Broadcom Inc

AVGOToday

+7.08%

5 Days

+0.49%

1 Month

-3.16%

6 Months

+10.36%

Year to Date

-3.81%

1 Year

+43.90%

TradingKey Stock Score of Broadcom Inc

Currency: USD Updated: 2026-02-06Key Insights

Broadcom Inc's fundamentals are relatively very healthy, with an industry-leading ESG disclosure.and its growth potential is high.Its valuation is considered fairly valued, ranking 28 out of 104 in the Semiconductors & Semiconductor Equipment industry.Institutional ownership is very high.Over the past month, multiple analysts have rated it as Buy, with the highest price target at 456.59.In the medium term, the stock price is expected to remain stable.Despite an average stock market performance over the past month, the company shows strong fundamentals and technicals.The stock price is trading sideways between the support and resistance levels, making it suitable for range-bound swing trading.

Broadcom Inc's Score

Support & Resistance

Score Analysis

Media Coverage

Broadcom Inc Highlights

Broadcom Inc. is a prominent American multinational firm that engages in designing, developing, manufacturing, and supplying a diverse range of semiconductor and infrastructure software products globally. Broadcom's extensive portfolio caters to various sectors such as data centers, networking, software solutions, broadband, wireless communication, storage, and industrial markets. In 2024, approximately 58 percent of Broadcom's revenue was derived from semiconductor-related products, while 42 percent originated from its infrastructure software products and services.

The company is led by Tan Hock Eng, who serves as president and CEO, and its headquarters are located in Palo Alto, California. In January 2016, Avago Technologies Limited transitioned its name to Broadcom following the acquisition of Broadcom Corporation. The stock symbol AVGO now reflects the unified entity, whereas the ticker symbol BRCM associated with Broadcom Corporation has been retired. Initially, the merged company was referred to as Broadcom Limited before adopting its current name in November 2017.

With the surge in AI advancements, Broadcom's market capitalization surpassed $1 trillion for the first time in December 2024, positioning the company among the most valuable enterprises globally.

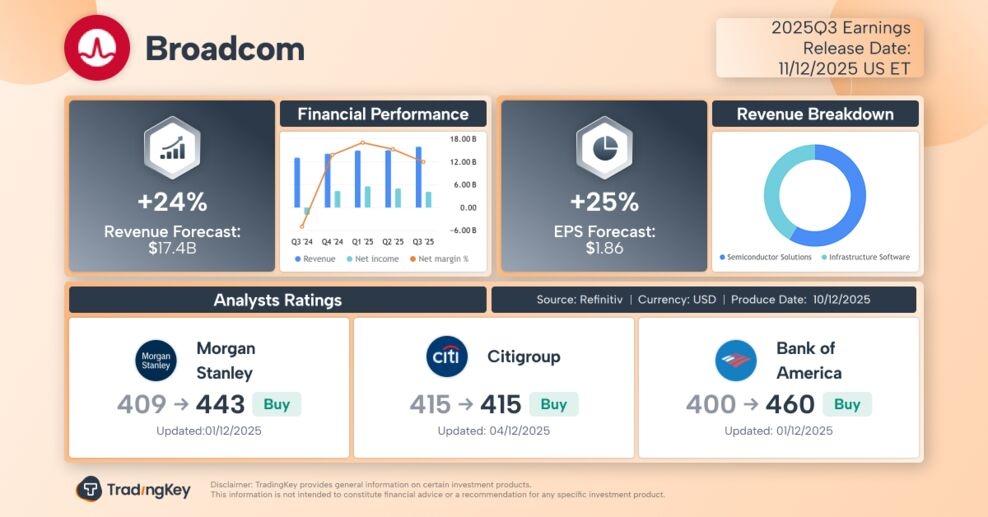

Analyst Rating

Broadcom Inc News

Why Nvidia, Broadcom and Palantir Crashed Today?

TradingKey - Technology stocks took a sharp turn lower on Wednesday, led by a heavy sell‑off in software names. Some of the year’s most popular stocks slid by double digits as investors tried to make sense of a new competitive threat: a fresh wave of artificial‑intelligence tools from Anthropic.

Why Broadcom Stock Is at the Center of the AI Chiplandscape in 2026

TradingKey - Broadcom Stock (AVGO) has become the most discussed semiconductor stock among smart money in 2026. With the rise of Artificial Intelligence (AI) technology, many investors are now reevaluating which semiconductor companies will be most successful moving forward.

Top 10 AI Events of 2025: Scrutinizing Nvidia and OpenAI, Reevaluating Google and Tesla

Over the three-year AI-driven U.S. stock market bull run, the AI narrative has evolved from speculative imagination and a race for hardware to performance realization and differentiation. This article will briefly review the top ten AI events of 2025, revisiting the significant AI moments that ...

$300 Billion Wiped Out: Why Broadcom’s "Flawless" Earnings Failed to Halt Wall Street’s Three-Day Slide

TradingKey - Chip giant Broadcom is experiencing its most severe market sell-off since March 2020, with shares tumbling 18% in three days after its earnings report.

Broadcom's AI Revenue Soars 70% But Shares Fall on Margin Concerns and Client In-House Moves

Following the earnings release, Broadcom's stock initially climbed 4% in after-hours trading on Thursday, but subsequently reversed course, dropping over 5% at one point.

Is Broadcom's Earnings Report a Golden Opportunity or a Bull Trap?

TradingKey - Over the past few quarters, investor attention toward the ASIC market has surged—and Broadcom (AVGO), the clear leader, has been riding that momentum.

Financial Indicators

EPS

Total revenue

Broadcom Inc Info

Broadcom Inc. is a prominent American multinational firm that engages in designing, developing, manufacturing, and supplying a diverse range of semiconductor and infrastructure software products globally. Broadcom's extensive portfolio caters to various sectors such as data centers, networking, software solutions, broadband, wireless communication, storage, and industrial markets. In 2024, approximately 58 percent of Broadcom's revenue was derived from semiconductor-related products, while 42 percent originated from its infrastructure software products and services.

The company is led by Tan Hock Eng, who serves as president and CEO, and its headquarters are located in Palo Alto, California. In January 2016, Avago Technologies Limited transitioned its name to Broadcom following the acquisition of Broadcom Corporation. The stock symbol AVGO now reflects the unified entity, whereas the ticker symbol BRCM associated with Broadcom Corporation has been retired. Initially, the merged company was referred to as Broadcom Limited before adopting its current name in November 2017.

With the surge in AI advancements, Broadcom's market capitalization surpassed $1 trillion for the first time in December 2024, positioning the company among the most valuable enterprises globally.

Related Instruments

Popular Symbols