Is Buying AST SpaceMobile Stock a Once-In-a-Generation Opportunity?

Key Points

AST SpaceMobile is launching a direct-to-device satellite internet service.

The company is spending a lot upfront but expects a huge revenue ramp shortly.

After a massive run, shares of the stock look overvalued today.

AST SpaceMobile (NASDAQ: ASTS) has soared in recent years, going from a low of around $2 a share in April 2024 to $45 as of this writing on Aug. 21, 2025. But is this satellite internet disruptor still undervalued?

Some may argue, yes. Even though AST SpaceMobile is pre-revenue, it is about to unleash a business model that could disrupt existing satellite internet providers like Starlink and kill upcoming services like Amazon's Project Kuiper before they even get off the ground. The company's direct-to-device connectivity innovation could invigorate growth at a massive pace, leading to billions of dollars in annual revenue.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Does that make AST SpaceMobile stock a once-in-a-generation buying opportunity? Let's find out.

Upfront spending, connectivity innovation

Building giant satellites that can directly connect smartphones to the internet without the need for wired connectivity, cellular towers, or a satellite terminal (such as Starlink) is how AST SpaceMobile plans to disrupt the satellite internet market. Through years of development and innovation, the company has built these large satellites and is now contracting with rocket launch providers to get them into orbit.

Management plans to accelerate its launch plans to get this internet service up and running shortly. It currently has six satellites in orbit, but plans to reach between 45 and 60 at some point in 2026. The manufacturing is well underway; it now just needs to get them up into orbit and start operations. Testing has validated the service, with internet speeds fast enough to stream video or make a video call from anywhere in the world, regardless of how close a device is to a land-based cellular tower.

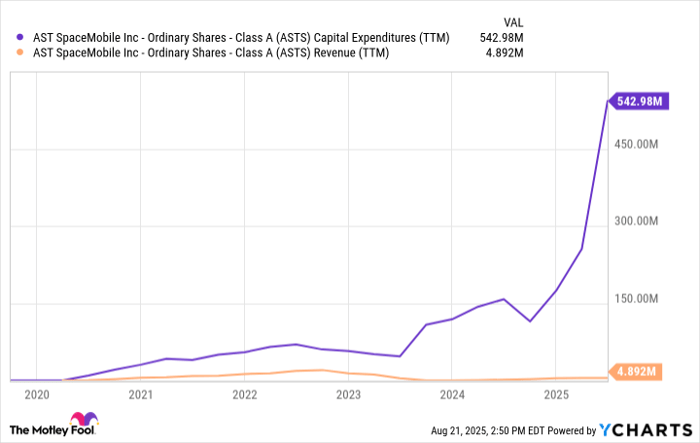

Building a new satellite internet constellation is exciting. However, it is not cheap. Over the last twelve months, AST SpaceMobile has spent $543 million on capital expenditures while generating virtually zero dollars in sales. As the company builds up its constellation, it will likely invest heavily to manufacture satellites. Management is well aware of the upfront capital needs, which is why it has raised money through various sources to give the company's balance sheet $1.5 billion in liquidity to fund this growth.

Image source: Getty Images.

Projecting future earnings

Once the satellite constellation is operational, AST SpaceMobile has prepared to quickly turn on the revenue spigot. How? By partnering with telecommunications providers such as AT&T and Verizon, or the equivalent providers in other countries. Through its many partners, AST SpaceMobile has the potential to target 3 billion existing smartphone and internet customers with its add-on service for remote internet capabilities.

That's why the company projects it will scale up revenue to $50 million-$75 million immediately -- likely in the second half of this year once the service is ready in the United States. In 2026, plans call for the service to get more coverage in the United States as well as expand to the United Kingdom, Canada, and Japan, which could help revenue accelerate quickly into the hundreds of millions of dollars. In addition to commercial opportunities, AST SpaceMobile already has contracts with the United States government, specifically military divisions.

Projecting how much revenue this could lead to is difficult given that the company generates close to zero in sales today. But let's try anyway. Assuming that 10 million customers sign up for this add-on service through the telecommunications providers within five years, at $10 a month, that is $1.2 billion in revenue for AST SpaceMobile. Adding on some government contracts and revenue may push that to $1.5 billion.

Revenue sharing with the mobile providers may take out a large cut of that $1.5 billion, but it would still leave AST SpaceMobile with $500 million-$1 billion in money coming in to cover its overhead costs. This would likely mean the company generating bottom-line profits in both net income and free cash flow at some point within the next five years if it all goes according to plan.

ASTS Capital Expenditures (TTM) data by YCharts.

Is AST SpaceMobile stock a buy today?

Everything going according to plan is not always the case when it comes to launching satellites into space. Just this week, India's space agency, Indian Space Research Organization (ISRO), said that it may delay the launch of an upcoming AST SpaceMobile satellite that was supposed to launch later this year to Q1 of 2026. Delays could mean more cash burn and require the company to raise more funds.

But even if AST SpaceMobile meets its current timeline, its valuation is rich. The stock has a market cap of $16 billion compared to zero dollars in revenue. Even if net earnings grow to $500 million in five years and there is no further share dilution, the stock will trade at a price-to-earnings ratio (P/E) of 32 based on the current market cap. That is still expensive compared to the average stock.

Add it all up, and AST SpaceMobile is an exciting disruptor in the satellite internet sector. But this stock has gotten ahead of itself, meaning it is not a buy for investors today.

Should you invest $1,000 in AST SpaceMobile right now?

Before you buy stock in AST SpaceMobile, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AST SpaceMobile wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,657!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,993!*

Now, it’s worth noting Stock Advisor’s total average return is 1,057% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 18, 2025

Brett Schafer has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.