Could Buying MP Materials Today Set You Up for Life?

Key Points

- MP Materials' share price has surged on the heels of strategic partnerships with Apple and the Department of Defense.

- The company owns the only mining and processing site in the U.S. for rare-earth elements.

- Continued growth will depend on its ability to generate revenue, which in turn depends on finishing its 10X Facility and raising magnet production.

- 10 stocks we like better than MP Materials ›

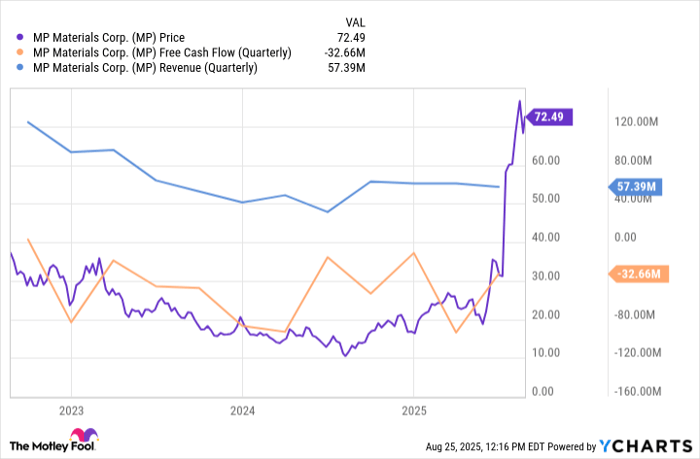

MP Materials (NYSE: MP) has had a remarkable run in 2025. To paint the picture vividly: If you had invested $10,000 in MP at the start of the year, your position would currently be worth $34,300 at today's price. That's a 343% change in share price.

Few mining stocks will ever see the same growth in such a short period. What is MP Materials doing right? And better yet: Could buying this metals stock set you up for life?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

MP Materials: America's rare-earth champion

MP Materials is a one-of-a-kind mining company that owns the Mountain Pass mine in California, currently the country's only active rare-earth mining and processing site. That matters because rare-earth elements -- like neodymium and praseodymium (or NdPr oxide) -- are integral to the production of permanent magnets, which are used in electric vehicle (EV) motors, wind turbines, and defense systems.

Technically speaking, rare-earth elements aren't geologically rare; they're abundant in the earth's crust. What makes them "rare" -- or more like "uncommon" -- is finding them in economically viable concentrates. Only a handful of countries, like China, Brazil, and Australia, own rare-earth reserves with enough viable concentrates to warrant the capital-intensive task of mining of them.

Currently, China dominates the rare-earth market. It extracts about 70% of it and processes 90% of it. The country's rare-earth reserves sit at about 44 million metric tons.

The U.S., for its part, has about 1.9 million metric tons, which is why 80% of American consumption of rare-earth metals in 2024 were imports, 77% of which came from China.

Over reliance on Chinese imports puts the U.S. at a strategic disadvantage, which is why Washington is trying to secure a domestic supply line. In July, the Department of Defense (DoD) invested $400 million for a 15% stake in MP Materials and guaranteed a floor price of $110 per kilogram of NdPr oxide for the next decade. That's roughly double today's Chinese market price.

Since mining companies rarely have predictable cash flow, the safety net from the DoD is nothing to balk at. Investors agreed, and the share price surged 50% on the heels of the announcement.

Growing fast, but bleeding cash -- for now

The public-private partnership with the DoD was nothing short of a game-changer. And it was only one of several strategic partnerships that are positioning MP Materials for expected growth.

Apple, for one, has agreed to invest $500 million in the mining company. Under this first-of-its-kind agreement, MP will supply the company with rare-earth magnets made in the U.S. from 100% recycled materials. This also entails expanding its Fort Worth magnet factory in Texas, which is projected to produce 1,000 metric tons of magnets per year starting at the end of 2025.

Even before Apple, General Motors had become a foundational customer. In late 2021, MP agreed to supply GM with NdFeB (or neodymium magnets) for the automaker's EV Ultium Platform, including its all-electric SUV and Hummer, giving the miner a guaranteed early market for its magnets.

Demand isn't a problem; magnet production is

With GM, Apple, and the DoD all committed as long-term buyers, MP Materials now faces its biggest hurdle: actually producing enough magnets to meet demand.

Although MP has always been a key player in extracting NdPr concentrates, it only recently started producing small batches of finished magnets at its Fort Worth plant. Worse, this plant, with its capacity of 1,000 metric tons, is hardly enough to cover the book orders of Apple, GM, the DoD, and whatever buyer the company picks up next. If it wants to control the downstream magnet business, it needs something bigger.

Enter the 10X Facility. This second magnet factory, construction of which will be backed by $1 billion in financing by JPMorgan and Goldman Sachs, could bring MP's total annual manufacturing capacity to 10,000 metric tons. If magnets sell for roughly $110 per kilogram, that would translate to about $1.1 billion in annual revenue. Compare that to MP's 2024 revenue of $61 million, and that's about a 1,700% increase.

MP has to build the factory, which is capital intensive. It doesn't help that the company is also bleeding cash. On top of that, it recently cut ties with its biggest partner in production, the Chinese company Shenghe Resources, which bought the vast majority of MP Materials rare-earth concentrate in 2024.

Can MP Materials set you up for life?

It's hard to overstate MP's opportunity, but don't overlook the risks. The miner is riding strong tailwinds, yet it doesn't have the production capacity to translate strong demand into profits. Not yet at least.

If MP can scale up within its timeline -- finishing the 10X Facility by 2028 -- buying the materials stock at today's price could certainly help you later. But as far as setting you up for life, the picture is too murky to confidently say that it will.

Should you invest $1,000 in MP Materials right now?

Before you buy stock in MP Materials, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MP Materials wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,220!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,114,162!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 25, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. Steven Porrello has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Goldman Sachs Group, and JPMorgan Chase. The Motley Fool recommends General Motors and MP Materials. The Motley Fool has a disclosure policy.