Could Buying AGNC Investment Stock Today Set You Up for Life?

Key Points

AGNC Investment's dividend currently yields a staggering 15%.

The REIT has the potential to produce a massive total return.

Several risks could weigh on its return profile.

AGNC Investment (NASDAQ: AGNC) is an alluring dividend stock. It currently offers an eye-popping monthly dividend yield of nearly 15%, over 10 times higher than the S&P 500's (SNPINDEX: ^GSPC) 1.2%. Based on this yield alone, investors could theoretically double their money every five years.

At this rate and with reinvested dividends, a $10,000 investment could grow to more than $633,000 over 30 years. This investment would be generating over $92,000 in annual dividend income by that time. From there, you could live off the dividends.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

But while it's possible that AGNC Investment could help you build long-term wealth, the chances of seeing those kinds of returns are slim. Here's why.

Image source: Getty Images.

A potentially lucrative investment strategy

AGNC Investment is a real estate investment trust (REIT) focused on investing in residential mortgage-backed securities (MBS) protected against credit risk by government agencies such as Freddie Mac and Fannie Mae. These mortgage pools are lower-risk investments with fixed-income yields in the low-to-mid-single digits.

The mortgage REIT invests in MBS on a leveraged basis, using repurchase agreements to buy additional MBS. This strategy enables AGNC Investment to earn even higher returns. For example, the company noted on its second-quarter conference call that in the current environment, it can earn a return on equity of around 19% on new investments. That's above its current cost of capital, which enables the REIT to generate enough income to cover its operating costs and lucrative monthly dividend payment.

AGNC has managed to earn a high-enough return to maintain its present dividend level for more than five years. That's impressive, considering all the volatility in interest rates during that period. As long as the REIT can continue generating returns above its cost of capital, it can keep paying its monster dividend.

Risks that can impact returns

AGNC employs dynamic risk management strategies to safeguard the value of its portfolio against risks such as interest rate fluctuations. However, even with these efforts, those risks can still impact its income.

Changes in interest rates are the biggest risk factor that can impact the REIT's business. For example, falling interest rates enable homeowners to refinance their mortgages at lower rates. As a result, the REIT earns less interest income on its existing MBS and needs to accept lower yields when reinvesting the repaid capital into new MBS investments.

Meanwhile, an unexpected uptick in interest rates can impact AGNC's borrowing costs. That can cause it to earn less of a spread between the interest it earns on its MBS investments and its borrowing costs.

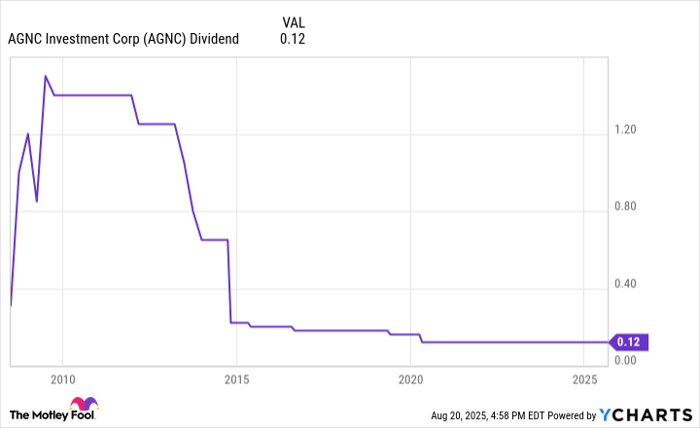

If interest rates or market conditions change dramatically, it can impact AGNC's cost of capital and returns. When returns fall below certain levels, the REIT might need to cut its dividend, which it has done several times in the past:

AGNC Dividend data by YCharts

If AGNC cuts its dividend in the future, investors would earn less income, which would lower their overall returns.

The stock price

Another factor that can affect AGNC Investment's total return is the stock price. The company would need to maintain its current stock price to deliver the mid-teens total return currently produced by its monster monthly dividend.

The problem is that the REIT's stock price hasn't stayed steady throughout its history. It has lost nearly 50% of its value since AGNC's IPO in 2008.

One factor weighing on the stock price is that the company frequently issues new shares to fund additional MBS purchases, substantially increasing its outstanding share count over time. For example, it issued 92.6 million new shares in the second quarter, raising $799 million in proceeds. This steady dilution has weighed on AGNC's total returns.

Because of this, AGNC's average annual return since its IPO has been 10.7%, not 15%. At that rate, a $10,000 investment would grow to about $200,000 in 30 years. That's solid, but likely not enough to change your life. And there's no guarantee future returns will match the past.

Probably not a game changer

AGNC Investment does offer appealing monthly dividends, but it also comes with real risks. If the dividend payment or the stock price drops, your long-term returns could take a big hit. Given this possibility, AGNC probably won't be a life-changing investment.

Should you invest $1,000 in AGNC Investment Corp. right now?

Before you buy stock in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AGNC Investment Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,657!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,993!*

Now, it’s worth noting Stock Advisor’s total average return is 1,057% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 18, 2025

Matt DiLallo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.