BYD Has Big Plans to Sell Half Its Vehicles Outside of China by 2030. Is This a Once in a Lifetime Investment Opportunity?

Key Points

- BYD is setting ambitious international growth targets and building the infrastructure to get there.

- The company has been on a steady upward trajectory for years, yet its stock still trades at an investor-friendly price.

- 10 stocks we like better than BYD Company ›

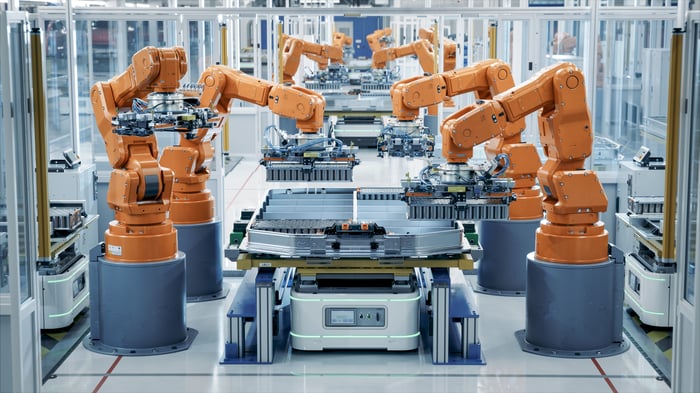

For years, investors have watched BYD (OTC: BYDDY) quietly transform itself from just another electric vehicle (EV) maker in China into a global powerhouse. The company is now on track to sell more EVs globally this year than Tesla, and it will be shipping those cars on its very own fleet of massive ocean carriers. With a goal of moving half its sales outside of China by 2030, BYD is charting its course for a true global expansion.

Image source: Getty Images

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

From steady gains to global goals

Over the past five years, BYD has been on a remarkably steady upward trajectory. Revenue, shipments, and global brand recognition compounded at a pace that would make most automakers envious. Yet despite that growth, investors can still pick up shares of BYD for $15. That's a surprisingly low buy-in in comparison to rival Tesla, especially for a company positioning itself as a dominant global automaker.

Owning the high seas

Most carmakers outsource logistics and pray for shipping slots. But BYD has taken a different approach. Though BYD continues to operate with traditional shipping contracts, its building its own fleet of seven car-carrying cargo ships so it can deliver vehicles to Europe and South America in a way that sidesteps costly bottlenecks and cuts out the middleman.

If you want proof of how serious BYD is about exports, it doesn't get much stronger than this investment in its own delivery fleet. The cost to build just four of its ships is estimated to be around $500 million. That's a significant investment that highlights just how committed the company is to this approach.

Strategically sidestepping speed bumps

Of course, ambition alone doesn't guarantee profits. BYD has been methodical about market entry, by balancing both tariffs and local politics. In Europe, it shifted manufacturing focus toward Turkey, where costs are lower and trade rules friendlier, while slowing down plans in Hungary. After the EU slapped higher tariffs on China-built EVs, BYD pivoted to shipping plug-in hybrids instead. This level of flexibility has positioned BYD to keep its European momentum alive while keeping showrooms stocked.

Demand that's hard to ignore

Meanwhile, global appetite for EVs keeps expanding. In South America, EV sales nearly doubled in Brazil during the first half of 2025, making it the fastest‑growing market in the region. Across Asia, sales of EVs in 2024 were up over 40% from 2023 as consumers adopt more affordable models. Western Europe just logged record-breaking registrations for EVs, helped by better charging infrastructure and the arrival of more affordable models.

BYD builds reliable, value-priced EVs that undercut traditional automakers while still delivering modern features. Simply put, the company is entering markets where people already want what its best at making.

Potential potholes in the path forward

Not every mile of BYD's journey will be paved with easy wins. For the first time in over a year, BYD's vehicle production fell in July, down 0.9% from a year earlier. This ended a 16-month run of uninterrupted growth. While sales were still up slightly month-over-month at 0.6%, that was much lower than the 12% month-over-month increase the company saw in June. Taken together, these figures highlight both the strength of BYD's recent momentum and the reality that growth is not always perfectly linear.

Additionally, geopolitical pressures could slow BYD's overseas growth. Major tariff concerns in Europe and North America remain a significant headwind. For example, BYD has halted its plans to build a major factory in Mexico due to concerns about U.S. trade policies.Still, over the long term, these issues look more like speed bumps than brick walls.

The bottom line on BYD

Whether BYD is a true once-in-a-lifetime opportunity remains to be seen. But its massive, rapid growth coupled with the vertical integration of its own shipping routes is certainly a rare setup among automakers. For long-term investors willing to accept some turbulence, BYD has potential. The next five years could make today's entry price look like a bargain hiding in plain sight.

Should you invest $1,000 in BYD Company right now?

Before you buy stock in BYD Company, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and BYD Company wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $656,895!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,102,148!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 184% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 25, 2025

Philippa Main has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends BYD Company. The Motley Fool has a disclosure policy.