Why Everyone Is Talking About Sirius XM Stock

Key Points

Sirius XM is rumored to be parting ways with one of its most popular programs.

Recent filings indicate Berkshire Hathaway has been buying Sirius stock hand over fist.

Despite operational challenges, Sirius could be a compelling opportunity for the right investor.

Nearly every major sector has grappled this year with the impacts of new tariff policies, which have rippled through supply chains, end markets, and corporate budgets.

Yet one industry that has proven resilient under the new tariff environment is media and entertainment. Shares of streaming pioneer Netflix and podcasting powerhouse Spotify Technology are up 35% and 63% year to date, respectively -- far outpacing broader returns across the S&P 500 and Nasdaq Composite.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

By contrast, Sirius XM Holdings (NASDAQ: SIRI) has not shared the same level of enthusiasm from investors. Shares of the satellite radio operator are roughly flat on the year, leaving it lagging far behind its peers. Yet despite its muted performance, Sirius XM has been making frequent headlines -- drawing renewed investor intrigue.

Two developments in particular are shaping the narrative around Sirius XM at the moment. Let's discuss the details and explore whether the stalling stock could be worth a look for your portfolio right now.

Shocking the shock jock

For nearly two decades, one of the most coveted assets in Sirius's content library was its exclusive partnership with iconic shock jock Howard Stern. Stern is often credited as the architect of Sirius's early rise, leaving terrestrial radio for a fledging satellite service that, at the time, had little traction or proven product-market fit.

Now, the Stern era at Sirius may be nearing an end. Multiple media outlets have reported that Sirius is weighing whether to move on from Stern's program. While this does not appear to be a full contract cancellation, reports suggest that Sirius no longer sees the same value in Stern's show -- one that historically commanded hundreds of millions of dollars per contract extension.

At first glance, this might seem to signal financial woes for Sirius. But a closer look tells a more nuanced story. Industry chatter indicates that Sirius may be seeking to renew Stern's contract at a vastly reduced rate or even to reallocate those dollars toward new talent -- such as podcast phenomenon Alex Cooper.

Such a shift could prove strategic in the long run. Stern's audience skews older, largely made up of fans who migrated from terrestrial radio in the late 1990s and early 2000s. Today's audio entertainment landscape looks quite different. With remote work and delivery services reducing commute times, the car-centric listening model that once gave Sirius an edge has lost some relevance.

By contrast, signing Cooper to a Stern-like deal could help reposition Sirius for the next generation of listeners, capturing the attention of younger demographics such as millennials and Gen Zers.

Image source: Getty Images.

The Oracle is doing his thing

Few investors on Wall Street command as much attention as Warren Buffett. Colloquially known as the "Oracle of Omaha," Buffett has spent more than six decades building Berkshire Hathaway into an investment powerhouse through a series of savvy, often contrarian deals. According to recent filings, Berkshire added 5,030,425 shares of Sirius XM between July 31 and Aug. 4.

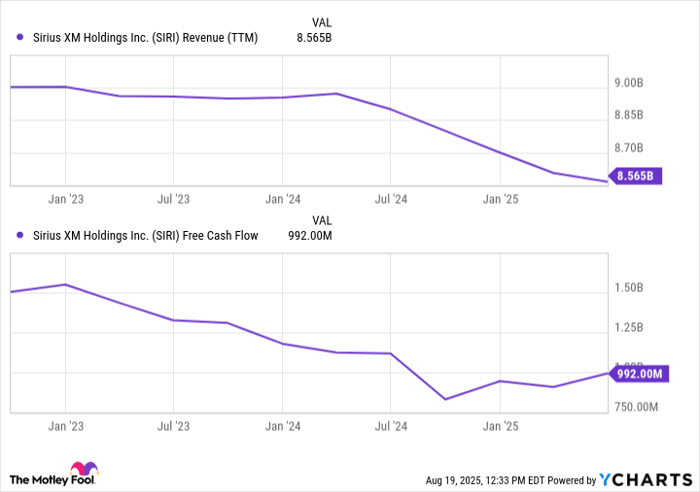

SIRI Revenue (TTM) data by YCharts

This raises an obvious question: Why in the world is Buffett gobbling up shares hand over fist of a declining business? As with the Stern situation, the answer is likely nuanced.

Sirius's revenue decline is primarily attributable to subscriber churn, a challenge that has intensified with the rise of podcasts and alternative streaming platforms. Yet a closer look at the financial profile above sheds light on something most investors are overlooking: The company's free cash flow is decelerating more slowly than revenue is falling.

This dynamic matters. Despite some subscriber attrition, nearly three-quarters of Sirius's revenue still comes from subscriptions. This model gives Sirius some durability, allowing the company to command premium pricing power over competing platforms because advertisers want access to a subscription-based audience -- something many of its rivals lack.

Is Sirius XM stock a buy right now?

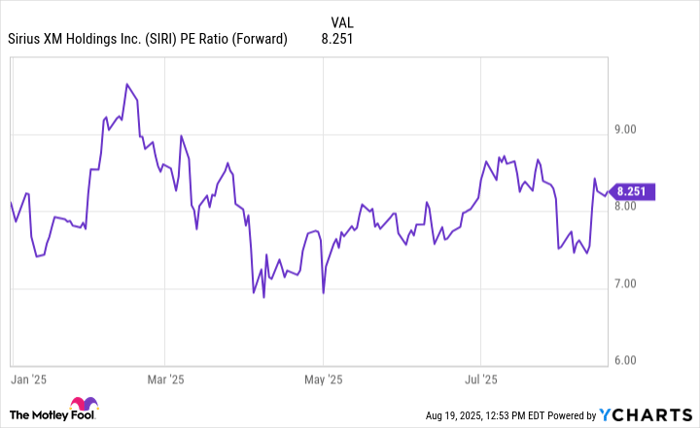

If there is one factor that defines Buffett's investing philosophy, it's that he avoids chasing momentum or paying a premium for businesses trading at frothy valuations. Consider that the average forward price-to-earnings (P/E) multiple across the S&P 500 hovers around 23. By contrast, Sirius XM trades at just 8.2 times forward earnings -- a steep discount to the broader market.

SIRI PE Ratio (Forward) data by YCharts

Buffett likely sees Sirius not as a fading relic but as a legal monopoly with durable profitability -- an asset that still carries enormous value, despite an uneven growth profile. In his eyes, Sirius stock probably sits firmly in deep value territory -- making it the type of business he prefers to buy and hold for a long time.

I think much of the headline-driven pessimism is baked into Sirius's share price at this point. While the stock may not carry the same weight as a lucrative high-growth opportunity, now may be a good time to mimic Buffett and scoop up shares of Sirius while it continues to trade at dirt-cheap prices.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,657!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,993!*

Now, it’s worth noting Stock Advisor’s total average return is 1,057% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 18, 2025

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Netflix, and Spotify Technology. The Motley Fool has a disclosure policy.