Billionaire Warren Buffett Sold 41% of Berkshire's Stake in Bank of America and Is Piling Into an Industry Leader That's Gained Almost 47,000% Since Its IPO

Key Points

Bank of America remains Berkshire Hathaway's third-largest holding even after selling a large stake.

Bank of America's stock is currently trading at a high premium compared to recent years.

Pool has proven to have a competitive moat that makes it a good long-term option to consider.

Few people command as much attention in the investing world as famed investor Warren Buffett. And when you look at his personal success and the success of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) -- a company that he's led since 1965 -- it's easy to see why.

Buffett has amassed a net worth of over $140 billion, which is more than the market cap of companies like Lowe's, Capital One, and Nike. And Berkshire? Well, it's the world's 11th-largest public company, with a market cap of over $1 trillion (as of Aug. 19). So, when Buffett and Berkshire make investing moves, people tune in.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

A recent move that people have taken note of is Berkshire reducing its stake in Bank of America, a company it has been invested in since Aug. 2011. Bank of America is now Berkshire's third-largest holding, with over 605 million shares, representing an 8.2% stake in the banking giant and 9.8% of Berkshire's total stock portfolio.

Image source: The Motley Fool.

Owning 605 million shares of any company is quite a bit, but this stake is much smaller than it has been in previous years for Berkshire. From July 2024 through the second quarter of this year, Berkshire has sold around 427 million Bank of America shares, or around 41% of its position.

Why have Buffett and Berkshire been selling so many Bank of America shares?

Bank of America hasn't been the only stock that Berkshire has trimmed its stake in. It's notably cut its stake in Apple and a handful of other stocks, bringing its cash pile to a record $344 billion. Although Buffett hasn't said specifically why it's sitting on so much cash, there are a couple of reasons that make sense.

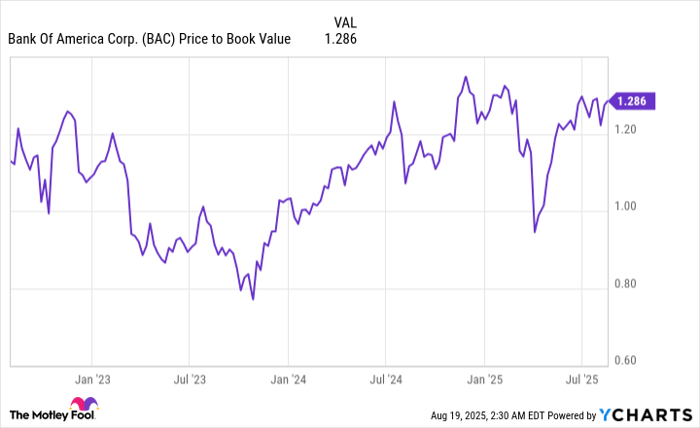

The first is that Buffett has said he expects the marginal corporate tax rate to increase, so selling shares now allows Berkshire to pay less in taxes than it might in the future if his assumption is true. The second reason comes down to value, which is something Buffett is known for chasing. At the start of August, Bank of America's price-to-book ratio was close to 1.29, meaning the stock was trading at around a 29% premium.

BAC Price to Book Value data by YCharts

This alone may not have been the reason why Berkshire has unloaded so many shares, but it seems fair to assume that it played a large part in the decisions over the past year.

What stock has Berkshire been loading up on?

In the second quarter, Berkshire increased its stake by around 136% in a company that the average person likely hasn't heard of: Pool (NASDAQ: POOL). Berkshire now owns over 3.4 million shares of the company, valued at over $1 billion at the time of this writing.

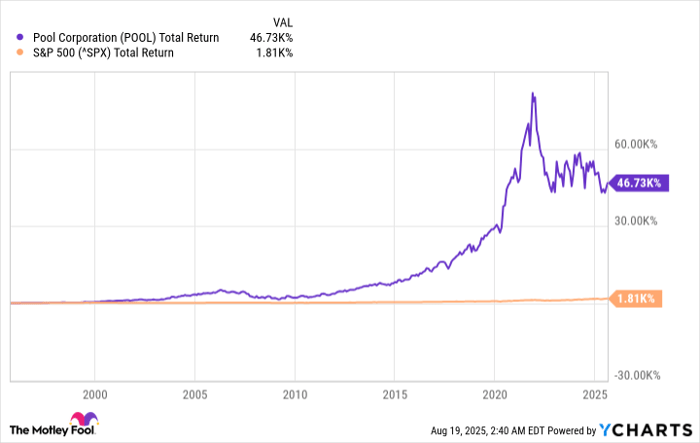

The appropriately named Pool is the world's largest wholesaler of swimming pool equipment, supplies, machinery, and other relevant outdoor products. It has been around for decades, and the stock price has returned nearly 47,000% since its Oct. 1995 initial public offering (including dividends).

POOL Total Return Level data by YCharts

Pool has a trifecta that Buffett often looks for in companies he invests in: a competitive moat in a niche market, consistent profits (though the business is cyclical), shareholder-friendly leadership, and an attractive dividend. Although the stock is down over 8.5% in the past 12 months, this decrease could have aided in the decision to load up on more shares.

I wouldn't advise you to blindly follow Berkshire's move and load up on Pool shares, but if you're looking for a dependable long-term investment, then it could be a good option. Don't go into it expecting the big tech-esque stock price growth that we've seen over the past few years, but instead focus on the steady income stream and shareholder value created.

Should you invest $1,000 in Pool right now?

Before you buy stock in Pool, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pool wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $650,499!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,543!*

Now, it’s worth noting Stock Advisor’s total average return is 1,045% — a market-crushing outperformance compared to 182% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 18, 2025

Bank of America is an advertising partner of Motley Fool Money. Stefon Walters has positions in Apple and Lowe's Companies. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, and Nike. The Motley Fool recommends Capital One Financial and Lowe's Companies. The Motley Fool has a disclosure policy.