Walmart (WMT) Q1 2026 Earnings Preview: What to Expect from the Retail Giant’s Earnings?

Source: TradingView

TradingKey - Walmart will report its first quarterly earnings for this fiscal year on Thursday, after the bell. As one of the largest retailers in the country, Walmart results can serve as a reliable proxy for grasping the US consumer sentiment, especially in the context of the recent economic woes. The company share price has been performing relatively well compared to the broad market, being up 7.5% in 2025, so far.

These are the following aspects investors should pay attention to:

Revenue and Earnings: The market expects $166.65 billion in revenue and $0.58 in earnings per share, 3.6% and -3.3% growth from 2025Q1 respectively. The numbers appear to be more muted than what we saw in the recent quarters, but that can be explained by the more conservative spending of consumers. Several factors may affect the margins in a negative way such as 1) expansion of international operations (which is often margin-diluting due to exposure to less mature markets) and 2) inventory accumulation that may lead to more aggressive discounting campaigns.

E-commerce Business: The rally in recent years has mostly been anchored to the fast development of the e-commerce business. Currently, the e-commerce revenue represents nearly 20% of the total Walmart revenue versus just 8% five years ago. This makes Walmart one of the most formidable competitors of Amazon in the US e-commerce field. Last quarter, the e-commerce revenue growth was 16%. For reference, Amazon is currently growing at around 10%. In the coming earnings report we will see whether the rapid growth in e-commerce will be taunted by the recent macro environment. If we see a continued strength here, this can be great news for investors.

Tariffs: A lot of things have changed since Walmart last reported earnings. The tariffs are one of the major macro factors that will affect the company’s performance in the coming fiscal year. We believe management will disclose more about their strategy to mitigate the tariff-related volatility, either with changes within the product mix (increase exposure to low tariff items) or adjust the supply chains towards countries with more favorable tariff rates.

AI Initiatives: Investors will be happy to hear any updates on the AI front for Walmart. Currently, Walmart does not disclose a specific amount of AI-related R&D expenses, however in the last fiscal year the company spent nearly $24 billion on capital expenditure, which is a significant ramp up from four years ago when the number was just $10 billion. Any positive developments in initiatives such as AI tools, voice shopping, warehouse automation, robotics and AI chatbots may change the narrative for the company in a positive way.

Valuation

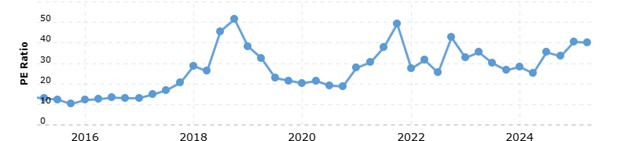

Source: macrotrends.net

We still believe that Walmart is currently valued to perfection. The stock is currently traded at 40 times the TTM earnings, which is already significantly higher than the 10-year historical average. The valuation is also higher than the main retail competitor Amazon (34x PE).