Bitcoin Miners Quiet Down—Volume Hits Lowest Since 2022

On-chain data shows the Bitcoin miners have seen a drop in activity as their transaction volume share has declined to multi-year lows.

Bitcoin Miner Volume Is Now At Its Lowest Since November 2022

According to data from the institutional DeFi solutions provider Sentora (formerly IntoTheBlock), the Bitcoin Miners’ Volume Share has recently gone down. This on-chain indicator measures, as its name suggests, the percentage of the BTC transaction volume that the miner-related transfers occupy.

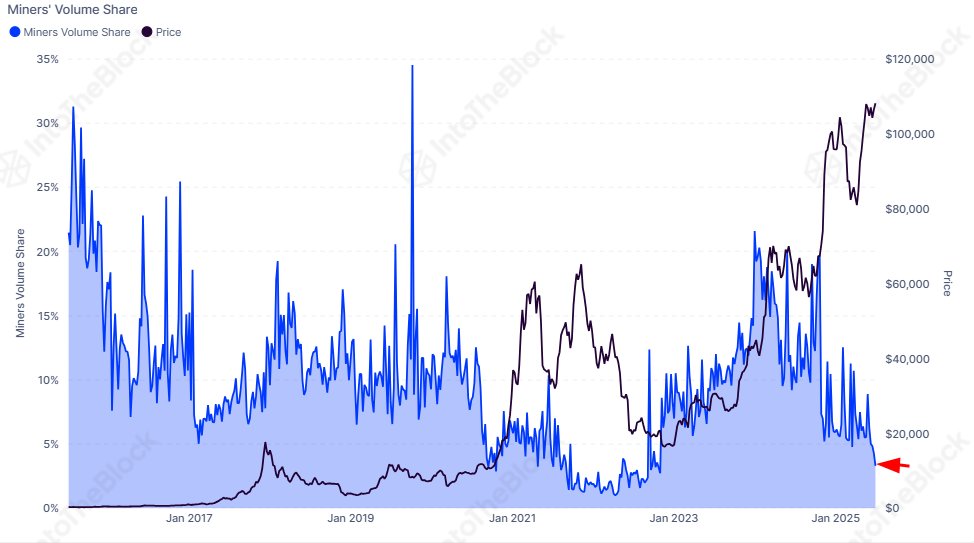

Below is the chart shared by Sentora that shows the trend in the Bitcoin Miners’ Volume Share over the past decade:

As displayed in the graph, the Bitcoin Miners’ Volume Share remained at a high level last year, indicating that the miners were participating in a notable amount of activity. On a few occasions, the indicator even crossed or hit the 20% mark, meaning that these chain validators contributed to one-fifth of the total network volume.

This year, the metric has witnessed a significant fall-off, and the decline has only deepened recently, with its value dropping to a low of just 3.3%. From the chart, it’s visible that this is the lowest that the indicator has been since November 2022, when the bear market reached its bottom.

Generally, miners transfer coins when they want to participate in selling, so their activity being low can suggest that they don’t have much appetite for selling. It only remains to be seen, though, what effect this has on the Bitcoin price, if any.

