Social Security Is a Financial Mess -- and Here's the Truth of How It Got to This Point

Key Points

Between 80% and 90% of retirees lean on their Social Security income to cover at least some portion of their expenses.

The program is in no danger of going bankrupt or halting payments, but the existing payout schedule, including cost-of-living adjustments., isn't sustainable beyond 2033.

Ongoing demographic shifts are primarily responsible for its financial woes -- although lawmakers do deserve their share of the blame (but maybe not for the reason you're thinking).

For most retirees, Social Security is more than just a monthly check deposited into their bank accounts. It represents nothing short of a financial lifeline that many would struggle to make do without.

For nearly a quarter of a century, national pollster Gallup has been surveying retirees to gauge how important their Social Security income is to their financial well-being. In the latest poll (in April), a combined 86% responded that it was a "major" or "minor" income source.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

In other words, its income that was needed, in some capacity, to cover their expenses. Every annual survey from Gallup has shown that 80% to 90% of retirees lean on this income as some form of financial foundation.

The problem for Social Security is that its own financial foundation has been weakening for decades. While America's leading social program is in no danger of going bankrupt, becoming insolvent, or halting benefits, sizable and unfavorable changes for beneficiaries await if lawmakers fail to act.

What follows is the no-nonsense truth of how deep a financial hole Social Security finds itself in, as well as how it got to this point.

Image source: Getty Images.

Social Security benefit cuts may become a reality eight years from now

Since the very first retired-worker benefit check was mailed in January 1940, the Social Security Board of Trustees has published an annual report detailing the program's financial inner workings.

The Trustees Report allows anyone to see how the program brought in every dollar in income since 1940, as well as track where every dollar in outlays ended up. The overwhelming percentage of outlays are benefits paid to eligible beneficiaries, but that also encompasses the cost to operate and oversee the program.

What's often more valuable with the Trustees Report is its long-term (75-year) financial forecast. This projection takes into account various changes in fiscal and monetary policy changes, as well as ongoing demographic shifts, to project how financially sound the program will be 75 years following the release of a report.

For 40 years, the annual Trustees Report has cautioned of a long-term unfunded obligation. In simple terms, projected income to be collected in the 75 years following the release of a report is estimated to be insufficient to cover outlays, including annual cost-of-living adjustments (COLAs). This unfunded obligation has been growing for decades and now stands at $25.1 trillion, as of the 2025 Report.

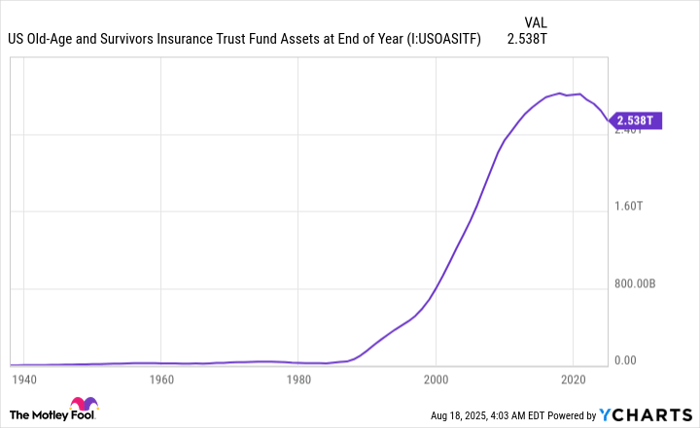

However, this long-term unfunded obligation isn't what's causing the biggest stir. Rather, it's the Trustees' estimate that the Old-Age and Survivors Insurance trust fund (OASI) will deplete its asset reserves by 2033. The "asset reserves" represent the excess income collected since inception that's invested in special-issue interest-bearing government bonds, as required by law.

The OASI's asset reserves are expected to be gone by 2033. U.S. Old-Age and Survivors Insurance Trust Fund Assets at End of Year data by YCharts.

To reiterate, Social Security isn't going bankrupt, halting payments, or disappearing. The program collects the bulk of its income from the 12.4% payroll tax on earnings. If Americans keep working and paying their taxes, there will always be funds to disburse to eligible beneficiaries.

The issue is that the current payout schedule, including COLAs, isn't expected to be sustained beyond 2033. If the OASI's asset reserves are exhausted, sweeping benefit cuts of up to 23% may await retired workers and the survivors of deceased workers in eight years.

Here's the full and truthful story of what's wrong with Social Security

Most people agree that Social Security is in need of reform, including many of our elected officials in Washington, D.C. However, not everyone agrees on how America's leading retirement program got into this financial mess in the first place.

What can be said with a high degree of confidence is that online message board claims of "lawmakers stealing/pilfering Social Security's trust funds" and "undocumented migrants receiving Social Security benefits" are not accurate reasons for Social Security's financial struggles.

Every cent of Social Security's asset reserves is accounted for and updated monthly by the Social Security Administration. Meanwhile, legal and undocumented migrants positively contribute to the Social Security program, with undocumented migrants unable to receive traditional Social Security income (retired-worker benefits, disability benefits, or survivor benefits).

With these pervasive online message-board myths out of the way, let's dive into the real reasons Social Security checks could be slashed in just eight years.

Image source: Getty Images.

The bulk of Social Security's growing long-term funding shortfall and projected OASI asset reserve depletion traces back to a number of ongoing demographic changes. In no particular order:

- Baby boomers have been leaving the workforce in greater numbers, which is going to weigh down the worker-to-beneficiary ratio. There simply aren't enough new workers entering the labor force to counter those retiring.

- Longevity has notably increased since the first retired-worker check was mailed in 1940. Social Security was never designed to provide benefit checks for two decades.

- The U.S. fertility rate fell to an all-time low in 2024. Couples are waiting longer to marry and have kids, which is expected to further pressure the worker-to-beneficiary ratio in the years to come.

- Income inequality is climbing. In 2025, all earned income (wages and salary, but not investment income) from $0.01 to $176,100 is subject to the 12.4% payroll tax. However, the wages and salary of high earners has been growing at a faster pace than the maximum taxable earnings cap (the $176,100 figure) on an annual basis. In short, more earned income is escaping the payroll tax over time.

- Net legal migration into the U.S. has dropped off considerably since the late 1990s. Most legal migrants are young, and the Social Security program counts on these younger workers spending decades in the labor force contributing via the payroll tax before one day receiving a retirement benefit of their own. Fewer legal migrants entering the U.S. means not enough payroll tax revenue being collected to cover future payouts.

But there's more blame to assign beyond demographic shifts.

The Federal Reserve hasn't helped matters by keeping interest rates at or near historic lows for much of the last 15 years. The special-issue interest-bearing bonds that the program's asset reserves are invested in (as required by law) ebb and flow with the central bank's monetary policy. Historically low interest rates pushed yields down and led to minimal interest income being collected.

Lastly, lawmakers do deserve their share of the blame. A lack of action by Congress to reform America's leading social program will only make fixing it costlier when the time comes.

Put bluntly, these are not going to be easy issues to address. Factors such as birth rates and net legal migration statistics don't meaningfully change overnight. Strengthening Social Security will require tough decisions to be made -- and it's unlikely everyone will be happy when all is said and done.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

The Motley Fool has a disclosure policy.