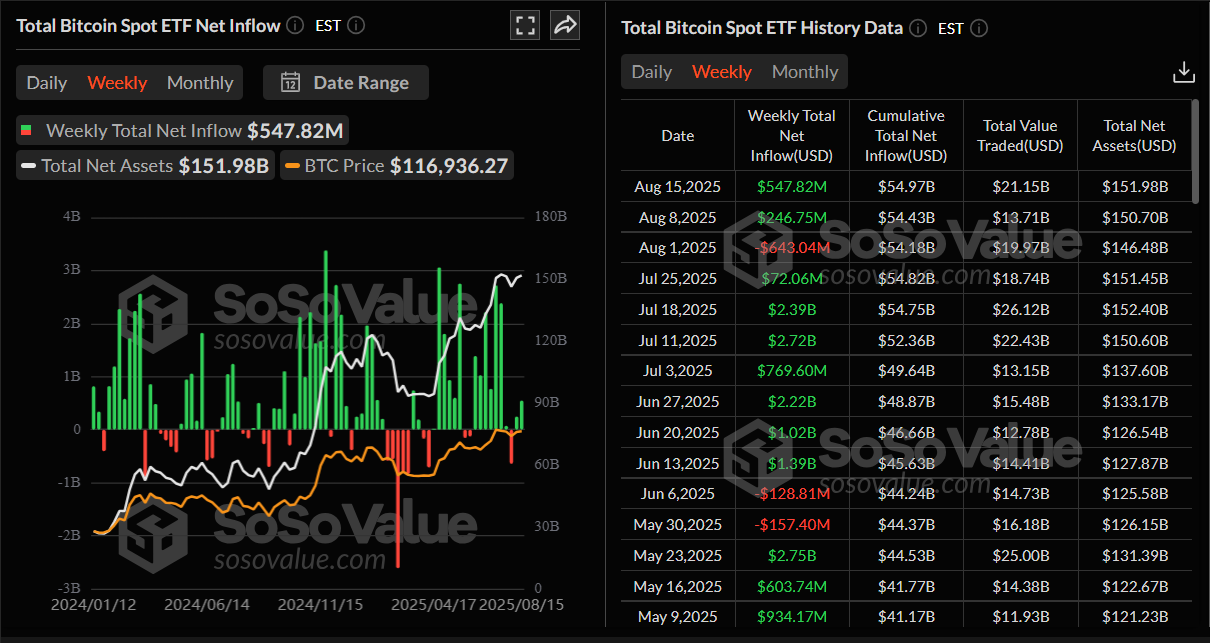

SoSoValue data shows that institutional investors have recorded a total net inflow of $547.82 million last week, slightly higher than the previous week of $246.75 million, but lower than those seen during mid-July. For BTC to continue its upward momentum, these inflows should continue and intensify.

Total Bitcoin Spot ETF Net Inflow chart. Source: SoSoValue

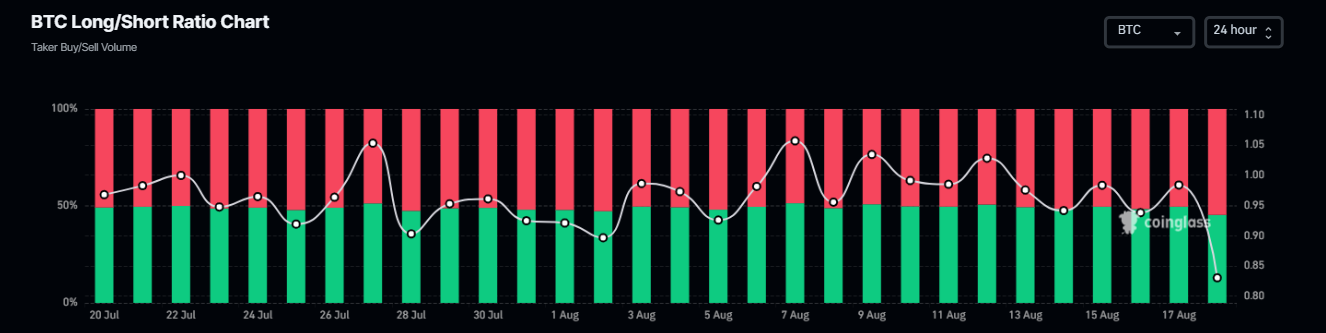

Despite robust corporate and institutional demand for BTC, derivatives data show some signs of concern. Coinglass’s long-to-short ratio for BTC reads 0.85 on Monday, marking the lowest level in over a month. A ratio below one suggests bearish sentiment in the market as traders are betting that BTC’s price will fall in the short term.

Bitcoin long-to-short chart. Source: Coinglass

Bitcoin Price Forecast: BTC shows signs of weakness in momentum indicators

Bitcoin price reached a new all-time high of $124,474 on Thursday but failed to maintain its upward strength and declined 4% on the same day. BTC hovered around the $117,300 level during the weekend. At the start of this week, on Monday, it trades slightly down, nearing its 50-day Exponential Moving Average (EMA) at $115,010.

If BTC closes below its 50-day EMA at $115,010 and closes below its ascending trendline (drawn by connecting multiple lows since early April), it could extend the losses toward its next support level at $111,980.

The Relative Strength Index (RSI) on the daily chart slips below its neutral level of 50 and points downward, indicating bearish momentum gaining traction. The Moving Average Convergence Divergence (MACD) also showed a bearish crossover on Sunday, giving sell signals and suggesting a downward trend ahead.

BTC/USDT daily chart

If BTC finds support around the 50-day EMA at $115,010 and closes above the daily level of $116,000, it could extend the recovery toward its psychological level of $120,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.