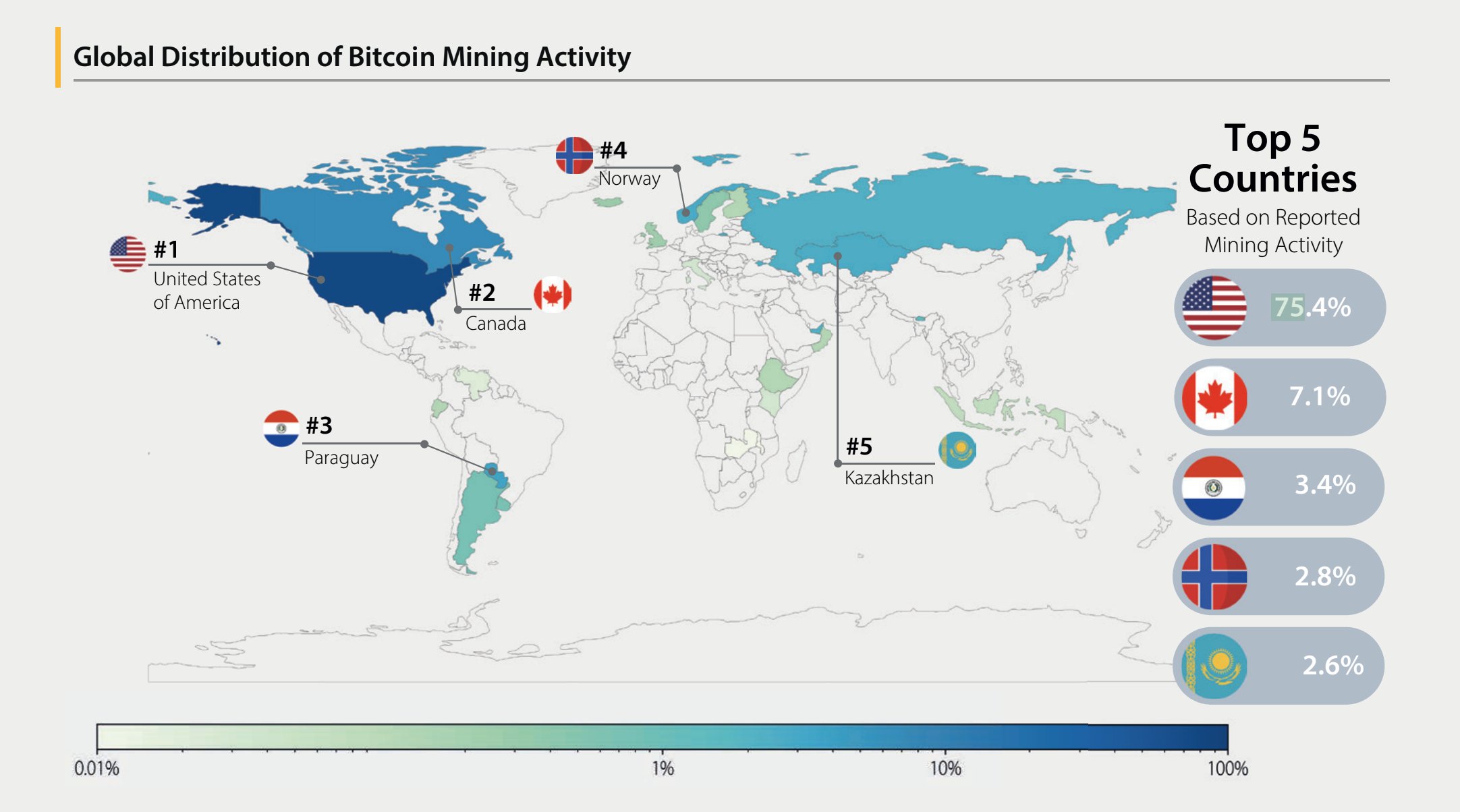

In some other news, as Capriole Investments founder Charles Edwards has pointed out in an X post, the recent Digital Mining Industry Report from Cambridge has revealed that 75% of all reported mining activity now occurs in the US.

Just four years back, 50% of all mining took place in China, but the ban in the country meant that miners had to take operations elsewhere. “Bitcoin is officially now ‘Made in America,'” notes Edwards.

The report has also reconfirmed the average miner electricity cost: $45/MWh. According to the analyst, Capriole’s BTC Production Cost model had been using this same figure for years. This electricity cost represents 80% of the expense that these chain validators incur to run their operations.

“Bitcoin Production Cost is one of the highest value indicators for sniping incredible Bitcoin buying opportunities, so it’s great to have these critical data points re-validated and accurate for 2025,” says Edwards.

BTC Price

Bitcoin continues to move sideways as its price is still trading around the $108,800 mark.