Delta Air Lines Q2 FY2025 Earnings Review

Delta Air Lines (NYSE: DAL) is set to release its Q2 2025 earnings on Thursday, July 10, 2025, before market opens, followed by a webcast and conference call to review financial and operational results.

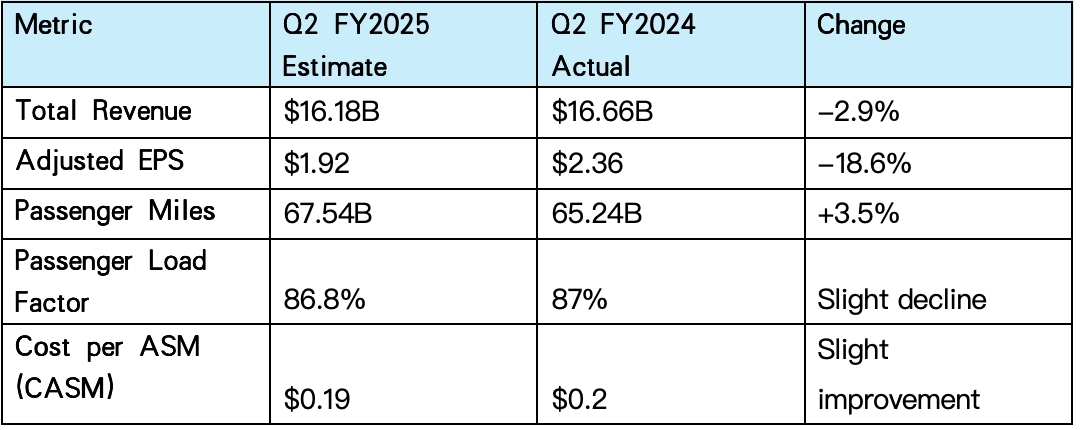

Market Forecast

Where Investors Should Watch

Delta’s Q2 performance depends on its ability to generate high-margin revenue and cost control in a tough economy. Premium cabins and international routes, especially in Pacific and Latin America, make up about 60% of revenue, offsetting weaker domestic demand and supporting profitability.

The decision to keep capacity flat in late 2025 shows Delta’s focus on higher ticket prices and margins over volume growth, a smart move given economic uncertainty. Controlling costs, particularly fuel and labor, through hedging and efficiency will be key to protecting profits.

Delta’s recent 25% dividend hike to $0.1875 per share signals strong cash flow. Progress in cutting debt and generating cash will support future payouts. Management’s guidance on bookings, pricing, and travel demand will shape investor confidence and stock performance.

Conclusion

Delta’s focus on premium travel, disciplined capacity, and cost management ensures resilience. Q2 2025 earnings should confirm its ability to grow profitably while delivering shareholder value in a challenging market.

Delta Air Lines Q2 FY2025 Earnings Review

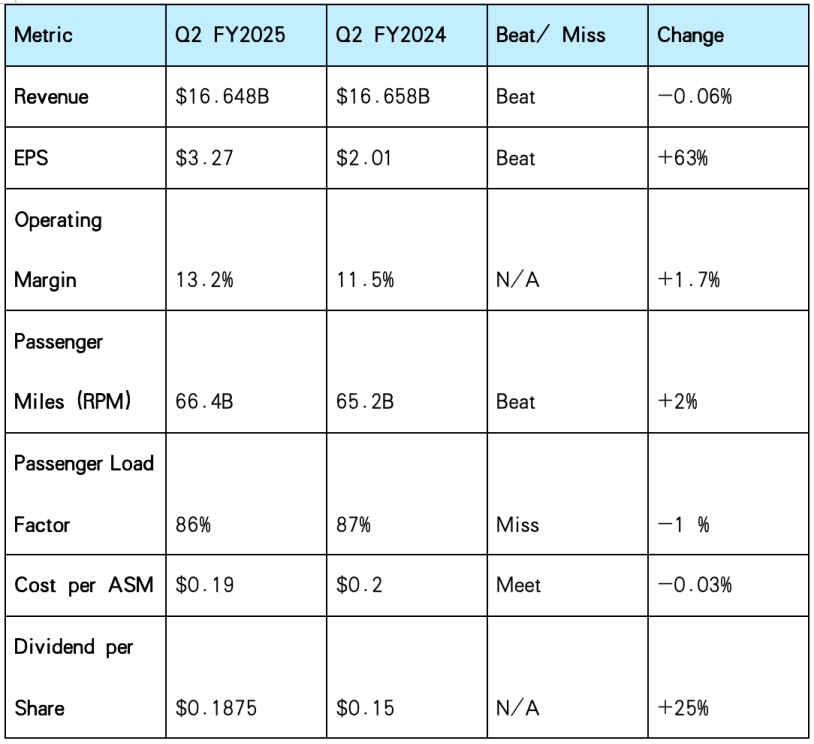

Delta Air Lines (NYSE: DAL) released its Q2 FY2025 earnings on July 10, 2025, delivering results that exceeded market expectations and drove a nearly 12% increase in its stock price.

Source: TradingKey

Key Financial Results

Guidance & Conference Call

l Delta’s management raised its full-year adjusted EPS guidance to a range of $5.25 to $6.25, surpassing market expectations, while projecting free cash flow between $3 billion and $4 billion, including $700 million generated in the quarter.

l For Q3, revenue is expected to be flat to up 4% YoY, with adjusted EPS guidance of $1.25 to $1.75.

Delta will keep capacity flat through late 2025 to focus on margin stability over volume growth. The Delta-American Express partnership generated $2 billion in Q2 revenue, up 10% YoY, and is on track for $8 billion in 2025.

Operational reliability remains strong, supported by investments in AI-driven pricing and the upcoming Delta Concierge virtual assistant, enhancing efficiency and customer experience. International expansion, especially in Pacific and Latin American markets, is a key growth area, strengthened by equity stakes in WestJet and IndiGo.

Management reaffirmed its commitment to cost discipline and a robust fuel hedging strategy to manage volatility. They expressed confidence in sustained premium travel demand while noting that U.S. economic conditions remain uncertain but are showing signs of stabilization, benefiting from recent progress in tax legislation “One Big Beautiful Bill” and ongoing trade policy developments.

Conclusion

Delta Air Lines’ strong Q2 results and raised guidance highlight solid execution and resilience in premium revenue streams, supporting a positive long-term outlook. Although main cabin demand shows some softness in off-peak periods, Delta’s diversified revenue base and disciplined strategy position the stock well for sustained growth, making it an attractive option for investors seeking exposure to a financially disciplined, premium-focused airline.

.png)