Gold price surges past $3,340 amid a firm US Dollar, traders eye key US data ahead

- Gold rallies to four-day high as DXY recovers after touching fresh three-year low.

- US Senate passes $4.5T tax cut bill; Bullion market largely unmoved by fiscal headlines.

- JOLTS Job Openings and ISM data support Powell’s wait-and-see stance; ADP and NFP in focus next.

The Gold price rises over 1% as the Greenback pares some of its earlier losses, which sent the US Dollar Index (DXY) to a three-year low. Meanwhile, the US Senate passed the Trump tax bill, which is ready to be sent to the House of Representatives for its approval. At the time of writing, XAU/USD trades at $3,340, trading around four-day highs.

Bloomberg revealed that “Senators voted 51-50 to pass the bill. Vice President JD Vance cast the tie-breaking vote. The package, which now goes to the House, combines $4.5 trillion in tax cuts with $1.2 trillion in spending cuts.”

The passage of the bill was ignored by Bullion traders so far. Economic data from the United States (US) was not ignored, justifying Federal Reserve (Fed) Chair Jerome Powell's wait-and-see stance.

The US Job Openings and Labor Turnover Survey (JOLTS) revealed that vacancies increased in May, exceeding economists’ forecasts. Manufacturing activity, as reported by the Institute for Supply Management (ISM), contracted for the fourth consecutive month but showed signs of improvement, approaching the expansion/contraction threshold.

Recently, Powell crossed the wires and remained slightly hawkish.

Aside from this, US Treasury Secretary Scott Bessent warned that countries could be notified of higher tariffs as the July 9 deadline approaches.

This shortened week, ahead of the US Independence Day on July 4, will feature ADP employment figures, Initial Jobless Claims, and the Nonfarm Payrolls report for June.

Daily digest market movers: Gold price climbs as US yields and US Dollar advanced

- Gold continues to rally, even as US Treasury yields rise. The 10-year US Treasury note is yielding 4.242%, a three-and-a-half basis point increase. US real yields, which are calculated by subtracting inflation expectations from the nominal yield, are also moving up close to four basis points to 1.979%.

- The latest JOLTS report revealed that job openings in May rose to their highest level since November, reaching 7.769 million, up from 7.391 million, and exceeding forecasts of 7.3 million.

- The ISM Manufacturing PMI in June improved, although it remained in contraction for the fourth consecutive month. The index rose to 49.0, up from 48.5 in May and above estimates of 48.8.

- Powell revealed that policy is modestly restrictive and added that he can’t say if July is too early to cut rates, though he wouldn’t rule anything out. He said that if not for President Donald Trump’s tariffs, the US central bank probably would have cut rates further.

- Citi expects Gold prices to return to $2,500 - $2,700 by the second half of 2026.

- The jobs data will be announced on Wednesday and Thursday. The ADP Employment Change is projected to improve from 37K private jobs added to the workforce to 85K. June’s Nonfarm Payrolls figures are likely to show that the labor market is indeed cooling down, projected at 110,000, down from May’s 139,000.

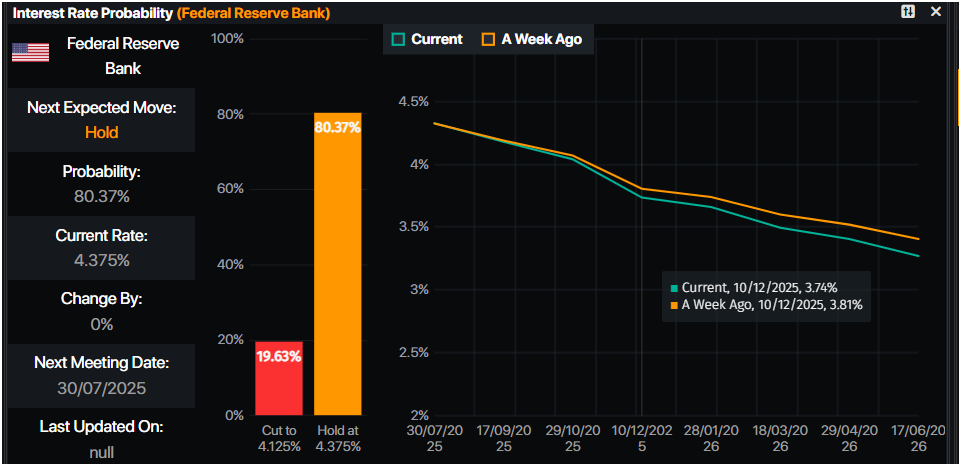

- Money markets suggest that traders are pricing in 62 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price poised to challenge $3,400

Gold uptrend remains intact, although traders need to achieve a daily close above the 50-day Simple Moving Average (SMA) at $3,322, which would keep them hopeful of higher prices. Bullish momentum has increased as portrayed by the Relative Strength Index (RSI).

That said, if XAU/USD climbs past $3,350, the next area of interest would be $3,400. On further strength, the following resistance levels would be $3,450 and the all-time high (ATH) at $3,500.

On the flipside, if Gold falls below the 50-day SMA, the first support would be $3,300. A breach of the latter will expose the June 30 swing low of $3,246.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.